I’ve been down to the #OccupyLSX, or #OLSX for short, site several times.

That’s the Occupy London Stock Exchange site for those not following them on twitter.

They were inspired by the #OccupyWallStreet, or #OWS folks, who began protesting back in September.

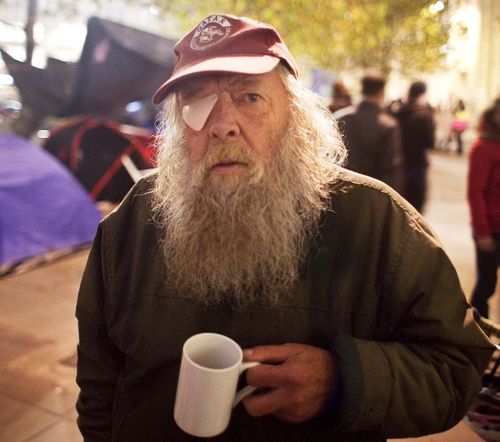

Our group is a similar rag, tag and bobtail amalgamation of disparate folks, from happy-clappy hippies …

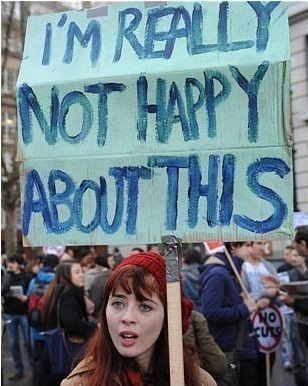

… to anticapitalist activists …

… with a healthy dose of travellers, vagabonds and vagrants …

… thrown in.

They do have a point, but their point is lost with so many disparate views and groups.

Some want environmental change; some want legalised drugs; some want a more eqaual society; and some just want to play their didgeridoo and hope for peace in the world.

It’s amusing rather than concerning.

- some are more activist, e.g. some took over buildings this week as protests and were being police kettled away;

- some are more sharp, e.g. they caught an undercover policeman in their midst during the protests; and

- some are just dumb, e.g. the policeman who got so drunk that he fell asleep in the protestors’ tents.

In between, there is a serious point here.

From the Occupy London website:

“The words ‘corporate greed’ ring through the speeches and banners of protests across the globe. After huge bail-outs and in the face of unemployment, privatisation and austerity we still see profits for the rich on the increase. But we are the 99%, and on October 15th our voice unites across gender and race, across borders and continents as we call for equality and justice for all.

“In London we have occupied the forecourt of St Paul’s Cathedral, next to the London Stock Exchange. Reclaiming space in the face of the financial system and using it to voice ideas for how we can work towards a better future. A future free from austerity, growing inequality, unemployment, tax injustice and a political elite who ignores its citizens, and work towards concrete demands to be met.”

Now many sympathise with the point that the divide between rich and poor is too great, and that fat cat company bosses are getting away with daylight robbery.

For example, in this ‘age of austerity’ where most folks are losing their jobs, the latest survey of boardroom pay finds that the average compensation for a FTSE100 company director went up by 49% last year to £2.7 million per CxO; the richest 400 people in America have more wealth than the 155 million poorest combined; and it’s getting worse.

According to CBS News, “the top-earning 20% of Americans received 49.4% of all income generated in America compared with the 3.4% earned by those below the poverty line. That’s a ratio of 14.5-to-1 gap between the richest and poorest; an increase from 13.6 in 2008 and nearly double the low of 7.69 in 1968.

“The poorest poor are at record highs. The share of Americans below half the poverty line - $10,977 for a family of four - rose from 5.7 percent in 2008 to 6.3 percent. It was the highest level since the government began tracking that group in 1975.

“The poverty gap between young and old has doubled since 2000, due partly to the strength of Social Security in helping buoy Americans 65 and over. Child poverty is now 21 percent compared with 9 percent for older Americans. In 2000, when child poverty was at 16 percent, elderly poverty stood at 10 percent.”

Also see Mission Silver for more.

Now most people agree with these core views.

Even bankers agree.

In a study by St Paul’s, that was released just after the protest started, they found that most financial professionals believe that bankers, stock brokers, FTSE 100 chief executives, lawyers and city bond traders are paid too much.

They say that of the 515 financial professionals surveyed, 75% agree that there is too great a gap between rich and poor.

So where is the disparity of opinion here?

There isn’t one.

But the issue lies more in expression.

If the 99%, as they call themselves as well – that’s the 99% of people not feeding at the trough of capitalism – want the 1% of those who are feeding to change, they need to make their point clearer.

And they need to make it more pertinent.

In fact, in London, they’ve really messed up by occupying a Church rather than the London Stock Exchange.

Who are they protesting against?

God???

Attacking a Church for Christ’s sake – sorry, for Cameron’s sake – is not going to change anything.

Meantime, no-one in the City cares about them.

In fact, no-one in the City is affected by them as their occupation doesn’t affect the banks, who are all now based in Canary Wharf and around Liverpool Street.

What a waste of time.

And if they want to make their point more pertinent they really need to hit people where it hurts, not just banks, but corporate greed and the divide between the rich and poor.

So how do you hit where it hurts?

In the wallet.

That’s what they really need to focus upon.

And to achieve that it needs political change, which is happening anyway.

Take note, the Bank of England are considering a crackdown on bankers’ bonuses through regulatory reform. From the Sunday Telegraph this weekend:

Robert Jenkins, an external member, said earlier this month: "Return on equity is the wrong target. Over the last 10 to 15 years it has helped to make many bankers rich and loyal shareholders poor."

Return on equity, or RoE, rewards bankers for taking risk that in the recent crisis was ultimately borne by taxpayers.

Instead, both Andy Haldane, the Bank's executive director of financial stability and a member of the FPC, and Mr Jenkins believe that bonuses should be measured against return on assets, or RoA, which adjusts for risk.

"While the risks have typically been borne by wider society, the returns have been harvested by bank shareholders and managers," Mr Haldane has said.

According to his analysis, the effect on bonuses from switching targets would potentially be huge. Between 1989 and 2007, in which time there was "increasing focus on RoE as a performance target", the average pay of the top seven US investment bank bosses rose from $2.8m to $26m. If their performance had been linked to RoA, it would have increased to just $3.4m.

"Rather than rising [from 100 times] to 500 times median US household income, it would have fallen to around 68 times," Mr Haldane said.

The difference can be illustrated using a mortgage. If a house price rises in value from £100,000 to £110,000, the RoA is just £10,000, or 10pc. But if it was bought with a £10,000 deposit and £90,000 debt, the RoE on the £10,000 of equity is 100pc.

However, where homeowners bear the risk of a fall in house prices, bankers do not. According to Mr Haldane: "In effect, RoE is skill multiplied by luck."

The changes are therefore happening, but not as a result of the Occupy protest, but down to good old common sense.

And if the protestors want to push the regulatory changes through faster, I would recommend our hippies, anarchists, travellers and homeless to go Occupy the Bank of England and Parliament until they get their regulations right and make the disparity between rich and poor, particularly where it’s based upon pure luck and no skill, a little bit better.

Meanwhile, their protest is pretty useless anyway.

By comparison with the States, where they have real passion, our lot are a damp squib.

In fact, there are many rumours that the protestors don’t even occupy the site in the evenings as it’s too cold.

So we went down there on Friday.

I stood by the tents and said: “I’m in favour of bankers’ bonuses, would anyone like to argue about that?”

No-one responded.

St Paul's Protest, 2nd December 2011, Part One from Chris Skinner on Vimeo.

I walked round the camp for about five minutes saying that I’d like to argue about why bankers’ bonuses are a good thing.

No-one came out of a tent.

St Paul's Protest, 2nd December 2011, Part Two from Chris Skinner on Vimeo.

It was 6:30 on Friday night, 2nd December.

So much for an effective protest.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...