Techcrunch analysed the views of 549 company founders to see what made them successful.

After “experience” and “management team”, “good fortune” was the third most important factor.

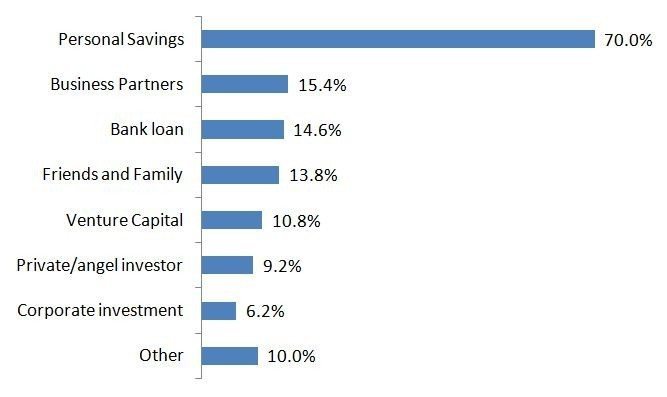

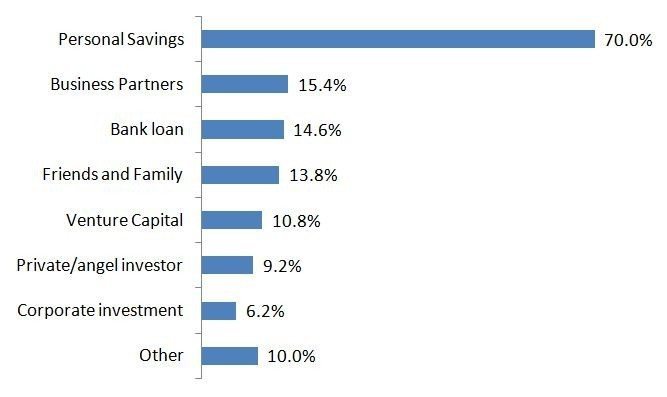

But the bit that intrigued was the way these guys started their businesses and what finances they used.

Apparently, nearly all began by using personal savings first, and borrowings from business partners, friends and family or the bank only if necessary.

Maybe that's not surprising, but it is surprising the difference between borrowing versus using savings:

Obviously, entrepreneurs don’t like being in hock.

*

The Finanser is sponsored by VocaLink and Cisco:

For details of sponsorship email us.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...