During my trip to Africa, we had a few days out at the magnificent

Victoria Falls. An amazing natural

wonder of the world, particularly from the Zimbabwean side of the falls where

you can walk the 1.8 kilometres opposite the massively flowing waters.

I mention this because I’ve known about Zimbabwe’s currency explosion

for a while, but seeing the aftermath of the currency’s implosion it shows how

money makes the world go around … or not, as the case may be.

In Zimbabwe’s case, the country has gone through a particularly

notable slump.

Back in the day when they changed the name of the country

from Rhodesia to Zimbabwe, the Zimbabwe Dollar (ZWE) was worth USD$1.47 … but,

by 2006, the ZWE was already becoming worthless, effectively trading at just

over half a cent of a US dollar to the Zimbabwe dollar.

Then it got worse, a lot worse, as the economic situation

worsened and hyperinflation kicked in.

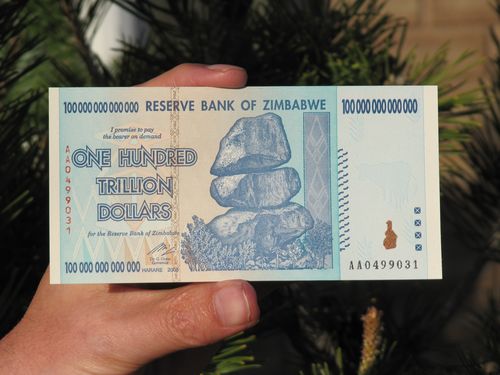

The result is that the government issued four rounds of

currency devaluations ending with the final laughable situation of issuing a

100 trillion dollar note (worth around US$300 when issued).

Now that may be funny, but it actually means in practice that

Zimbabwe no longer uses Zimbabwe currency for trade.

They use US dollars mainly.

A nice stable currency.

South African rands are welcome too, and even euros and

pounds are acceptable in some hotels and situations.

The problem with this is that they don’t have enough of

these foreign notes in circulation so you either tip a porter or driver $10 or don’t

tip at all.

It also means there’s a massive trade in selling old bank

notes.

As we walked the main street of Victoria Falls town which comprises

a mere five or so souvenir shops, we were rapidly pounced upon by touts selling

everything from wooden carvings to jewellery.

More often than not though, they were selling money.

Old Zimbabwe money.

Old Zimbabwe dollars.

Every guy on the street would hold out a wad of notes, many

well used notes, and ask for US$20 to take them as a souvenir. You then haggle and barter and pay about US$5

to take the things off their hands.

In some ways, I bought a lot of these notes as I felt sorry

for the chaps – one guy hassled me non-stop for about ten minutes and I eventually

said that we were leaving that day so could not buy any more stuff.

He said: “You’re leaving today? Well maybe you have some old T-shirts or

pants you could give to me? I don’t mind

how old sir. I’ll wait outside your

hotel.”

Another guy noticed that we had some bread in our bag (to

feed the birds) and asked if he could have it to eat.

That’s how poor this economy is today.

So buying a few old dollars with US dollars wasn’t such a

big deal.

The big deal is actually made about the 100 trillion dollar

note however.

Many were issued, but these are the prized notes of the

townsmen who would ask if I wanted ot buy old Zimbabwean dollars.

I’d say not, I’ve got loads of them already and then one or

two of them would pipe up: “but do you have this note, the big one?” and would

hold up the rarer 100 trillion dollar note in pristine condition.

Sure enough, I got suckered into buying one for US$10 … only

to find you can buy them uncirculated in mint condition at the airport.

The airport of all places!

The airport has books of 100 trillion dollar new notes,

selling for US$17 - well it is the airport

shop and not street seller. Sure enough,

I bought another one.

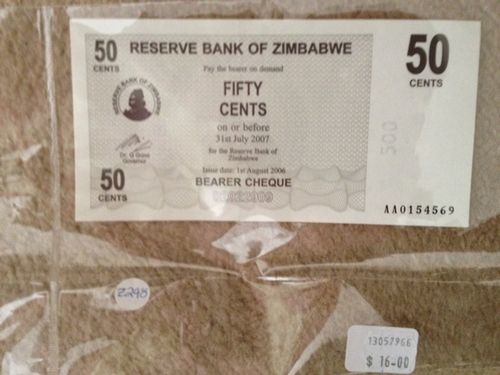

Then I noticed they had an older pristine 50 cent bill. A half a dollar note.

These date back to before the hyperinflationary activity and

so now I’m buying a worthless Zimbabwean half dollar bill for US$16.

Mind you, some would say 50 cent is worth more than 50 cent …

Hmmm … I guess I just like buying weird bank notes (yes, it’s

a hobby of mine – more on this in a follow on blog).

So now I’ve got pockets full of old and new, circulated and uncirculated

Zimbabwean dollars and feel good … only to see one final piece of monetary

memories sitting in the airport shop that made me stop in my tracks.

Many years ago, friends of mine returned from Rhodesia as it

was in the 1970s, with homes and farms lost as the country was taken over by

Robert Mugabe and militant African factions, leading to a three decade

dictatorship.

That’s my take on things anyway, in case you care to

disagree with this summation.

Before 1980, the country was a British colony until 1965,

when Ian Smith declared unilateral independence, sparking a long period of sanctions

and protests from Britain to the United Nations, and ultimately leading to the

conditions that allowed Mugabe to take over.

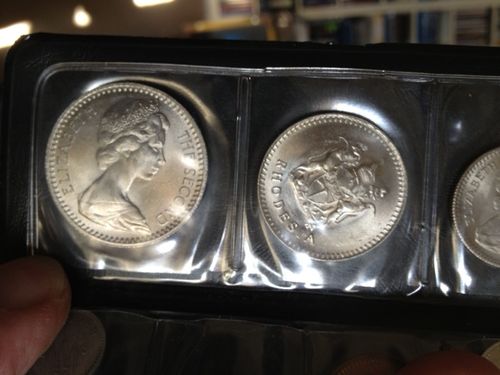

So I was pretty shocked to find a collection of old

Rhodesian coins in the airport shop and even more surprised that they still

proudly showed the Queen on the coin.

It’s the sort of thing that you imagine would have been

melted down and destroyed years ago and yet there it was, up for sale to

excited British tourists passing through the airport.

And yes, guess which tourist bought the set for his weird

and wacky money collection.

You got it.

More on weird and wacky money shortly.

Meantime, if you’re interested in more on the hyperinflation

and history of Zimbabwe, I recommend you go over to Wikipedia and read about

it. It’s interesting stuff.

Wikipedia – revaluations of the Zimbabwean dollar http://en.wikipedia.org/wiki/Zimbabwean_dollar

and history of Zimbabwe http://en.wikipedia.org/wiki/Zimbabwe.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...