Building upon the previous two blog entries that discussed the new business models in banking based upon products (cloud-shared leveraging data analytics) and processing (real-time via open sourced APIs), we now arrive at the customer layer (mobile and social).

Seen as the most important layer, as this is where the relationship between provider and their client comes together, it is not.

It has an equitable status with the other two layers, and often people misinterpret the value of the end-user relationship.

Who owns the customer? they ask, but the more important question should be Who is the customer?

Right now, some banks should be targeting the likes of Simple (pre-BBVA takeover) and Moven as their customer, as these are the companies trying to deliver a great customer experience through social media and apps via mobile and tablet.

That is not all they are doing, but a Moven or Simple as a client of a bank processor or product provider, is just as important as a bank or provider delivering direct to the user.

Having said that, this final layer is where the rubber hits the road.

The mass volume processing of finance at a personalised level via the device of choice is where the real battle for the consumer will take place and, as I state in my latest presentations, connecting people to the network is where the business battle take place.

Last century, the battle was over electricity and connecting products to the grid. This century, the world has moved from products to connecting humans to the net.

And some firms will focus upon the human interface, whilst others will focus upon the content and process.

Amazon could not be the retailing giant it is today without the product providers ( publishers, manufacturers and stores) and processors (post offices and logistics firms) that it partners with.

In Amazon's retail business it produces no product and processes no fulfilment but, what it does do amazingly well, is leverages the client relationship by innovating with 100% focus upon the customer experience.

That is why I love Amazon.

Equally, when we look at Starbucks or Uber, they are well loved because they take away the friction of the process.

With Uber, my need is to get to B when I am stuck at A.

In the old world, I had to find the product (the taxi) at point A to get to point B and, when I arrived at point B, would have to manage the process (the payment) for the product.

What Uber does brilliantly is to take away the friction of consuming the product (taxi) and process (payment), so that all I have to do is think about getting to B as fast as possible from A.

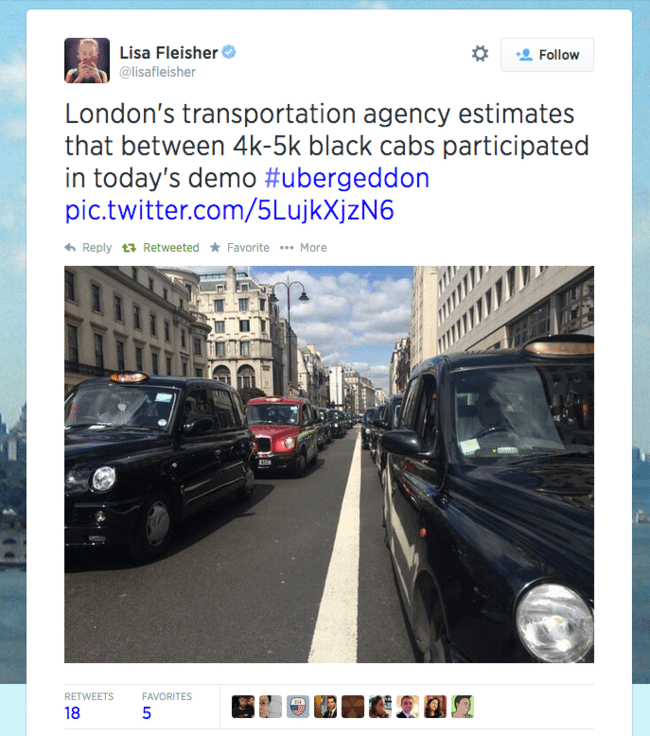

That is why I love Uber and why London's licenced taxis hate it, organising a massive protest against the app.

Intriguingly, on the day that they protested against Uber (June 11 2014), downloads of the Uber app increased 850% because people could not get a taxi.

That demonstration is like the dinosaur protesting against the impact of the ice age, and banks who try to do the same will feel the same impact.

Meanwhile, there will be banks that I will love in the future.

Banks that recognise they do not have to create any financial products, they just need to deliver them in the most customer intimate way.

There are already banks doing this.

Banks such as ICICI in India who take great financial products like SmartyPig and repackage them as iWish in Facebook.

Or banks like Fidor in Germany, who realise that processing across borders does not need them to build the capability.

They can just buy that capability off someone like hyperWALLET for cross-border payments, or BIPS for bitcoin payments, or loans via the P2P platform Smava.

This is the future playground for the provision of service, and it will revolutionize the bank front-end.

The integration of social mobile connectivity with apps and plug-and-play services that consumers and corporates can use as the best experience will be the battle.

A great example of how a bank is adapting to this battle is Deutsche Bank in fact.

Deutsche Bank has taken all of their components of corporate financing - supply chain management, account receivables, foreign exchange, cash management, etc - and broken them into over 150 component pieces deployed in the Deutsche Bank Autobahn appstore.

These pieces are all apps that make the process of finance easy to track, trace and manage.

Corporate clients can then go to their Autobahn store and assemble their own pieces of treasury operations management into the dashboard of tools that best suit their business.

In this case, the client builds the front-end experience from the smorgasbord of components offered at the back end by their financial partner.

In this new world, the lines are blurred - when is the product a process, the API and app and the app a product? - but the simplistic way of viewing the future financial map as being products in the cloud using open sourced processes to deliver amazingly well packaged customer experiences, does at least provide a map for the future banking business.

In my final piece on this structure, I will take a look at the way this changes the game overall.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...