There are many fintechs I follow closely: Stripe, Adyen, Klarna, Nubank, Ant Group to name just a few. London and the UK in general has been at the centre of all of this, and is home to almost 30 fintech unicorns, with many more rising.

The thing is that, as these firms mature, things change. Markets move. Strategy changes.

A good example is Wise, formerly TransferWise.

Wise are quite important for me, as they move my money around the world. This was not important for me when living in jolly old blighty but, since moving to Poland, it’s become pretty critical. The reason? Moving money from jolly old blighty to Poland proved pretty expensive with jolly old banks. Wise makes it affordable.

This teenage company founded in 2011 now moves over £145 billion around the world each year for over fifteen million customers, at a fraction of the cost charged by banks. This was always their mission and, from their latest financial reports, they are achieving great things.

In thinking about their origins, the memories of their launch were all based on pants to banks and Richard Branson giving them a leg-up in a $25m funding round in 2019 …

… but this was years ago. Today, like Revolut and others, they’ve grown up and their focus has always been on reducing the costs of moving money across borders. In fact, the strategy has really been to create a borderless world of money, and it’s working.

The idea began in 2011 when two Estonian friends living in London – Kristo Käärmann and Taavet Hinrikus – grew frustrated with the “massive problem” of bank fees on international transfers. They started TransferWise that year to help people send money abroad at the true exchange rate. Bearing in mind that, according to the Bank for International Settlements (BIS) global Forex trading is over $7.5 trillion daily, it’s not a bad place to target. This is why Wise became the largest IPO of a fintech in London in 2021, with a valuation of near $11 billion*.

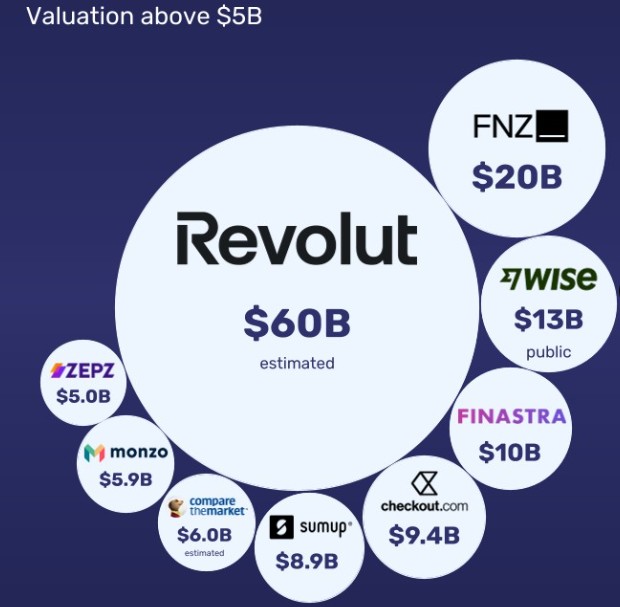

Interestingly for me is that Wise is just one of many fintech startups that have broken into the Unicorn brigade. By way of example, six of the top ten unicorns in the UK are fintechs. Having said that, as Sifted note, only 13 of Europe’s fintech unicorns are profitable. Bit of a quandary there.

Meantime, and this is the point of why I am writing this, there is a worrying development. Fintechs and unicorns no longer want to be in the UK or in London. Unicorns are moving to the USA. Wise just announced that they would move their listing to New York and there are concerns that many others - Monzo, Starling, Revolut and more - will follow. This seems to be due to the UK government policy to tax everything and is seeing a flood of wealth leaving the country …

Wealth Exodus Leaves Britain Counting Cost of Taxing ‘Non-Doms’

… could we be seeing the same happen as London’s fintech stars list overseas?

This is where the friction lies today: should I stay or should I go?

Talking of which, if you are travelling these days, have you noticed that HSBC is no longer the world's local bank?

* You can read a lot more about Wise in Sam Boboev’s Fintech Wrapup.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...