A final posting on bank stats, but this time focused upon capital markets.

According to the report from TheCityUK (which I cited a couple of times last week):

- Companies raised £83 billion on the London Stock Exchange in 2009, including £5 billion raised on AIM, the market designed specifically for smaller, high growth companies.

- An additional £21 million was raised on PLUS, which also caters for smaller high growth companies.

- Of the 1,038 UK companies quoted on AIM, 603 are based outside London, as are 42% of the companies on PLUS.

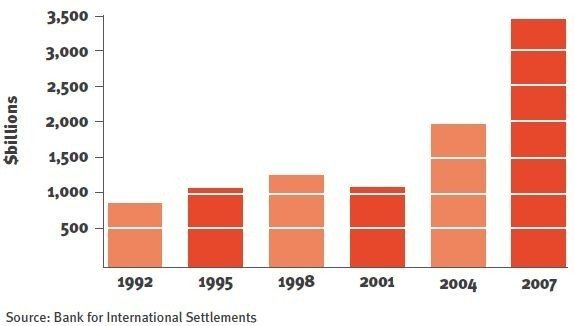

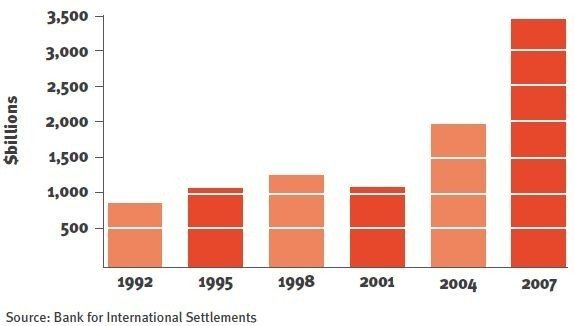

Meanwhile, FX transactions have gone through the roof, ever since they became a tradable instrument on the foreign exchange markets. This BIS chart of the Global FX transactions since 1992 shows the impact this has had:

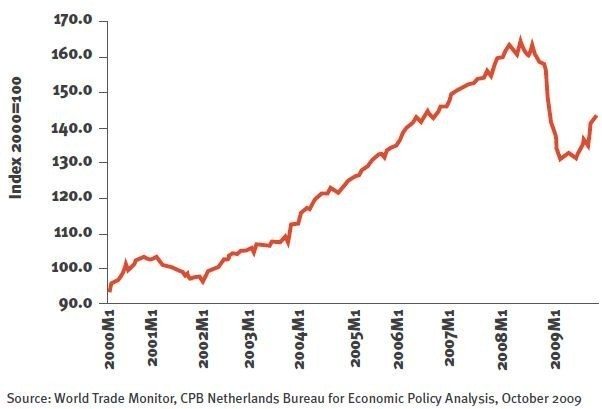

Of course, this has to be combined with globalisation, so here’s the world’s trade volume growth from 2000 through 2009:

Charts sourced from TheCity UK report

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...