So I finish my time in Toronto with a little relaxation and sight seeing.

Won’t bore you with all the details …

… but one of the most interesting places to visit is a place called Casa Loma, the House on the Hill.

It's more like an amazing castle to be honest, that sits in the suburbs of Toronto and is used for many movies and other extravaganzas these days.

I went there because I love the X-Men movies, and this was the location used to film the Xavier Institute of Higher Learning ... so why post all this touristic stuff on the blog?

Because the story of the owner of the estate is fascinating and demonstrates the nature of banking and risk.

A billionaire financier, Sir Henry Pellatt was a benefactor of Toronto and Canada, controlling 25% of the country’s GDP at one point. He died penniless but a hero.

Sir Henry Pellatt was born in 1859 in Kingston of English parents and was a successful Toronto financier, industrialist and military officer.

His father had started a stock brokerage which Henry joined at the young age of 23.

It was very early on that Henry Pellatt demonstrated his business acumen: he founded the Toronto Electric Light Company in 1883, the same year that Thomas Edison developed steam-generated electricity.

This company was responsible for providing electric lighting and street cars on the streets of Toronto.

After his father’s death in 1892, he was able to make even more aggressive investments and guessed right on the money when he purchased stock in the Canadian Pacific Railroad and the North West Land Company.

Business colleagues used to call him "The Plunger" since he had a habit of plunging head-first into the next promising business venture. His astute decisions assured his path to financial success.

By 1901 Henry Pellatt was chairman of 21 major companies with interests in mining, insurance, real estate and electricity. As a single person he directly controlled 25% of Canada’s economy.

His entrepreneurial spirit continued and together with some business partners he built the first hydro-generating plant at Niagara Falls in 1902. Henry Pellatt was knighted in 1905 by King Edward V for his service to the Queen and his efforts in bringing electricity to the people of Canada.

In the early 1900s Sir Henry Pellatt was one of Canada’s richest men and his high aspirations also extended to his personal life: he aimed to build a real castle by the name of “Casa Loma” – “house on the hill”.

Construction on the complex started in 1906 and the castle itself was built between 1911 and 1913.

It cost $3.5 million (about $60 million dollars in today’s money), took nearly 300 men almost three years to complete.

However, Sir Henry's charmed life was disrupted by a government that resented his monopoly over power.

As a result, politicians created the Ontario Hydro Electric Commission and seized all power generation into the public sector.

Sir Henry Pellatt and his business partners had the business seized by the government without compensation. Bear in mind, this was a massive project to capture the power of water generation from Niagara Falls, a feat that was light years ahead of its time and cost him and his colleagues millions.

The Toronto power company also was lost, as his franchise to provide electric lighting to the city was revoked.

Sir Henry tried to recover from this double blow by investing in the future of air travel. He built a business just before the war training pilots and building aircraft.

Guess what?

This business was also taken over by the government, again without compensation, as part of the war effort in WWI.

These actions, and the end of the war, spelled disaster for him as Sir Henry had way over-extended his financial positions, with millions owed to the banks.

He was also spending too much on Casa Loma, with over $100,000 per year in maintenance on the new house, including $22,000 in wages, $15,000 for 725,000 kg (800 tons) of coal, and $12,000 in property taxes.

The final nail was when one of his banks folded. He owed the Home Bank of Canada $1.7 million – or $20 million in today’s currency – and the bank went bankrupt in 1924.

Creditors, first and foremost the City of Toronto, turned to the castle to recover their unpaid property taxes.

Sir Henry and Lady Mary Pellatt had to abandon their dream castle and moved to a farm in King City. Lady Pellatt passed away shortly after at the age of sixty-seven.

Broken and penniless, Sir Henry ended up living with his former chauffeur in a modest bungalow in Etobicoke, one of Toronto's suburbs.

However, Sir Henry's role and historic importance were not forgotten.

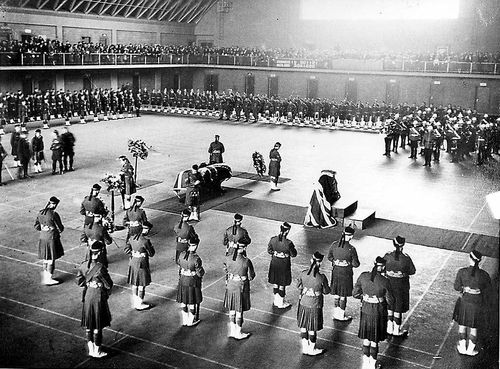

Upon his death in 1939, he received the largest funeral Toronto had ever seen up to this point.

Thousands of people lined Toronto streets to catch a glimpse of his funeral procession and he was buried with full military honours.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...