I was really interested that Barclays Private Bank published an interview about AI the other day.

Why?

Because it’s the private bank and it’s from a bank.

The interview is with Professor Michael Wooldridge, one of Oxford University’s leading AI academics with more than 450 research papers to his name. He knows his stuff. What I liked about the interview is that Professor Wooldridge made several impactful statements. For example, why is AI such a hot topic today?

“Artificial intelligence has been with us for decades … what’s different now is the extraordinary breakthroughs in large language models and the ability to build AI systems at a scale nobody had attempted before. Systems like ChatGPT can generate text, write computer code, translate languages, even answer questions in ways that feel natural. That’s new – we simply didn’t have technology that could perform at this level until very recently.”

Is AI safe?

“Many companies are rushing to implement new models, and with that speed comes a risk that important safety or ethical considerations might be overlooked.

“From my research on multi-agent systems, one lesson is that when you have lots of interacting AI agents, outcomes can become difficult to predict. And if organisations deploy these systems quickly, without fully understanding how these dynamics might play out, there’s a real chance of unintended consequences.”

So what is AI for right now?

“AI is fundamentally a productivity tool: automating routine work, improving decision-making, and even enabling new business models.”

That sounds like it could have very high impact?

“[AI’s] impact is likely to be uneven. Some sectors will feel the effects more quickly than others, depending on how central information and knowledge are to their operations. In areas where work is highly specialised or physical, adoption may take longer … [but] businesses will increasingly find practical ways to use AI in day-to-day operations – drafting documents, helping with customer support, analysing data. These are relatively low-risk but high-impact applications that can save a lot of time and money.

“When it comes to risks, safety and reliability are key. Large language models are known to make mistakes, or “hallucinate”, and if outputs are relied on without careful oversight, the consequences could be serious … beyond that, there are ethical, regulatory and practical considerations that need careful management as AI adoption grows.

“One of the biggest concerns is reputational risk. If AI outputs are used in high-stakes environments – like customer service, media or financial advice – mistakes or misleading results can quickly damage trust in a company or institution. That’s why oversight and management are so important.

“Regulation is another challenge. Many policymakers don’t fully grasp what AI actually is.”

And in the near future, will we see AI everywhere?

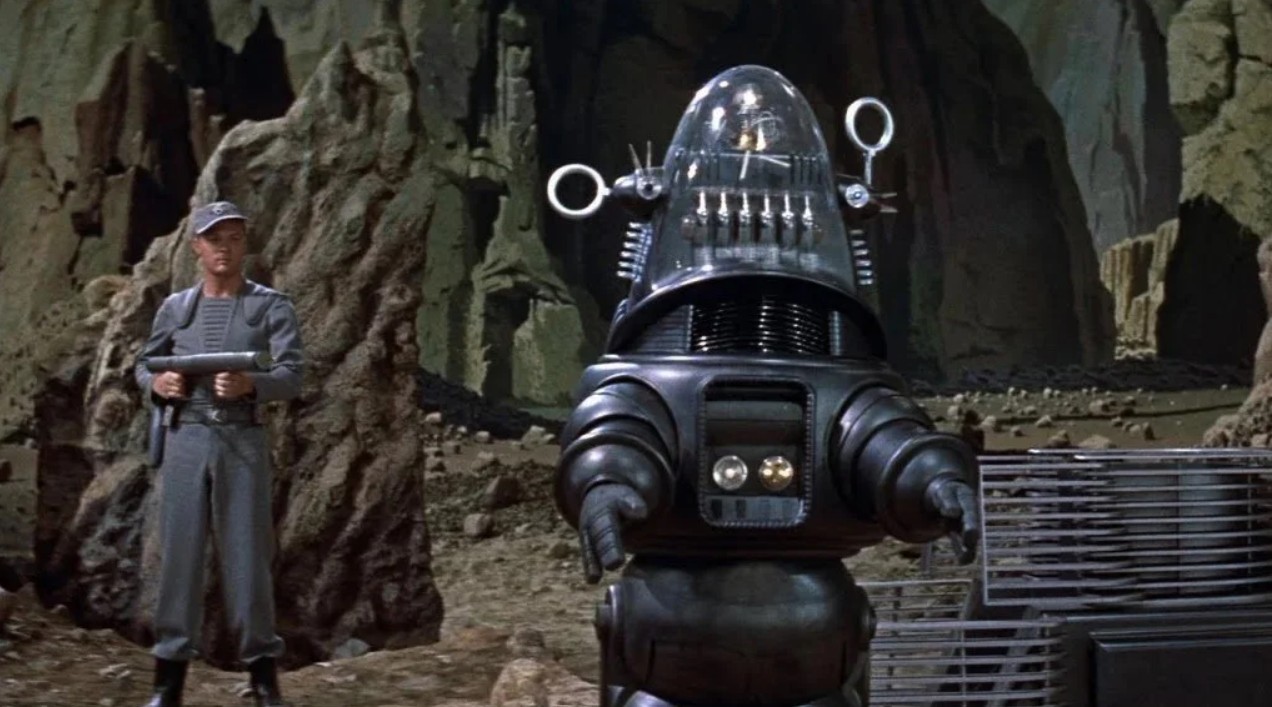

“Most people still imagine AI as something like ‘Robbie* the Robot’ from science fiction. In reality, it’s usually just code running on servers, quietly becoming part of our daily lives – things like Google Translate, which most people don’t even think of as AI.”

This is a shortened version of the full interview.

* I noted that whoever wrote up this interview got the text wrong. They spelled Robby as Robbie, as in Robin Williams. Robby was a robot from the 1950s and it is where the boomer and GenZ divide appears. Who is Robby? Robby the Robot is a fictional character who first appeared in the 1956 film Forbidden Planet. He made a number of subsequent appearances in science fiction films and television programs, which has given him the distinction as the hardest working robot in Hollywood.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...