We are really good at creating bingo buzz words in business to get everyone feeling they are missing the buzz. Terms such as Big Data, Banking-as-a-Service (BaaS, invented by me!), embedded finance, invisible banking and more turn up every day. Some get traction and some don’t, but the whole idea is to make you feel that you are missing the boat.

As a decision-maker, most CxO’s are wise to the tech and consulting industry practices to make them feel this. I always remember the blockchain buzz ten years ago and one banker telling me that they can see what it means but cannot see the RoI (Return on Investment). Instead, he was far more interested in Artificial Intelligence, and that’s where the money flowed.

In other words, for all the buzzword bingo, what gives bang for the buck?

I also think it’s interesting that an awful lot of these buzzwords are poorly defined. I have spent a long time trying to define terms like fintech and digital banking. I cannot say my definitions ten years ago are right, but they are there or thereabouts.

These days, everyone seems to be talking about embedded finance and Ron Shevlin, my friend from Cornerstone, raises a good question: what is that?

Using ChatGPT, he got these answers:

McKinsey & Company

"Embedded finance is the placing of a financial product in a nonfinancial customer experience, journey, or platform."

▶️ Accenture

"Embedded finance is the use of banking-as-a-service platforms by non-banks to offer financial services such as lending, payments, or insurance as part of their core product offering."

▶️ Finextra

"It’s not about banks embedding themselves in other ecosystems. It’s about other ecosystems embedding financial services in theirs."

▶️ Ron Shevlin, Cornerstone Advisors

"Embedded finance isn’t about making banking better. It’s about making financial services disappear into digital experiences where the financial element isn’t the main attraction."

And concludes that he “cannot vouch for the accuracy of any of these citations, because I've never written what ChatGPT ascribed to me”. That’s the beauty of AI for you.

So, I asked ChatGPT to write a definition of embedded finance in the style of Chris Skinner. Here’s what it came up with:

Embedded finance is the seamless integration of financial services—payments, lending, insurance, even investment—directly into non-financial platforms, apps, and digital ecosystems. It's not about building a bank. It's about making finance invisible, contextual, and part of the customer journey.

Think Uber: the payment happens, but no one talks about it. Think Shopify: merchants can access capital, process payments, and manage finances without ever going to a traditional bank. That’s embedded finance in action.

For the C-suite, this isn’t a tech trend—it’s a strategic shift. It allows non-financial companies to create new revenue streams, increase customer stickiness, and control more of the value chain. And for financial institutions? It’s a call to reinvent distribution models—or risk becoming utilities in someone else’s experience.

Embedded finance is the future of financial services—delivered where the customer already is, by brands they already trust.

Not bad tbh, except that I don’t believe in embedded finance.

Embedded finance is an inside-out view. Embedded finance is the perspective within the industry of moving finance to every potential digital service, enabled by technology and provided by financial firms that could be fintechs or banks. But it has no perspective on the customer experience.

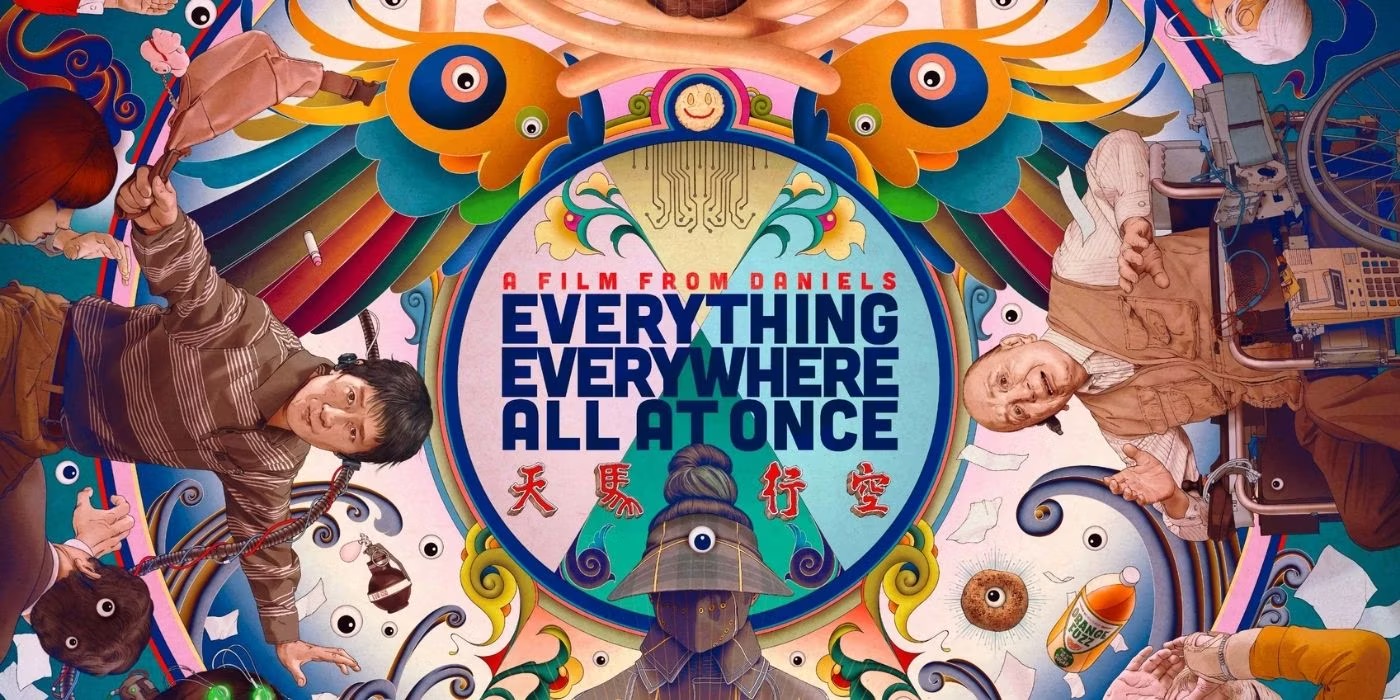

From a customer’s perspective, I want secure, reliable and trusted finance that is easy, convenient and everywhere. As we move to an augmented world of Meta Ray-Ban AI augmented glasses and wearables, the customer wants everything, everywhere finance all at once without having to think about it.

So, there’s the future: everywhere finance. It’s not about embedded (inside-out); it’s about everywhere (outside-in).

#justathought

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...