I’m such a futurist nerd in banking that, thirty years ago, I forecast banks would open telco services and vice versa, and can prove it if you want. The reason? Both have frequent customer contact, high transaction volumes and similar capabilities.

Just seven years ago, I was still banging on the same drum. It is nothing new. Many banks have opened telco services – Rabobank memorably did so back in 2006 – and several mobile operators have opened banks – Orange is a notable one, launching the Orange Bank in France in 2017 which gathered 20,000 customers a month before closing its doors in 2024.

The latter is a key point. Rarely does a bank make mobile work and vice versa. The reason? A culture clash.

Banks want basis points – bps on credits and debits – because their focus is interest income; telcos want volume – data and minutes – because their focus is time on the network.

The profit focus is radically different.

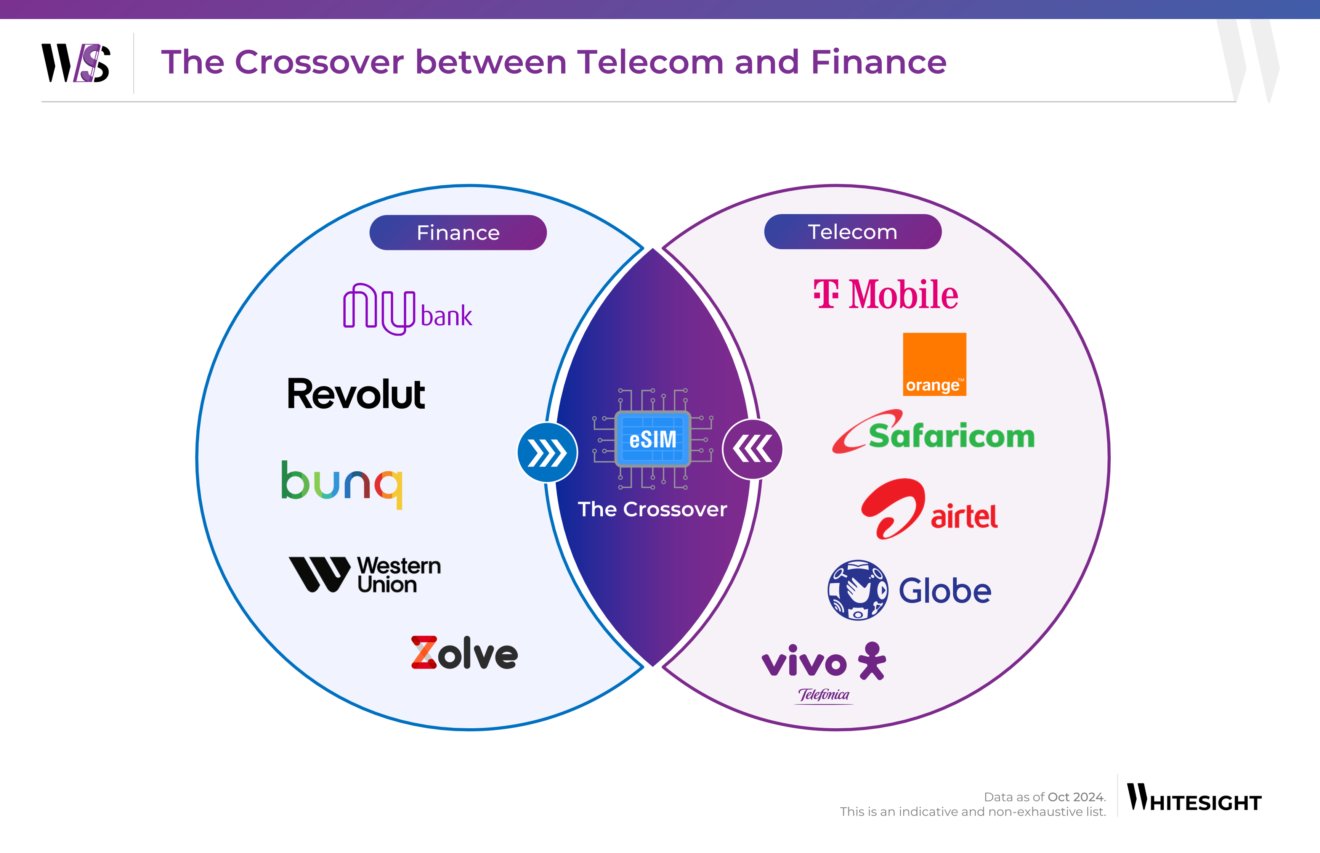

However now, with the latest developments around eSIMs, are things changing? In the past twelve months, many challenger banks have launched eSIMs embedded in their apps. Revolut, Bunq, Nubank and now Monzo are all moving in this direction, as are other outliers like Klarna. Why, and will it work?

Well, interestingly, most media are portraying the launch of bank eSIMs as an attack on core telco operators like Vodafone, Virgin, EE, O2, Orange and T-Mobile.

Source: Whitesight

Well yes, it is true that an eSIM can replace a physical SIM card. An eSIM (embedded SIM) is a digital SIM built into a device, allowing users to activate a mobile plan without needing a physical SIM card. It offers advantages like faster setup, dual SIM capabilities, and easier international travel. This then allows a bank to not only take over the interface from the physical SIM provider, but also get far more control over the mobile apps and security of those apps through that eSIM.

Take Authorised Push Payment (APP) fraud – is it a coincidence it’s an app? – where people get a call from a faker pretending to be from the banks’ fraud department. You challenge them, and they say: don’t worry, just call us back on the bank’s official fraudline. You do that without realising they’ve just been holding the line, waiting for you to call back. An eSIM from a bank could detect such activity far earlier and provide prevention.

In other words, the bank’s fraud and detection systems become symbiotic with the phone and its access controls. That could be a winner and, between international calls, lower costs for domestic services from data to calls, and fraud and security, an eSIM for a challenger makes absolute sense. The thing is however, to not think of this as a revenue and profit generator, but as a cost and loss preventer. Now, there’s an interesting idea.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...