I just received an interesting report by Deloitte about API Banking and Banking-as-a-Service … the things I talked about back in the 2000s. The report is called the future of money movement, although I would argue it is the present of money movement along with embedded finance and open banking, which are also mentioned in the report.

This is where we get issues between those looking over the horizon versus those who live in the way we do things today. Anyone who thinks Banking-as-a-Service (BaaS), APIs and open banking is the future have missed the fact that this is the reality for many. I've been advocating these things for years. In fact, looking at my presentations, my first discussions of BaaS were back in the late 2000s. This is not new. Open banking launched in 2018 as part of the UK’s response to the EU’s Payment Services Directive 2 (PSD2). This is nothing new.

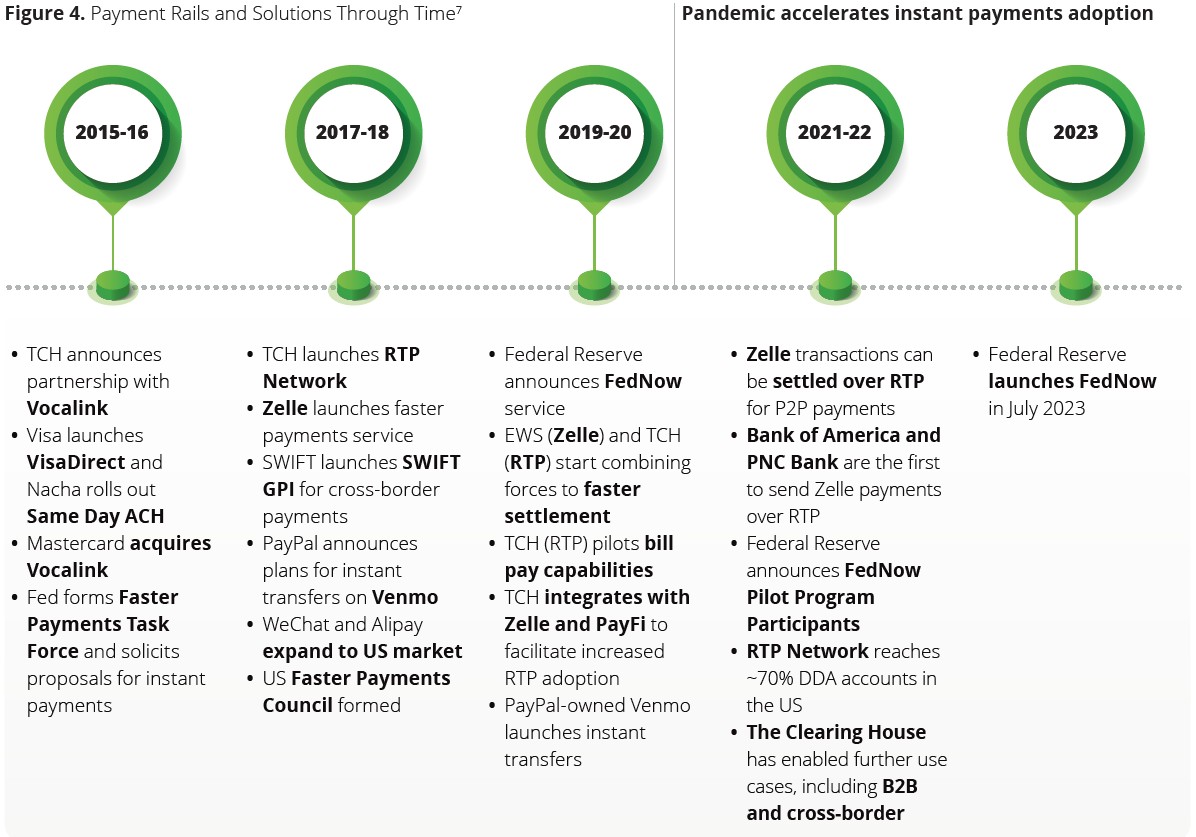

In fact, what really disappointed me in the document is that the term agentic is not mentioned once and embedded only once to talk about APIs being in embedded in the infrastructure of BaaS. You will see why that disappointed me in a minute but then, as I delved deeper into the report, I realised it is pretty US oriented, as illustrated by this chart …

… but then, looking at the authors, they all appear to be based in New York which explains that and, although a decent report, we all know in the rest of the world that the USA is about ten to fifteen years behind other regions in their payments processing technologies.

So yes, seven years after Europe and the UK implemented API-based Open Banking, the USA is finally catching up, but it has nothing to do with the future of money movement. These are the realities of money movement. The near-term is embedded payments and the future is agentic finance.

Embedded payments is pretty much here, although there are few who have defined it. My personal definition is where I don’t need cards or cash. In other words, everything is digital. In this space, it is not necessarily mobile payments – although the mobile wallet space is the most crowded space today, with Apple Pay looking like the leader – but it goes further. If you think that cards are no longer needed, what is the role of acquirers and issuers? If cash is no longer required, why are we still doing cash management?

These are critical question because, in the near-term – let’s say within the next five to ten years – the world will be living with embedded payments where no business or citizen uses cash or physical cards. Are we prepared for this? Are you?

Now, let’s add on AI which leads to agentic finance. If all of the payments people make are embedded with no card or cash required, then agentic finance brings intelligence to the wallet that is managing those financial actions. The embedded agentic financial wallet will sit within wearable tech, like Meta’s Ray-Ban AI glasses …

… and knows your every need. Buying a coffee? Just take the coffee and go. Taking a train ride? Just go to seat 36A. Going to a concert? Just pass through the gate, as we got your ticket for you. You get the idea.

In ten years, we will move around with totally embedded agentic finance and will laugh at the idea that people used to carry around cards and cash. Obviously, this has huge ramifications on payment terminal providers, banks and the whole infrastructure we set up over the last fifty years. But the point is that this was over the last fifty years. What are setting up for the next fifty years?

And a lengthy paper from Deloitte about API open banking does not cut the mustard for me if we are talking about the future of money movement. Sorry.

Nevertheless, to give it some support, here is a summary:

The Future of Money Movement

The document discusses the transformative impact of API Banking on the future of money movement and payment services, highlighting its benefits, challenges, and the evolving ecosystem in the financial industry.

Transformation of Payments Landscape

The payments and financial transaction landscape is rapidly evolving, driven by customer demand for instant and convenient digital solutions. The shift towards real-time payment solutions and API Banking is reshaping how financial services are accessed and delivered.

- Customers expect instantaneity, accessibility, and convenience in digital applications.

- Financial services lag behind other sectors in providing seamless mobile experiences.

- Transitioning from T+2 to T+1 and T+0 settlement cycles necessitates transparent access to trade data.

- API micro-services architecture is crucial for enabling real-time access to bank account information and transactions.

Rise of API Banking and BaaS

API Banking is revolutionizing the way financial services are delivered, allowing third-party developers to create innovative solutions on top of existing banking infrastructure. Banking as a Service (BaaS) enables non-bank companies to offer banking capabilities without extensive licensing processes.

- API Banking allows secure data sharing and service offerings to external parties.

- BaaS facilitates access to banking products for non-bank companies, enhancing market speed.

- Open Banking promotes data sharing between financial institutions and authorized third-party providers.

- APIs enable real-time transaction data, instant payments, and reduced costs.

Challenges and Limitations of API Banking

Despite its advantages, API Banking faces several challenges that need to be addressed for successful implementation. These include scalability, integration complexities, regulatory compliance, and data security concerns.

- Scalability and performance must be ensured to handle varying transaction volumes.

- Integration with legacy systems can be costly and complex.

- Different API standards may hinder interoperability and innovation.

- Regulatory compliance is essential but can be time-consuming and challenging.

- User consent and data privacy are critical issues that require transparency and control.

Current API Solutions in Banking

The banking industry is leveraging various API solutions to modernize payment processes, enhancing functionality and capabilities. These APIs facilitate payment initiation, status inquiries, account validation, and transaction tracking.

- Payment Initiation API triggers money transfers between accounts.

- Payment Status API allows real-time tracking of payment conditions.

- Account Validation API pre-authenticates bank account ownership before transactions.

- Balances and Transactions APIs provide up-to-date account information and transaction details.

Evolution of Payment Rails and Solutions

Payment rails in the U.S. are evolving to support instant payment capabilities, with various solutions like ACH, RTP, FedWire, and FedNow. These advancements are crucial for enabling real-time payments and reducing settlement times.

- Payment Rails are transitioning to support same-day settlement (T+0).

- ACH typically takes 1-3 business days, while RTP and FedNow offer immediate availability.

- FedNow launched in July 2023, enhancing real-time payment capabilities.

- 70% of U.S. depository institutions have access to the RTP Network.

Impact of API Banking on Trade Life Cycle

API Banking is significantly shortening the trade execution and settlement cycle, moving from T+2 to T+1 and eventually to T+0. This transformation requires automation and changes in operational processes.

- API-based money movement allows for real-time processing of trades.

- The traditional batch processing model is being replaced by automated systems.

- The shift to T+1 and T+0 necessitates a reevaluation of client communication and technology flows.

- The entire trade life cycle can be accelerated, enhancing efficiency and responsiveness.

Financial Inclusion Initiatives in India

India's financial inclusion initiatives, such as PMJDY and UPI, have significantly increased banking accessibility for citizens. These programs leverage APIs to integrate banking services with existing infrastructure.

- PMJDY has created 510 million new bank accounts, with 60% in rural areas.

- UPI allows free 24/7 money transfers and integrates with third-party applications.

- APIs are essential for UPI's functionality, enabling secure transactions and user authentication.

- The initiatives have largely eliminated transaction fees, making banking accessible to all.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...