I often look at the Fed's Mortgage Maps of America to cheer myself up(?).

Had a look today to see if there were any green shoots, and find that prime and subprime still aren't looking good.

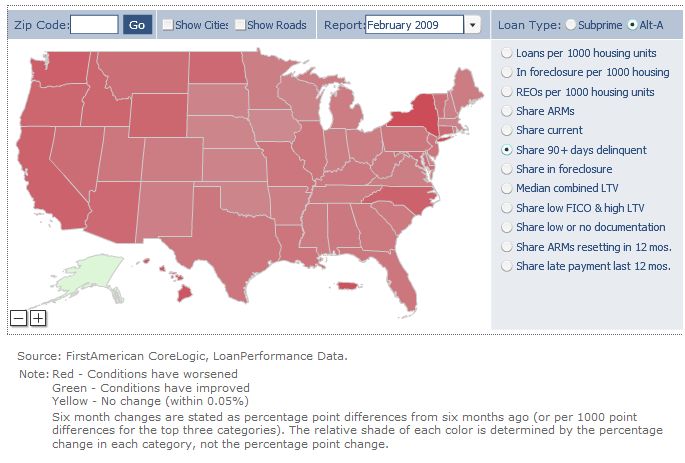

Prime customers in default over 90 days compared with six months ago (green means it's getting better, red means it's getting worse):

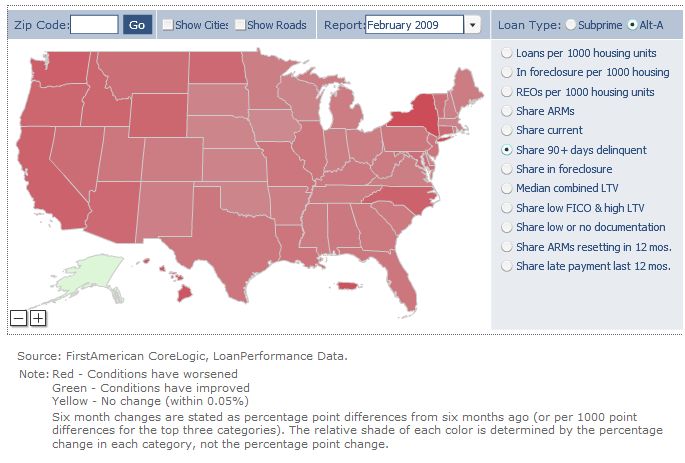

And subprime in default over 90 days compared to six months ago:

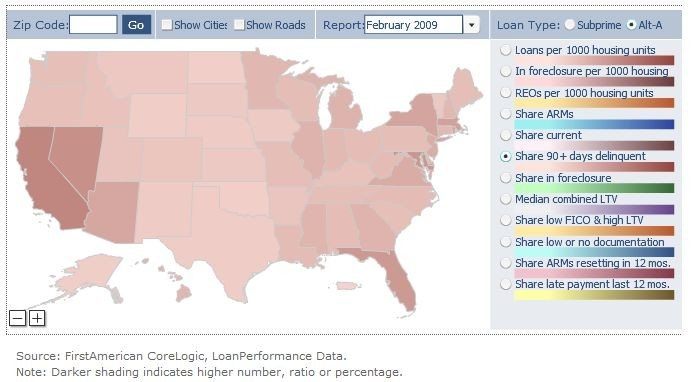

I then looked at current rates of 90+ days delinquencies hoping that might show a better picture but prime:

and subprime:

are both getting worse.

Aw shucks.

Mind you, subprime foreclosures appear to be stabilising so ... you never know.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...