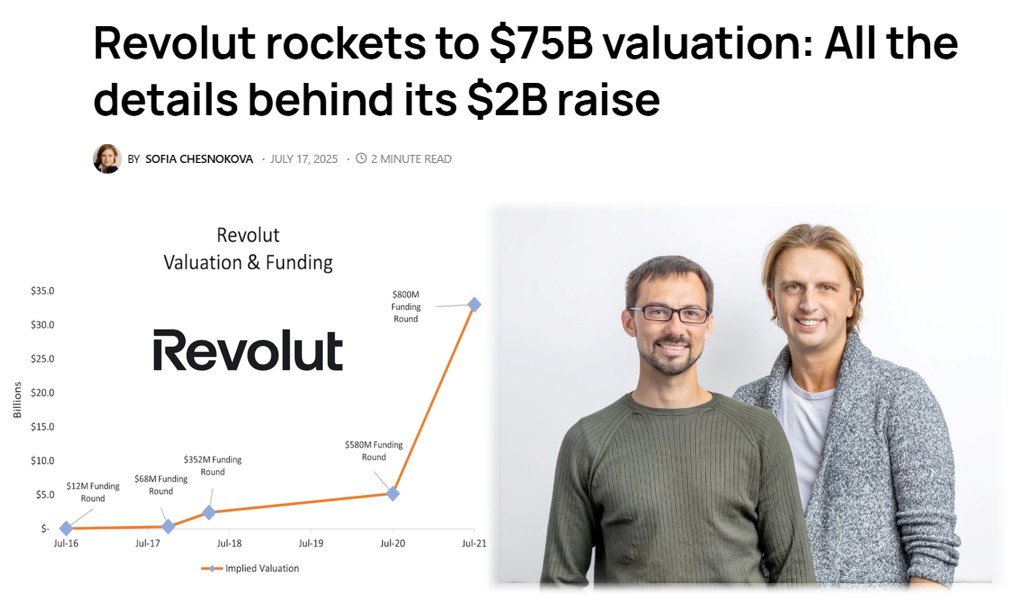

In a trip to London last week, I was lucky enough to be given a deep dive into the status of Revolut, Europe’s stand-out fintech unicorn valued at $45 billion last year and $75 billion today.

This is a company that, ten years ago, was just two guys sitting in a Canary Wharf office coding. Those two guys are Nik Storonsky and Vlad Yatsenko who, interestingly, are Russian and Ukrainian by background. No warfare here.

What has happened?

Well, going way back when, Nik and Vlad worked at Credit Suisse and both have a background in banking, admittedly with different perspectives. Nik was a trader and Vlad a developer. Nevertheless, working in derivatives in 2008 is a clear moment that shaped Nik’s thinking and, launching Revolut in 2015, he and his partner have followed a path to become the biggest fintech unicorn in Europe. How?

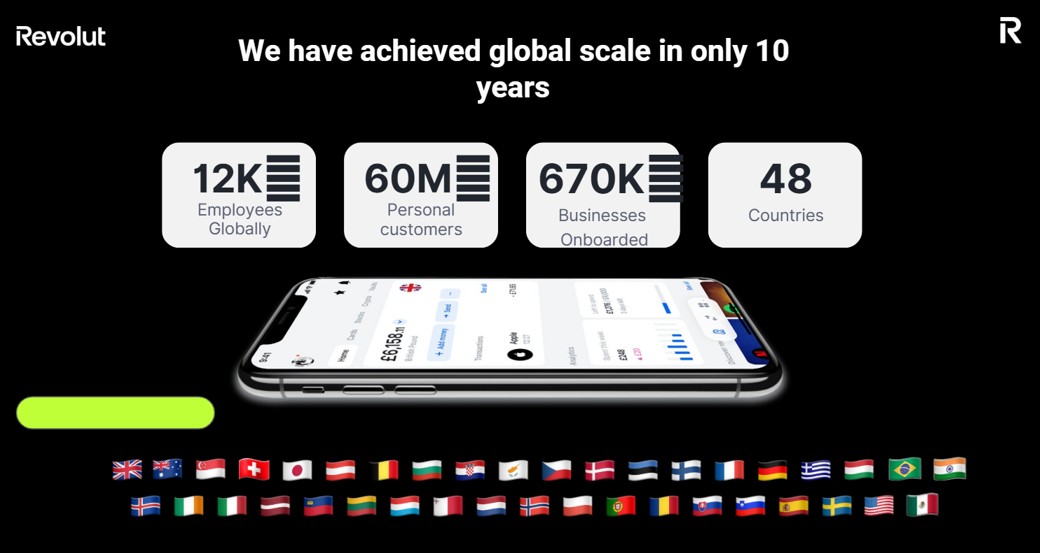

Well, it began simply: reduce foreign exchange fees. The thing is that path was already being trodden by TransferWise, now Wise, so Revolut pivoted to expand rapidly into other areas, gaining a full banking license in Lithuania in 2018. That gave them the ability to passport more products to customers across the EU which is 27 countries and more than 450 million people.

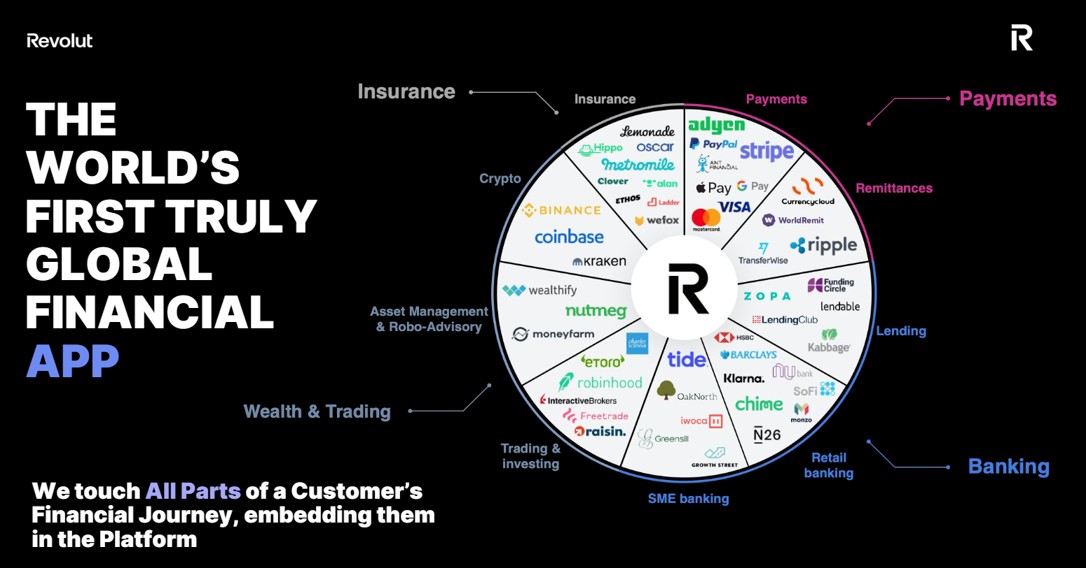

In other words, Wise wins on cross-border transactions, but Revolut won on full-service finance. In fact, today, they talk about themselves as the world’s leading financial super-app and, looking at their spectrum of products, you could pretty much agree.

Through the ecosystem, Revolut offers free and subscription-based digital banking, domestic and international bank transfers, debit cards, credit cards, a stock and cryptocurrency exchange, savings accounts, loans, insurance, wealth management and more.

It wasn’t this way just a few years ago, but they did something interesting internally called New Bets. New Bets is the opportunity to pitch any idea to the executive team and, if successful, you get a few million pounds to develop the idea. The thing is that it has to be delivered within eighteen months. There are almost 50 new bets made since 2021 of which five have been breakout successes, according to Nik.

The most notable thing however, is the phenomenal growth since 2020. What happened in 2020? Oh, COVID. Yes, that thing. Oh, and global expansion. Yes, that thing.

So, for all the media reports of a difficult culture, and some questionable practices, Revolut have not just come through but they have shone through. The biggest question now is whether they will IPO in London or New York, as Nasdaq looks like their preferred option.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...