Lloyds took a big hit in first quarter for PPI payments, the mis-selling of payment protection insurance. The other banks did the same and Santander took a hit this quarter.

The issue is that PPI is an insurance that is meant to cover loan repayments if the borrower becomes ill or loses their job. The banks all sold these policies as part of making loans, but often bundled them in as part of the package without explaining to the borrower what they were doing. As a result, many of the policies sold by the banks were mis-sold, with customers unaware they had purchased and were paying for an insurance policy on top of their mortgage or loan.

The issue became a hot potato and, in April, the banking industry lost its High Court challenge to new rules on the sales of PPI that require them to review all of their past sales to see if their customers have a claim for mis-selling, whether or not they have actually complained.

This not only resulted in the banks making these huge provisions - one bank tells me that one in four of their PPI complaints come from customers who didn't even have a loan with them - but the vultures appeared fast.

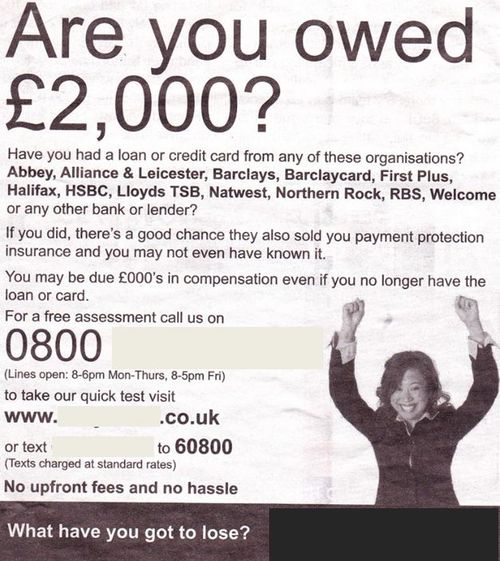

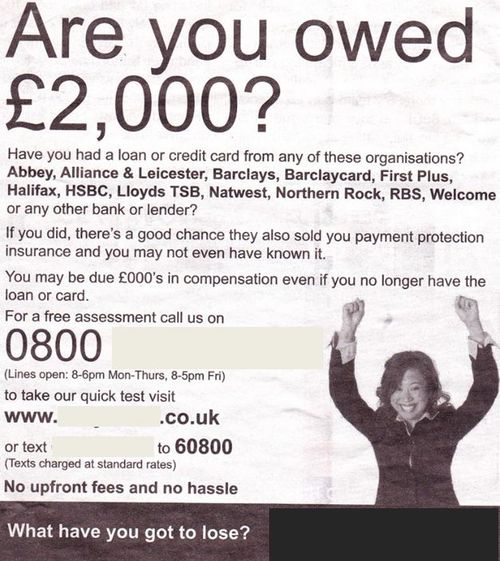

First, there were adverts and leaflet drops ...

... then there are all the websites such as PPi Claim Today, No Win No Fee PPI Claim, National PPI Helpline, PPI Claimback ...

... and now there are the TV ads too, with this one from Just Refunds being a prime example ...

The result is that the issue is going to cost the industry about TWICE the amount estimated.

When the case was lost in the courts, the FSA estimated that the mis-selling would cost the banks around £3.2 billion.

They made this estimate on the basis that over £15.6 billion of PPI products had been sold since 2005 and that 1 in 5 were mis-sold.

On that basis, it would cost about £3.2 billion.

They didn't take into account all the vultures that would fire up the claims and hence the cost is more like 1 in 3 customers rather than 1 in 5, or £6 billion worth.

That is clear on the basis that the banks have set aside almost £6 billion in reserves for the issue: Lloyds Banking Group (£3.2bn), Barclays (£1bn), RBS (£850m), Santander (£548m) and HSBC (£269m).

Nothing like a gentle advert or two to get some quick cash, is there?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...