I've talked a lot about Metro Bank already, and will probably talk a lot more about them as they are the first brand new spanking retail bank to launch in Britain since Charles Dickens popped his clogs.

Well, almost.

Actually, it's quite strange in that, like buses, you don't see a new bank launch and then a truckload of them turn up what with Project New Bank and JC Flowers joining the Virgin, Tesco, Post Office, Government and more in opening bank stores and operations.

But Metro Bank is one of my favourites as I've been tracking their progress pretty much from Day One. In fact, two years ago I posted a blog about the co-founder of Metro Bank, Vernon Hill, who created the massive Commerce Bank success in the USA. A few words from that blog entry are worth repeating here, as you'll see the Commerce Bank approach reflected in Metro Bank:

Commerce

Bank's success is based upon their philosophy that

they are retailers and not bankers, and features some unusual ideas,

such as:

Instant creation of ATM cards on the spot at the time of account

opening- Free "Penny Arcade" coin counting machines for both customers and

non-customers

No-Fee Visa Gift Cards for customers- Lollipops and dog biscuits in the lobby and drive-thru

- Foreign ATM fee reimbursement

- "No Stupid Fees, No Stupid Hours"

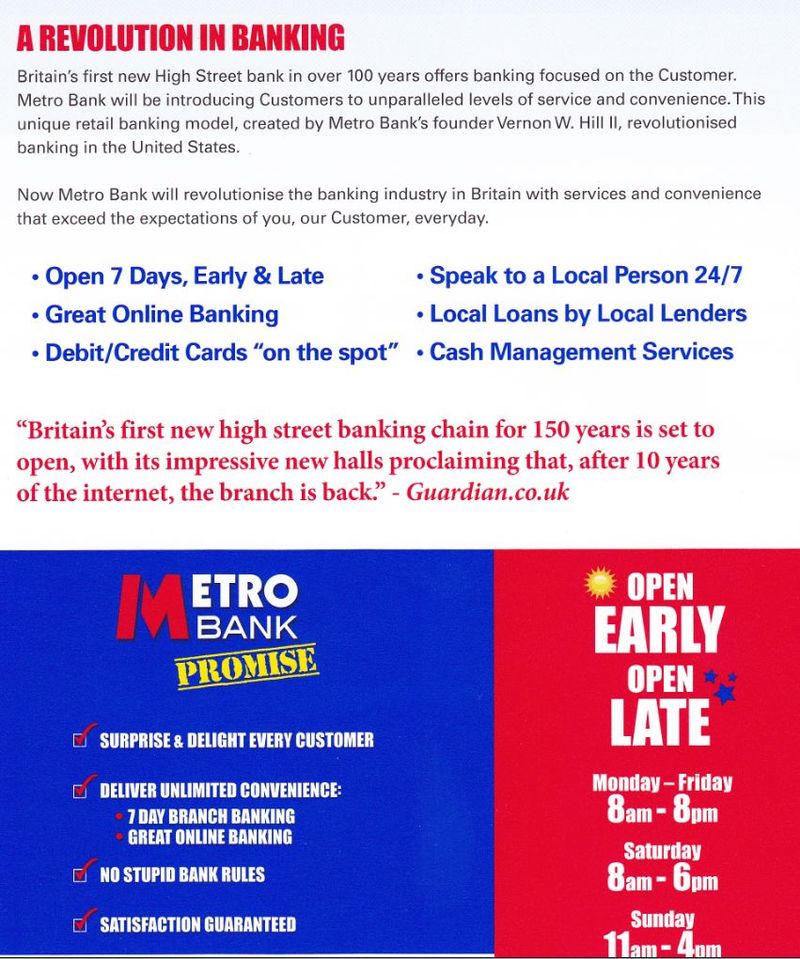

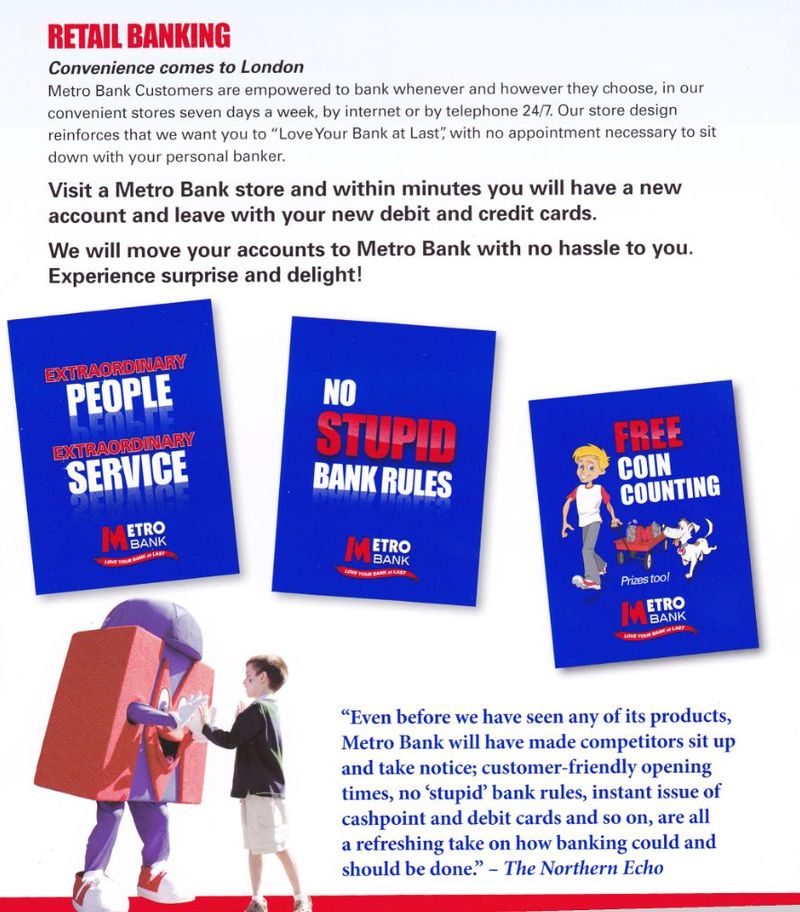

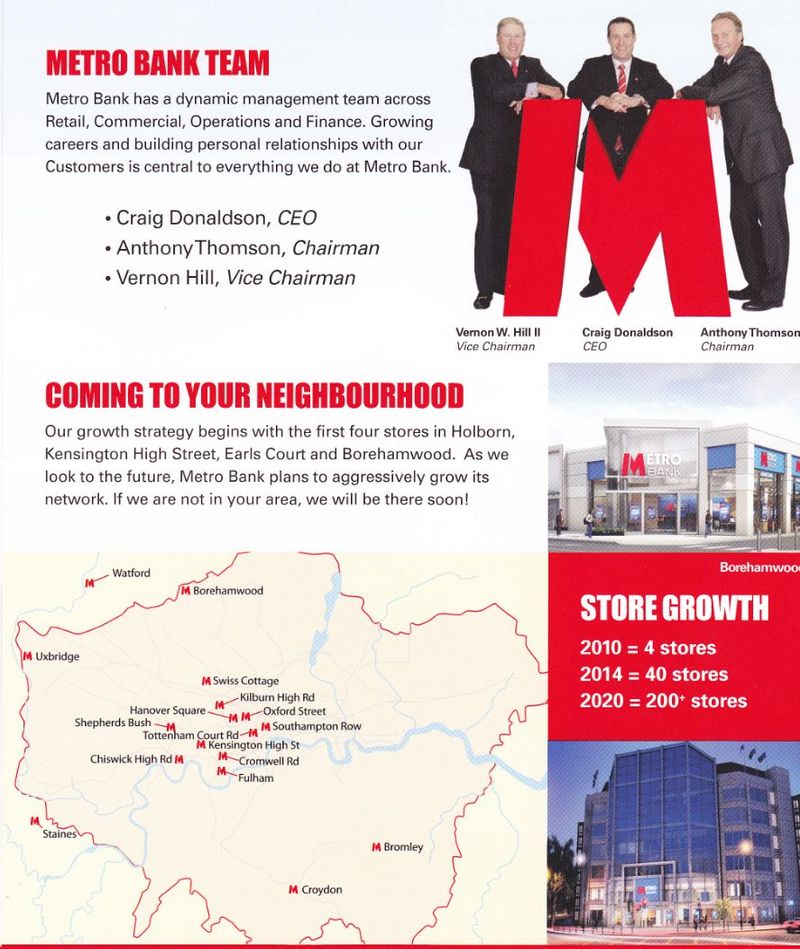

So I get an invite to the official opening of Metro Bank - their first day of opening will be July 29th - and am impressed by their marketing brochure. It's slightly different to a typical bank brochure. Have a look (doubleclick images to see large pictures):

Love the dog!

UPDATE: 21st July 2010

Fascinating debate below in commentary about Metro Bank's design and branding. I'll wade in shortly but, in the meantime, just got the BBA's Summer Magazine with an article from Metro Bank CEO Craig Donaldson (ex-RBS) on their strategy. Interesting:

NEW BANKING FOR BRITAIN

Craig Donaldson explains how Metro Bank, the first new high street bank for over 100 years, is going to revolutionise banking in the UK, starting in London in July.

The UK, like many parts of the world, is used to revolutions. However, unlike many other countries, ours tend to be more pragmatic than idealistic!

The eighteenth century saw the agricultural revolution, which transformed the process of food production in the UK. It led to a massive increase in agricultural productivity and net output. This, in turn, supported unprecedented population growth and freed up a significant percentage of the workforce. This helped drive the industrial revolution, which marked a major turning point in human history; almost every aspect of daily life was eventually influenced in some way.

Metro Bank is planning to start a revolution: we want to revolutionise banking in the UK and here I’d like to explain why. We plan on delivering a service that exceeds expectations and, in order to achieve this, we have been looking closely at one key question: What do customers want?

Customers have told us they want branch banking, they want telephone banking and they want internet banking. They also want to choose where, when and how they use all of these different channels. Having the ability to make the decision about how they bank is important to them.

So what’s the big idea?

We believe (and there’s a lot of research to support my view) that customers simply want a better experience from their bank, the kind they typically get from a great retailer, and that’s what we intend to give them.

We think like a retailer. Great retailers put their customer at the heart of everything they do, they are passionate about giving the customer a great experience and that’s what we’re going to do.

Here are a few examples:

Open when people want to bank

People’s lives have changed, great retailers have moved with them and banking should reflect this, so every Metro Bank location will be open seven days a week. We should be there when people want to bank, on their way to work, on their way home and at weekends, so we will be open 8am till 8pm.

Passionate people giving great service

People want to deal with people who want to be there. We have interviewed over 5000 people for 60 jobs so that we can get people with a ‘can do’ attitude, people who want to serve people and will be smiling while doing it. Over the last few years, a lot of automation has been introduced to high street banks. Whilst we will have all of the automation you would expect (and more) we also have more staff to meet customer needs in stores, and real people answering the phones.

Make banking more fun

Great retailers are lively and interesting. Our stores (remember, we’re a retailer) are large and airy. We don’t have glass security screens but we do have free coin counting machines, safety deposit boxes, treats for your children and your pets. We’ve even introduced toilets for customers!

And there are hundreds of other details, but – hopefully – this illustrates how we are building a bank for the convenience of our customers not for the convenience of the bank.

We believe if people come to you for a great experience then they will be prepared to give you more of their deposits, for a longer time. But you don’t have to take our word for it. Metro Bank is co-founded by Vernon Hill, who was the founder of Commerce Bank, which grew from a one branch bank, to the eighteenth largest bank in America with the same model of giving customers a great experience.

The revolution begins at the end of July when we will be offering customers a great retail experience and enabling them to ‘love your bank at last’.

Craig Donaldson, Chief Executive, Metro Bank

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...