There is a sea change taking place in finance, the economy and the world, thanks to digitalisation and technology.

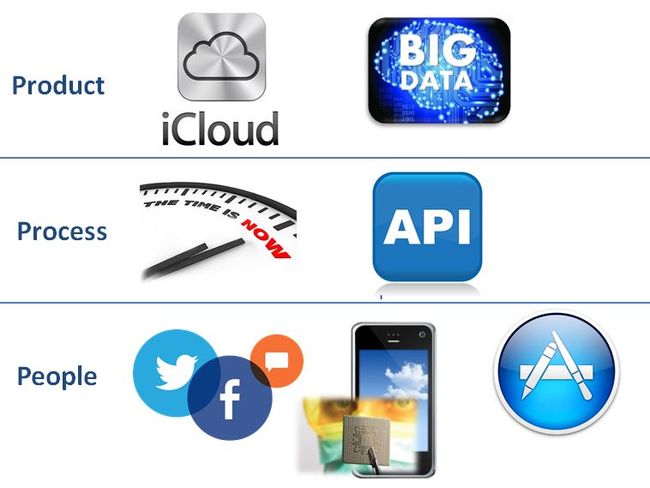

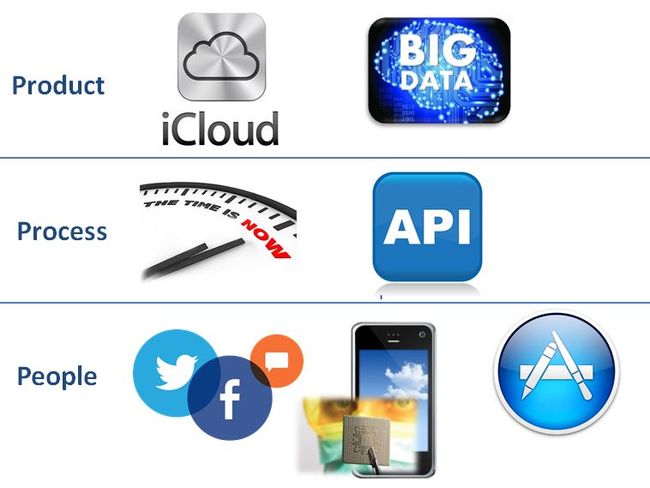

In banking, I’m not sure that it’s seen, or that it is seen visibly, but the sea change is being enabled by seven key technology components right now: cloud and big data in the back office; APIs (Application Program Interfaces) and real-time connectivity in the middle office; and social media, mobile and apps in the front office.

This is represented in a chart like so:

In this first piece on these technology changes, I will focus upon the back office impact of cloud and big data, before looking at the other components in follow on pieces and then, finally, at the pieces combine to create the whole.

So let’s begin in the back office.

The two big tech changes in the back office are related to cloud and big data.

Cloud provides the ability to provide a product anywhere through centralised services on the net. Big data allows a bank to leverage those services anywhere on the net with a highly targeted 1:1 offer.

Take the example that I use regularly of proactively targeting an individual with service on the net.

The idea is that as I am walking down the street, you will know where I am, what I am doing and what I might need.

I might be walking past a store and your front end nudges me that I qualify for a discount coupon in this store.

“$25 off a 1 terabyte UBS stick if you walk in now.”

Wow! I’ll buy it!!!

But how did the bank know to make that offer at that time?

Obviously at the front-end they are geolocating my proximity to the store but, at the back end, they are leveraging the data about me – my digital footprint – to find the relevant offers for my needs.

This analytical capability amongst banks will be a huge battleground in the future as it represents a core value. If my friends are getting great services from their bank thanks to their bank knowing their needs by analysing their data more effectively than my bank, then I will defect.

It’s all about mass personalisation and mass personalisation today is based upon data analytics. Big data analytics.

But there’s no point in having great analytics if you don’t have great products, which is where cloud comes in.

In the back office, cloud will be the product.

Banks and other providers will be building capabilities of financial processing that are components that can be integrated, off-the-shelf, into the front-end.

So your bank might generate a great loan product but, in the digital bank future, your loan product needs to be a plug-and-play component.

It needs to be a piece of product code that I can download into my app and share and use with data to leverage customer share-of-wallet.

This is the age of the Digital Bank and, as I write these pieces of illumination, the Digital Bank structure will become clear but it starts with these basics: products are cloud-based components that leverage data in the back office to be relevant to the customer in the front office.

More to come.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...