A week before Zopa luancheed in Britain in 2005 one of the co-founders, the now late and much missed Richard Duvall, presented the concept to the Financial Services Club.

No-one really understood it at the time although now, it makes great sense. An eBay for money. Those who have money get higher interest whilst those who need money pay lower interest, and Zopa manages the risk.

Makes so much sense and, during a period when interest rates hit rock bottom and credit dried up, higher returns on savings and lower costs for borrowing has made the disruptive start up a hit.

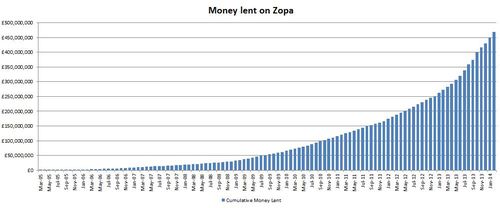

Just look at the hockey stick effect as the credit crisis hit Britain in Q4 2008 and you can see what I mean.

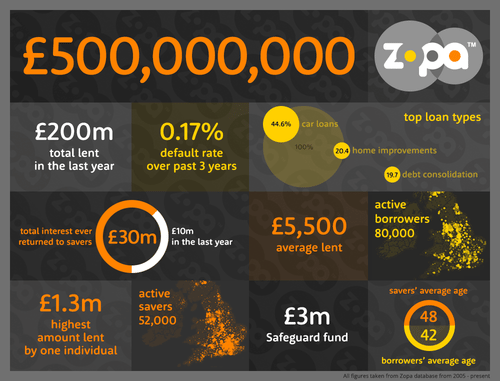

So I was delighted to receive this infographic from the folks at Zopa the other day (doubleclick to enlarge):

What this shows it that Zopa has now lent over £500 million of consumer savings to UK borrowers since launching in 2005 with significant levels of growth, lending over £200 million (40% of total) in the last 12 months.

In other words, word has spread. People get it. They now understand it. And they like it.

From small acorns, oak trees grow.

These record lending levels highlight how peer-to-peer lending is no longer an experiment but a reliable, trusted alternative for thousands of consumers to cut out the banks and get a better deal.

Zopa currently has 52,000 active savers lending on average £5,500. With the average saver aged 48. Interestingly, Zopa expects to hand back over £20 million in interest from borrowers this year alone and has helped deliver £30 million in interest since it launched.

Zopa has savers lending amounts from £10 to £1.3 million with no maximum lending limit.

Zopa has a default rate of just 0.17% on all money lent in the last three years – lower than any other bank or peer-to-peer lender.

With over 90,000 loans made, Zopa has a total of 70,000 active borrowers.

A significant 40% of all loans go towards cars and, in 2013, £86 million of the £200 million borrowed was for a car loan; £39 million went towards home improvements and £36 million helped people cut down existing debts (Wonga?).

Surprisingly, 30% of Zopa borrowers pay their loans back early – benefiting from there being no early repayment penalties. The average borrower is 40 years old and typically borrows £7,500.

Giles Andrews, Zopa CEO and co-founder said: “by cutting out the banks and offering returns of 5% (compared to bank savings rates typically under 1%) we are rewarding people for being sensible with their money. Even better to know is that with the protection of our Safeguard fund, no saver has lost money with Zopa. Our borrowers enjoy market-leading low-rate loans and award winning service. Lending the next £500 million won’t take another nine years as we expect to reach £1 billion lent in the next 12 months”.

£1 billion in the next year?

Doubling year-on-year?

At that rate, Zopa will be a mainstream lender for consumer credit with a double-digit market share within three years.

Watch this space!

Postscript: in our bi-annual update on Zopa's progress, Giles will be speaking at the Financial Services Club London next week.

If you want to come, register here: http://fsclub.net/

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...