I was having a chat the other day. It was behind closed doors, under Chatham House Rule but, nevertheless, will share my thoughts here as the big question was: who are you marketing to?

Several major football teams have bank brands all over them. Many websites are associated with financial brands. On television, there are many adverts created by financial firms, my favourite of which is the recent Nationwide TV series of ads …

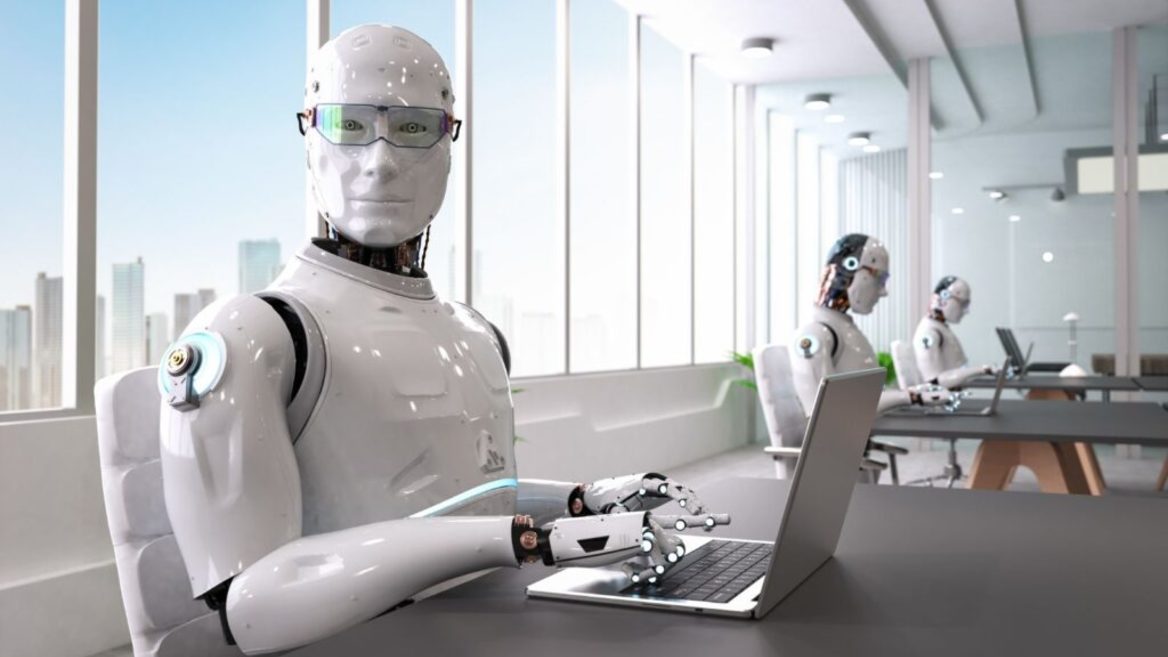

But the point is that we shouldn’t be marketing to consumers in the old way. The old way is to target the human. The new way is to target the bot.

Bot-to-bot relationships are where the new relationship lies. We are no longer dealing with humans or B2C. We are designing bots, or B2B (bot-to-bot), for bots. The game has changed or, if you prefer, it’s a gamechanger.

The critical factor here and everywhere is that we are moving from human-to-human systems to bot-to-bot systems.

So, think about what a bot wants. It wants connectivity, uptime, reliability and constant comms in real-time , What does a human want? Relationship, dialogue, interface and constant comms in real-time. They seem similar but the marketing to humans is very different to the marketing to bots.

Marketing to humans is all about noise, recognition, relationship and emotion; marketing to bots (robots) is all about availability, uptime, access and data. The former is entirely malleable; the latter is all about numbers. Can you ensure your bot is more competitive than your competitors’ bot?

Today, for example, we go on to comparison sites to find the best deal. Tomorrow, our bot does it for us. We no longer have to search. Our bot just delivers.

What this means for financial firms is that, for all the advertising through branding football teams and airports, is that the cold, hard truth is that decisions will be made by systems. There is no point in advertising or sponsorship. The point is to be at the top of the bot brigade.

Marketing to bots will be the big change in the next decade as we move from marketing to humans to marketing to bots.

The key requirement is therefore to be available through the network. It is not about brand, visibility, marketing; it is much more about reach, connectivity and availability.

This is a gamechanger as we move to a new level of marketing where the network rules and the suppliers serve. Until now, most of marketing has been about mindshare; today, it’s about networkware. How aware of the network is who you are, where you are, what you do and how you do it. This is what bots want to know. They don’t want to know your emoticons or emotions; they want to know your statistics and rates. Pure and simple.

Are you ready for the bot-to-bot war of rates or are you still stuck with emotions marketing? If the latter, you will lose.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...