Short answer: possibly.

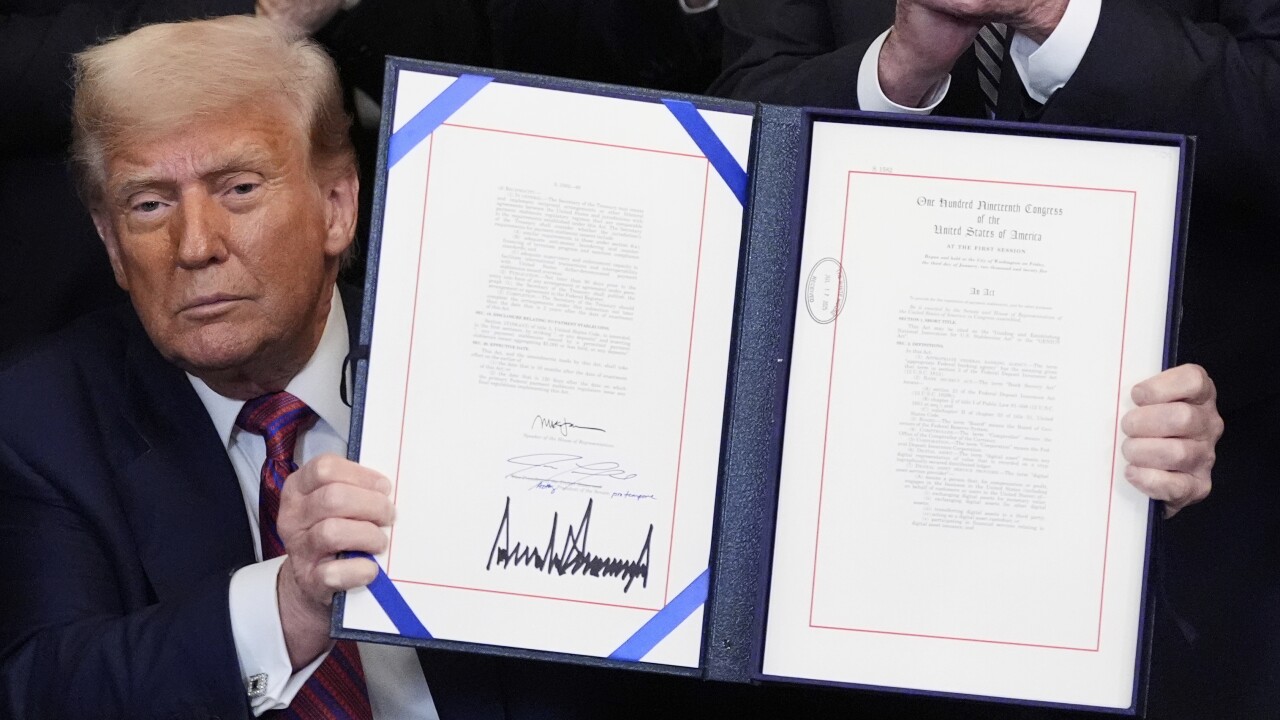

Long answer: the GENIUS Act (the Guiding and Establishing National Innovation for U.S. Stablecoins Act) gives a massive stamp on cryptocurrency tokens, stablecoins and protecting the US dollar as the reserve currency of the world. Oh, and it also creates a major opportunity for non-banks to become players in payment processing. For example, in June, Amazon and Walmart announced that they were working together on developing their own stablecoin with potentially other major retailers onboard. Why now? Because of the GENIUS Act, a bill setting federal rules and guidelines for cryptocurrency tokens pegged to the U.S. dollar. These ‘stablecoins’ would now allow digital assets to become an everyday way to make payments and move money.

The result is that many companies are working out their own stablecoin strategies to leverage the ability to support instant payments and settlement on their platforms. These include the big banks but also retail heavyweights like Amazon and Walmart. In a post the other day, Marianne van Groeningen gave her view about the implications of the Act and the opportunities it creates for the large corporations:

Walmart and Amazon are building their own USD stablecoins [because] they want to own the rails, bypass banks, crush interchange fees [and] most important, cut $143 billion payment tax to banks … strategy is clear: replace cards with tokens; replace float with programmable dollars; replace settlement networks with smart contracts.

Interesting take. Although she says that the retailers won’t be trying to replace Visa and MasterCard, the critical change is that they will try to crush the interchange fee system between issuer and acquirer banks. In other words, break the four-pillar model using stablecoins, licenced under the GENIUS Act. For banks and fintechs, however, the GENIUS Act is not just about new payment rails. It also raises critical compliance challenges — from KYC, CDD, and sanctions checks at the issuer level to transaction monitoring and suspicious activity reporting across jurisdictions.

What got me – having reposted Marianne’s view to my network – is the comments coming back. I’m not going to list them all here – click through the embedded links – but the gist seem to be what Amazon and others could offer consumers as incentives by doing this and, more importantly, what would the big retailers lose by doing this.

For example, they would now have all the regulatory overheads of being a payments processer, and the liabilities that go with this, and little return on that investment. Sure, they would lower or eradicate interchange fees, but is it worth it?

I guess this question will float around for a while, but it is definitely an area to watch as everyone is thinking about opportunities in this space. It’s not just Amazon and Walmart but Experian, the big airlines and more. The thing is that they have to wait for the fine tuning and details to emerge. After all, although the GENIUS Act has been signed into law, its implementation may be several years away as federal banking regulators have to work out the detailed rules for the use of stablecoins in practice.

This may actually be the area where all of the speculation of non-banks offering payments and clearing stumbles over. If you take a big firm like an Amazon, a huge part of their revenues are generated by their AWS cloud services, of which the major client base is in finance and payments. This is where partners play a role. For example, I’ve recently been introduced to WNS who, through their Centre of Excellence in Digital Assets provide financial clients with due diligence and investigations across cryptoassets — including cryptocurrencies, NFTs, and stablecoins. The team performs deep investigations such as fraud detection, AML monitoring, and blockchain transaction tracing, enabling clients to reduce risks while scaling adoption responsibly. In other words, for all the talk of Big Tech and Big Retail destroying bank structures with technology, it is far more likely that Big Banks will reinvent their systems to embrace new opportunities created by technology AND regulation.

This is why banks like JPMorgan, BofA, Citi and U.S. Bank are all talking stablecoins too.

JPMorgan Chase CEO Jamie Dimon said the biggest U.S. bank will be involved in both their own deposit coins and stablecoins, “to understand it and be good at it, during their recent Q2 earnings call. Expanding on the theme, Dimon’s view is that stablecoins “are real, but I don’t know why you’d want a stablecoin as opposed to just a payment” and that, given the fintechs and other activities in this space, “we have to be cognizant of that, and the way to be cognizant is to be involved. So we’re going to be in it and learning a lot.”

Similarly Brian Moynihan, CEO of Bank of America, reinforced these comments during their Q2 earnings call. His point was slightly different saying that the bank would “be there, just like we were there when we moved from checks to Zelle”, but that that bank is “still trying to figure out how big or small it is”. His core point was that the business case for stablecoins are “still to be proven, frankly.”

In fact, bearing in mind that the GENIUS Act could be viewed as purely enabling another way to make a payment, some people think it is just going to go the same way as other forms of payment by mobile and will be absorbed into mobile wallets like Zelle and Venmo.

It will be interesting to see how Big Tech, Big Retail, Big Banks and the other big firms play out in this space.

Meantime, the most interesting aspect is that it is all tied to the US dollar. Isn’t that the real motivation here, as in avoid de-dollarisation and put America first? In other words, the genius behind the GENIUS Act is making America great again.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...