Meeting with a mate last night, who happens to be on the inside track of EU regulatory matters as they relate to Capital Markets, he turned to me and said: "have you seen CESR's latest?"

Of course I hadn't, as I've been payments oriented all week and CESR is the European Regulatory body that created MiFID, the Markets in Financial Instruments Directive. This is the regulation for managing equities trading across Europe.

"What are they saying?" I asked.

"Only that everyone now has to use EBBO!" he chortled.

EBBO is the European Best Bid-Offer pricing system.

What does EBBO mean?

It's basically a price that is dynamically updated with each change in the best price in any of the relevant markets where the instrument is traded.

Therefore, if you're trading in HSBC or Vodafone, EBBO will look across all of the execution venues where those stocks are traded and will tell you the best bid and offer for those stocks in real-time.

So what are CESR saying?

Looking at their website, they've updated MiFID with a new ruling on price waivers for execution venues as from Tuesday of this week (did anyone notice?).

Here's the exact text:

Waivers from Pre-trade Transparency Obligations under the Markets in Financial Instruments Directive (MiFID) - Updated 9th March 2010

...

All orders will be submitted to the system for execution/crossing at the midpoint of the European Best Bid and Offer (EBBO). The European Best Bid price is the highest binding bid (or buy) price available in the central limit order books of the regulated markets and MTFs contributing to the determination of the EBBO. The European Best Offer price is the respective binding lowest offer (or sell) price. Thus the EBBO will always deliver the tightest spread available in the contributing trading platforms.

...

The document says a lot more, but the heart of it seems to be getting at the opaqueness of pricing and lack of a single price feed.

Hence, by enforcing a new rule whereby every participant has to guarantee Best Bid-Offer or - if crossing - the mid-point, they have wiped out much of the motivation for dark pool trading overnight.

Why?

Because dark pools work at giving you a better spread than on the open market based upon a volume order, as well as allowing block trading unseen.

You want a 1,000 HSBC or Vodafone stocks?

Old days: you look at the markets and make a Visible Bid for them. If someone can trade at that price then they make a Visible Offer.

New days: you place your order into a dark pool and it sits waiting to be filled at the price you specify, a Dark Bid. This bid is often a price that is better than on the open markets, e.g. not the European Best Bid-Offer but your, discounted Best Bid-Offer which can only be met by other 'dark' players who make a Dark Offer that is also unseen by the markets.

If you want to know more about how dark pools work, the flash illustration on Turquoise's website shows this well.

CESR's new ruling wipes out the new days overnight, as you are now only going to get that order filled by placing visible pricing levels.

Or that's how my friend reads it.

Download the full documentation here (19 page pdf).

Meanwhile the question that arises is that Nomura and UBS have just launched into dark pool territories in the recent weeks ... has this just screwed their efforts big time?

UPDATE #1 13:45 11th March

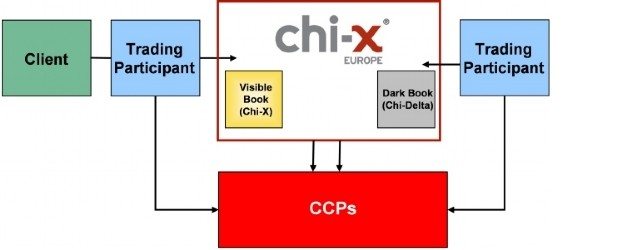

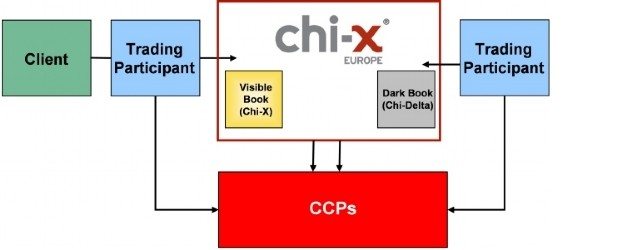

Ben in France points me to references that the CESR rules allow Primary BBO (PBBO), and is not restricted to EBBO therefore. PBBO is explained well on Chi-X's website.

Ben says he's asked CESR and they've confirmed that PBBO is OK. Might have been worth them putting that in the document more clearly in my view, e.g. PBBO isn't mentioned once but EBBO is everywhere.

And it still doesn't answer the basic question: by forcing dark pools to use mid point pricing for all trades undertaken removes the raison d'etre as this gives bank owned dark pools a significant reduction in spread, and therefore P&L, due to the price being a mid price set from an external source.

On the other hand, people like Nomura were fully aware of this. In fact, it's part of the reason for bringing NX to market (see page 5):

'NX Mid Match (NXMM) operates as a dark mid point crossing venue, with executions made with

reference to the mid point of the Primary Market where the Security is listed. NXMM operates under a MiFID pre trade transparency waiver with mid-point crossing only as per Example 3 of “Acceptable crossing logics” in the CESR document “Waivers from Pre-trade Transparency obligations under the Markets in Financial Instruments Directive (MiFID)”.

'The NXMM matching logic has been designed to achieve the following characteristics:

- Simple structure;

- Minimal information leakage;

- No gaming;

- No timing advantages; and

- No probing.'

So why would Nomura, Barclays and UBS make announcements and investments in dark pools if it gives them no major P&L advantage?

According to Ben, it's motivated by the need to access the LSE's Turquoise strategic steering committee ... and so the game rolls on.

My City friend agrees that Nomura understand what they need to do in their MTF (Multilateral Trading Facility), but that the real issue is whether banks can still put their trading desk up as a counterparty to a customer order at anything other than a mid price?

This cuts to the heart of being a Systematic Internaliser, which none of them want to be and is the reason for the rush to be a dark MTF. However, if the rules are interpreted as above and all customer orders go into a dark pool, then the issue of where they are crossed with the prop book arises.

Does the FSA allow the prop book to cross a customer order outside the MTF or is it more likely that crossing with the prop book will need to be done within the MTF at the midpoint, which then cuts the P&L and internaliser gains?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...