Everyone and their weird cousin is invested today. In crypto, of course. Bitcoin, Ethereum, XRP, even Dogecoin, or its low-rank pup Floki. Cryptocurrencies are constantly on the news, social media is buzzing, and one in about a gazillion investors wins big.

We’re not even debating here if the notion of digital assets has merit as a technology, because of course it does, can’t stress this enough.

We’re focusing on the followers. The mob, the congregation, if you will. They will try everything to get to you, not short of making a video on clideo.com and detailing why you need another sh*tcoin in your life (feel free to replace with any of the over 25K names out there). But you’ve lost big on Pepe, pal, and now your grandma won’t give you cash anymore…

Don’t believe me, just look at how big memecoins have gotten.

Public Takes Sides. Why So Divisive?

It’s been a decade since Bitcoin first stepped on the scene and people are still ready to tear each other to shreds over a piece of technology that’s basically an enormous transaction log.

This log is very useful for instant transfers, overseas money exchange, grew smart contract capabilities, and, in its purest form, limits the influence of malicious players, if the digital asset is decentralized.

I don’t remember anyone having this much debate over servers or GPUs… But the crypto clowns are a special bunch. Yet, there are still several sides people typically take.

Deny! Call It Evil!

If you’re into the crypto scene, you’ve probably heard people like Warren Buffett (chairman of insurance company Berkshire Hathaway) spitting heavy criticism in the overall crypto direction. Now look, I’m not saying he’s right about Bitcoin being worthless. But the guy worth $148 billion has a say in what a good investment looks like. And many people take notice.

Meanwhile, denying the utility of an entire new technology is just as reckless as investing your entire 401k in it. Balance and common sense are somewhere out there, but they have remarkably fewer followers. As usual.

These people like to get ‘triggered’ by conversations about crypto, they like to give crypto investors a hard time.

Maybe, rightfully so, it’s not for me to decide. But these next folks can sure be pushy.

Ideology Will Keep Us Fed & Warm

Now, there are others, who like to idealize whatever they believe in. These people will take a constellation of calculations, algorithms, and notions, and turn it into religion.

Oh, you’ll see, Warren! Bitcoin is the future! Blah-blah-blah… Yes, but please stop indoctrinating your family.

Just do your thing, invest as you see fit, and if/when you smoothly (or sharply) transition to owning three Lamborghinis, people WILL notice, and WILL ask you how you did it. That’s your cue to start talking about it. Before that happens, just focus and educate yourself. That’s it. Please don’t turn financial decisions into a cult.

Few more points to make:

- These are also the people who would try and convince you that Jesus coin (yes, I’m not even joking) can set you free.

- On the opposite end of the obsession are crypto-heads who deny that ANY digital asset apart from Bitcoin even has any merit. None. Even ETH, because Buterin runs a tight ship over there, and Ethereum is not decentralized (which it’s not, to their defence).

- Invest smart and ease up on the ideology. If something doesn’t work for you, dump it, the coins don’t have long-term memory.

Profiteers to the rescue!

There’s absolutely nothing shameful in wanting profit for the sake of profit. You don’t have to be emotionally invested in every single decision you make.

Crypto profiteers know what they want and state it outright. We WANT PROFIT! Crypto is a juicy pie, and we want a piece. What’s wrong about that?

Let me answer myself. NOTHING. Investing solely for the sake of getting a tenfold return is what capitalism is built on. This is where it gets interesting.

In order to win big, these people collect intel on many different small, up-and-coming coins that are just about to hit the market, and, supposedly, explode. We’re talking 100x and more.

They sniff out who is behind the project, who are the investors, and which platforms took on the ICO.

They can dig up someone’s ex to get inside information, they sometimes stalk people online, make connections on Twitter (oh, pardon me, X) etc. You get the gist.

Big assets like the established top 20 or rather top 50 won’t get you big wins, because they already have considerable market caps. As of late December, 2025, the 50th coin by market cap, KuCoin exchange’s token KCS, is worth over $1.4 billion. And so, the profiteers often try and create a hype around a coin of their choice to MAKE SURE it shoots big. Get the loop?

Wolves in sheep's clothing

Oh, this is my ‘favourite’ bunch. They are the most dangerous if you ask me. These are people who sell you the ideology, while being a profiteer on the inside.

Are they deceiving you? Are they deceiving themselves? Doesn’t really matter. The dangerous thing is you can’t always tell them apart from the relatively harmless ideologs who only want some of your time and good company.

Crypto is a new way of thinking about money, mate! It’s our community answer to the greed of capitalism, wake up, it’s about decentralization, man!! Yeah, right… If I could slap you across the screen, I would. Of course it’s about money! What kind of delusional thinking is this?

They will get on the AppStore, download some software, make a hype video ( in commercial purposes, of course) then change their tune in a few hours.

What are you to do about all of this? Be the type #5.

Low-Profile Crypto-Heads

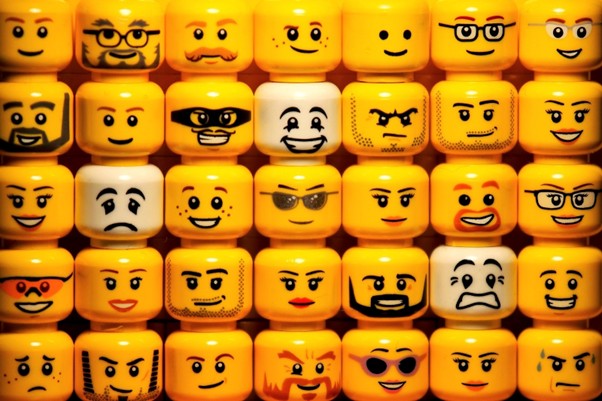

If we’re not talking about the execs and influencers in the industry, only one type of crypto investor is left. In my understanding, low-profile crypto investors are the most sane kitties in the litter. Like those memes… This is Kevin. He:

- Does their research meticulously.

- Reads reputable sources, staying on top of the news.

- Has an online presence, but don’t use it to indoctrinate others.

- Admits the risky nature of digital asset investments, and uses it to diversify their portfolio, not to compile it completely. If there’s anything to diversify, or course. No offense.

- Knows how to keep their money safe, have cold wallets, and prefer not to blame online platforms in case of a loss.

In other words, be like Kevin.

Crypto is a Brussels sprout in Ferrero Rocher wrapper.

Critical thinking is one of the best, most fascinating, and fast-fleeting skills we have. Use it. Doesn’t even matter what kind of pink delusions you had stepping into the field.

You wanted the fast gain, the instant 1000x, the opportunity to get EVERYTHING you’ve ever wanted in one fell swoop. That’s not happening.

That’s why crypto is getting a bad rep. Not because it’s worthless, but because of the investors who see it as a magic wand against poverty and the human condition, and the ill-advised ‘puppeteers’ who sell those notions to people who don’t know better, and profit in the process.

You expected a sugar rush from the chocolaty goodness of Ferrero Rocher candy (substitute with favourite candy, I don’t mind).

But instead, you actually get something better. A solid technology that will serve humans for decades, and has the capacity to actually make their lives better. Just not instantly.

In other words, a Brussels sprout that will possibly make you fart for about an hour, but is ultimately great for your digestive system.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...