So I started this series of blogs by talking about the age of the Digital Bank and that it starts with these basics: products are cloud-based components that leverage data in the back office to be relevant to the customer in the front office.

Building block one: cloud and big data.

Building block two: APIs and real-time.

I showed this in the chart in the first blog entry:

But building block two is the processing part.

To get the product that is now relevant to the customer. thanks to our data analytics, to the customer, we need processing.

We need to make sure that our product is in front of our customer’s face at every opportunity (especially bearing in mind that we are no longer in front of our customer’s face), so APIs are the way to go.

An API takes our cloud-based functionality and allows anyone to integrate that product functionality into their offer. It allows Starbucks and Uber to offer a payment process, thanks to unbundling our payments product and allowing ti to be stitched into anyone’s offer in real-time.

It is the reason why PayPal has succeeded.

If you thought PayPal’s success was down to their coding or eBay’s vision, you’ve got it wrong.

PayPal’s success today is down to their unbundling of the payments processing into an API.

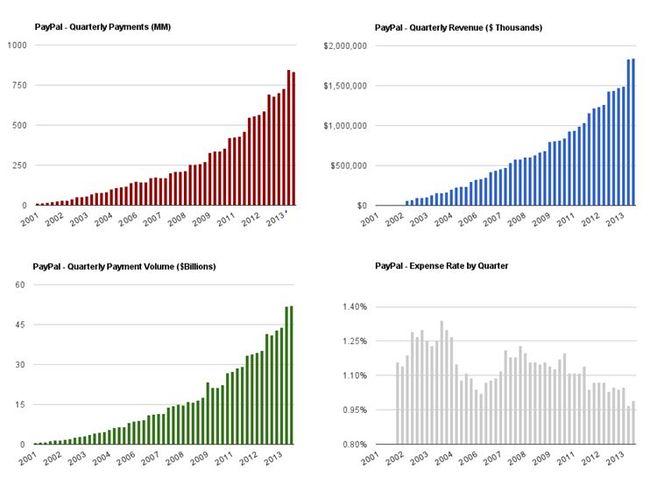

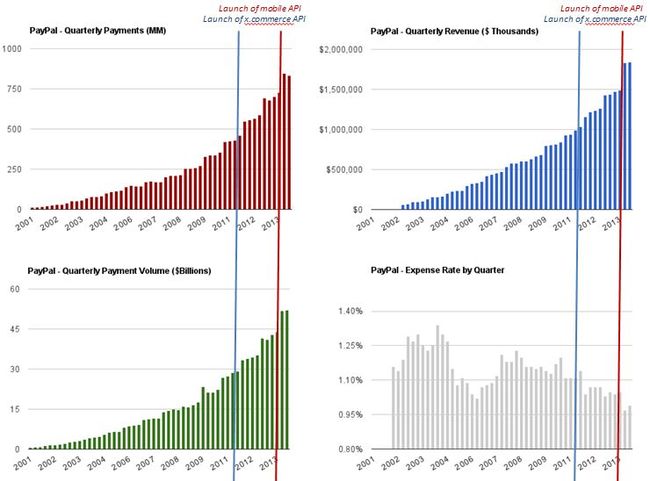

This can be easily seen from the charts below (taken from Glenbrook news).

What you can see below is PayPal’s cost-income ratio through the years.

Now, do you see that spike in Q2 2011 and Q3 2013?

These are two key milestone points.

The first is the launch of PayPal’s API in October 2011.

PayPal announced that anyone could plug PayPal payments processing into their systems and there was a spike in revenue and reduction in cost.

The reason for the spike is that the global development community picked up PayPal and started to use their electronic functionality in their apps and products (front-end and back-end).

In other words, PayPal is enabling the middleware through real-time APIs.

Clever.

In fact, it became even smarter when PayPal simplified the whole thing for the mobile world in March 2013, as demonstrated by this second spike in revenues and reduction in costs.

What this is clearly demonstrating is that those who open up their processing for plug-and-play will win.

It is why Citi opened up their Global Transaction Banking platforms to APIs, as have several other banks.

The days of playing your cards close to your chest have gone. If you do that, you are a control freak, and freaks will not survive.

You have to be mainstream and you can only be mainstream by being real-time and open sourced.

Taking the back-end cloud products and making them relevant through data analytics, then delivering them through real-time APIs to the end-user is the way to go.

I hope you agree and, in the last two parts of this series, we will see what this means to the customer and the customer experience.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...