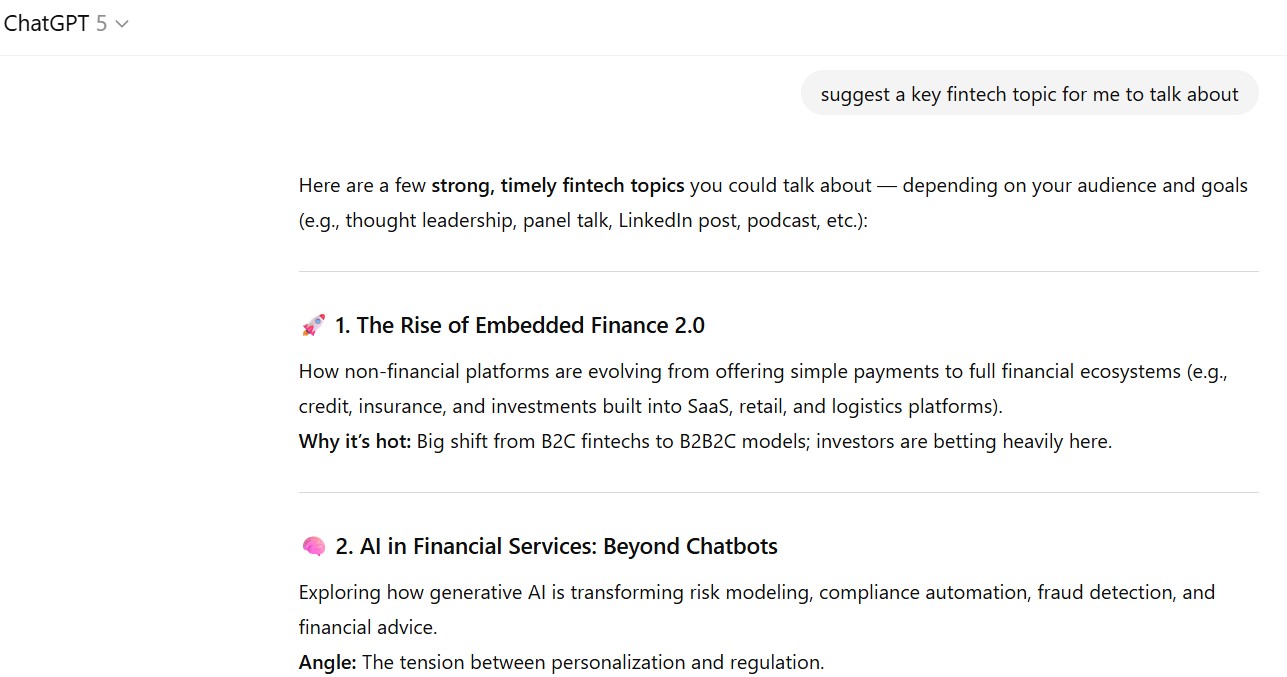

Giving away one of my trade secrets, I asked ChatGPT to give me suggestions about what to blog about and it came up with seven things:

🚀 1. The Rise of Embedded Finance 2.0

How non-financial platforms are evolving from offering simple payments to full financial ecosystems (e.g., credit, insurance, and investments built into SaaS, retail, and logistics platforms).

Why it’s hot: Big shift from B2C fintechs to B2B2C models; investors are betting heavily here.

🧠 2. AI in Financial Services: Beyond Chatbots

Exploring how generative AI is transforming risk modeling, compliance automation, fraud detection, and financial advice.

Angle: The tension between personalization and regulation.

🌍 3. Fintech and Financial Inclusion in Emerging Markets

How digital wallets, alternative credit scoring, and cross-border payments are unlocking access for underbanked populations.

Bonus: Tie in trends from Africa, India, or LATAM for global relevance.

💸 4. The Future of Real-Time Payments

The implications of FedNow, SEPA Instant, and UPI on banks, fintechs, and consumers.

Focus: How real-time infrastructure is changing settlement risk and liquidity management.

🔐 5. Digital Identity & Trust in Fintech

The growing importance of verifiable credentials, biometrics, and privacy-preserving KYC in a world of increasing fraud.

Relevance: Crucial as fintechs scale globally and face tighter AML rules.

🪙 6. Tokenization and the Future of Assets

From real estate and carbon credits to US Treasuries — how blockchain is reshaping asset ownership and liquidity.

Trend: “On-chain finance” (RWA tokenization) is one of 2025’s biggest institutional focus areas.

🌱 7. Sustainable Fintech: ESG Meets Money

How fintech is enabling green finance — from carbon footprint tracking to climate-risk scoring in lending.

Angle: ESG transparency through data and AI.

Nice.

What is noticeable in this list however is no mention of cryptocurrencies, stablecoins or CBDCs (Central Bank Digital Currencies). ChatGPT doesn’t know everything. Equally, neither does the UK Government.

The CEO of Kraken UK, Bivu Das, was discussing the issues at the Zebu Live conference in London saying that the UK has lost its Fintech Crown due to the sluggishness of embracing and regulating cryptocurrencies.

Talking about the way in which the US and EU have been first movers, Das said: “At least they’re on the road, but we’re sitting there on the hard shoulder, waiting to see if the other two crashes before deciding what to do.”

Why the hesitancy?

I guess it is because there is so much else for the Treasury to deal with, what with rising inflation and taxes. It was notable however that on the day I saw that headline about Kraken saying the UK has lost its Fintech Crown, Innovate Finance agreed!

Well, they didn’t quite agree but CEO of Innovate Finance, Janine Hirt, did say that: “Fintech is a huge driver of growth, but in order for the full power of our sector to be unlocked and help benefit this community and our entire economy, we need government and we need regulators to get behind us as well and support this sector,” and warned that UK investment into the sector was slipping, giving way to the rise of rival international fintech sectors.

Speaking at Innovate Finance’s Fintech as a Force for Good event, she stressed that the UK has “to grasp the opportunity that lies before us, because other countries around the world, they see that opportunity too, and they are moving forward. We have got to take action, and we’ve got to take action now if we are going to cement our leadership in financial innovation and fintech.”

Totally agree.

It is interesting that with all the hype, growth, investment and community around Fintech in the UK, the froth is dissipating. UK Gov needs to bring back the Fintech mojo.

Postscript: this blog was written by Chris Skinner and not by Chris Skinnerai and, just to prove it, here is the FCA's new consultation paper on tokenising funds:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...