At Money2020 Amsterdam I met Airwallex, a company that has risen rapidly from nowhere to the top of the heap. I was a bit embarrassed not to know much about them but, in 2018, Stripe offered $1.2 billion to acquire Airwallex. At the time, their revenues were just $2 million. Stripe's Patrick Collison negotiated directly and Sequoia investor Michael Moritz urged them to accept.

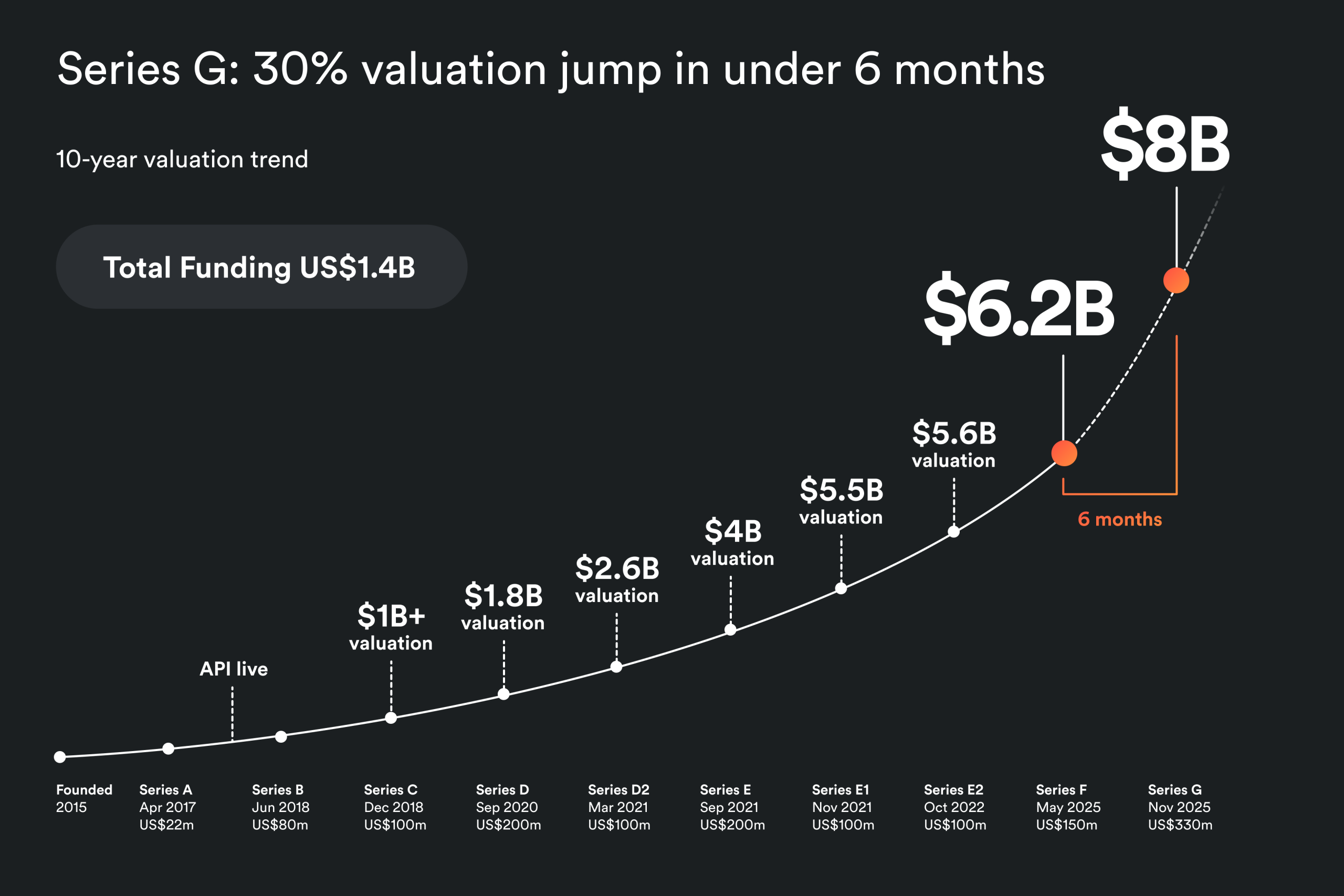

The co-founders voted via WhatsApp and said no. Were they mad? No as, today, they’ve just shared that their latest valution is $8 billion valuation, based upon $1 billion in revenues (ARR).

How come they’re worth so much, making so much and where did they come from?

Let’s start at the very beginning, as that’s a very good place to start (Ed: sorry, doing my Julie Andrews there).

Where did they come from?

The company was founded in Melbourne, Australia by Jack Zhang, Max Li, Lucy Liu, Xijing Dai, and Ki-lok Wong in 2015. Jack Zhang is also the CEO, and I blogged about him recently.

What do they do?

Well, they claim to help businesses accept payments, hold money in multiple currencies, pay suppliers internationally and all of this without needing multiple bank accounts across different countries.

How come they’re making so much?

They claim their systems make it easy for companies to consolidate 10-20+ banks into one platform, and eliminate 4-6% in hidden currency conversion fees*.

That’s pretty compelling and is why they are used by over 200,000 customers including McLaren Racing, Arsenal Football Club, Navan, Qantas, BILL, Bolt, Canva, Brex, and Deel.

Anyways, they’ve just made a major announcement today. The announcement is a valuation of $8 billion based upon $300 million in new funding through investors T. Rowe Price, Activant, Lingotto, Robinhood Ventures, TIAA Ventures, and led by Addition. This pushes their valuation to $8 billion, just a little bit more than Stripe offered, and represents a significant 30% jump in valuation in just six months.

The valuation is based on the fact that the company now has $1 billion in revenues, which is 90% YoY (year-on-year) growth.

But there is more as you can add on to this that they are making a billion dollar investment in US expansion (2026-2029) to take on Stripe and other competitors; add on to this that they are building Agentic AI workflows to handle invoicing, procurement, treasury, and policy checks … all of which is building toward a fully autonomous finance stack. Add on to this that they launched in 12 new countries over the last year, and now have 80 licenses and registrations.

It's a pretty impressive story.

What I really like is that they have basically built a private global payment network that routes around the traditional banking system. The company make it clear that 90% of transactions arrive same day using local rails that are fast, cheap and transparent. That's pretty impressive n'est pas?

* Airwallex can hold over twenty currencies in one account, so money never has to convert until the client decides. This alone saves companies 3-6% on every international transaction. Compare that with traditional banking and payments partners where, if you earn USD, the bank converts those dollars into your home currency. A short time later, you need to pay a supplier USD and then the bank converts your home currency back into USD. There’s two currency conversions, two FX fees and money lost both ways. That’s where Airwallex wins, so they say.

** Bloomberg covers the $8 billion valuation in more depth.

Disclaimer: this article is commissioned to coincide with a major release update of Airwallet's valuation.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...