Building on yesterday’s blog about Project Nemo, it’s worth mentioning the Purple Pound. Every year, Britain celebrates Purple Tuesday – in case you missed it, it was last week - and it is all about recognising the massive community in all countries who are financially challenged.

78% of people who have disabilities find it difficult to go shopping; 66% find pubs, bars and restaurants difficult to access; and 48% find theatres and concert venues difficult to deal with. Yet, this community has more than half a trillion dollars of spending power or, as the charities describe it, the Purple Pound..

Did you know that 17% of people around the world are challenged? That’s 1.8 billion people.

Did you know that seven out of ten people who are challenged will leave a business service and never return? That’s millions of customers you just missed.

Project Nemo puts this into a context that asks that financial services firms – banks and fintechs – consider the needs of those physically and mentally challenged in their thinking and, when you think of those stats – 1.8 billion – it would be stupid not to particularly as these millions of people spend, spend, spend.

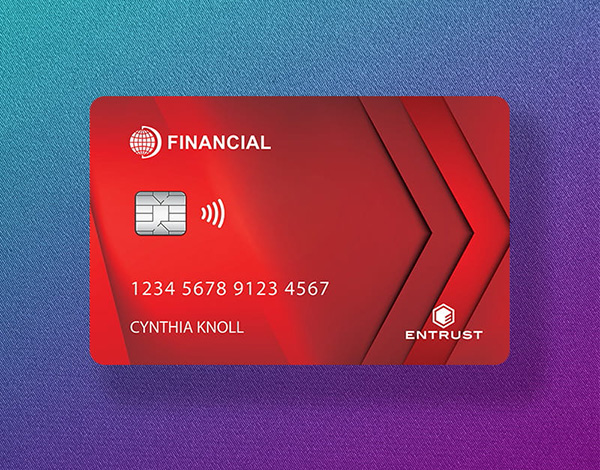

Just in the UK alone they spend almost £15 billion a year, according to Visit Britain. Expanding on this, the total value of the Purple Pound market spending is almost £300 billion a year and yet financial institutions are doing less and less to support them. Take this example: flat cards.

What are flat cards? Well, they are the new cool cards that MasterCard and Visa are rolling out where the embossed credit card number is no longer needed on the card. Supercool … or super oversight missing blind sight. Blind people cannot use a card that has no physical feel. This was raised in a major Parliamentary debate recently asking that financial firms continue to roll out embossed cards to customers who request them.

In a similar fashion, I always remember working at NCR who make ATMs, and we realised that many cash machines were at standing height rather than wheelchair sight. If you are seated, you cannot see the ATM screen or use the keypad effectively. That led to a rollout of lower level ATMs.

It then led me to thinking about what happens if you have been born without limbs or lost them through war, sepsis or something similar. How can you use apps, ATMs and such like?

Well, there are ways. Some can use their feet and toes to hold and operate a smartphone. Others can use a mouth stick. A mouth stick is a stylus held in the mouth which allows a user to make selections on a touchscreen or keyboard. Equally, you could use a residual limb – the crook of the wrist or elbow – to make selections and tap with a stylus pen or similar.

Taking it further, you can use eye tracking and voice to drive apps and systems.

The question in my mind is whether banks or, for that matter, any businesses are considering these needs for access.

As we move to digitalise everything, close all branches, push customers onto apps and away from any face-to-face service or even voice-to-voice, is anyone considering the needs of the millions less abled?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...