We see the media regularly slagging off bank customer service as terrible. Bank complaints are soaring, and branch closures are regularly reported as a disgrace.

But this is where the media gets it wrong.

First, bank customer service is second to none compared to other industries and, second, banks don’t need branches to provide service. As banks consistently move to digitalisation, the role of the branch is changing. Historically, they had to be in every community to enable transaction services but those transaction services are now online, so they are becoming sales centres, and you don’t need a sales centre in every village.

But here’s where it gets interesting as face-to-face is where the rubber hits the road.

I discovered this recently in dealing with an issue with my mobile carrier, Vodafone, and my friends hate it when I use the blog to have a rant against bad customer service but hey, it’s my blog. So, here’s the low-down and, if you don’t like a whinger, please read no more.

Just before Christmas my iPhone 5S died. It stuttered for a while, and then died. I thought it was the battery but it wasn’t. It’s a hardware fault, as I found out, and it was dead.

I rang Vodafone and discovered there was a 25 minute wait for service but, usefully, they have this feature where you can ask them to call back when you’re front of queue, so I tapped that.

When I finally got a call back half an hour later, the call centre guy listened to my problem and said: “ah, first you have to go to Apple. They will fix it.”

“OK”, I say, “but the last time I went to the Genius Bar to get a fix they asked me to show a ‘proof of purchase’, can you send me one?”

“No”, he says. “You have to do that online.”

“OK”, I say. “No problemo.”

Ah, there is a problemo.

My account only shows my billing details for calls online, not my order for an iPhone 5S a year ago. So I call back and get the usual half an hour wait for a call-back. When it comes, it’s disappointing as they cannot issue the proof of purchase. They suggest I engage with their online chat to get it, which I duly do.

That conversation is shown below and note, even that service takes minutes to get a response:

Copy of your recent chat with Vodafone online chat service team.

|

General Info | |

|

Chat start time |

Dec 18, 2014 9:47:23 AM EST |

|

Chat end time |

Dec 18, 2014 10:02:38 AM EST |

|

Duration (actual chatting time) |

00:15:14 |

|

Operator |

Tom |

|

Chat Transcript |

|

info: Welcome to Vodafone! You will now be connected with a service adviser. Your approximate wait time is 13 minute(s) and 9 seconds. . We’re looking forward to assisting you today. |

I gave up.

So I went to the Apple Store and found they couldn’t book me into the Genius Bar until after Christmas, so I left it until the New Year to make the journey to the Genius Bar.

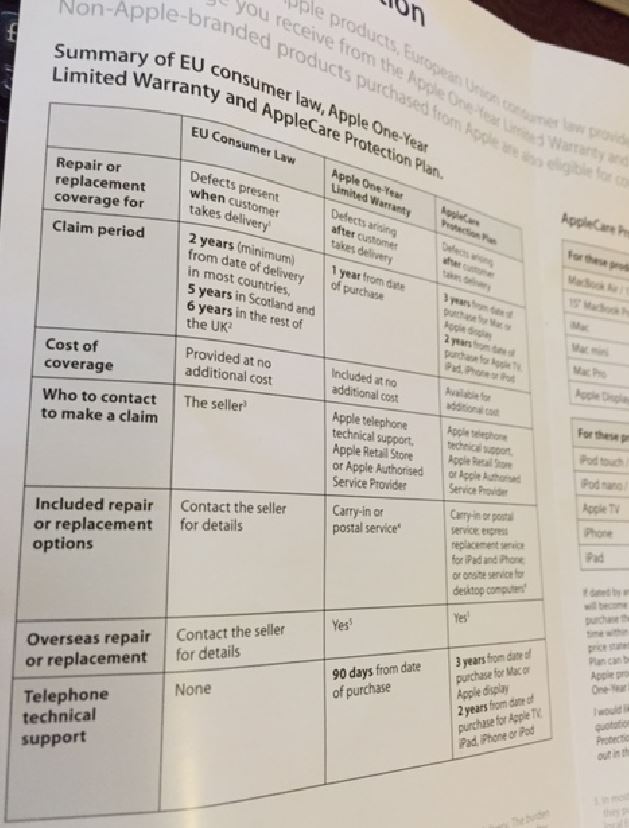

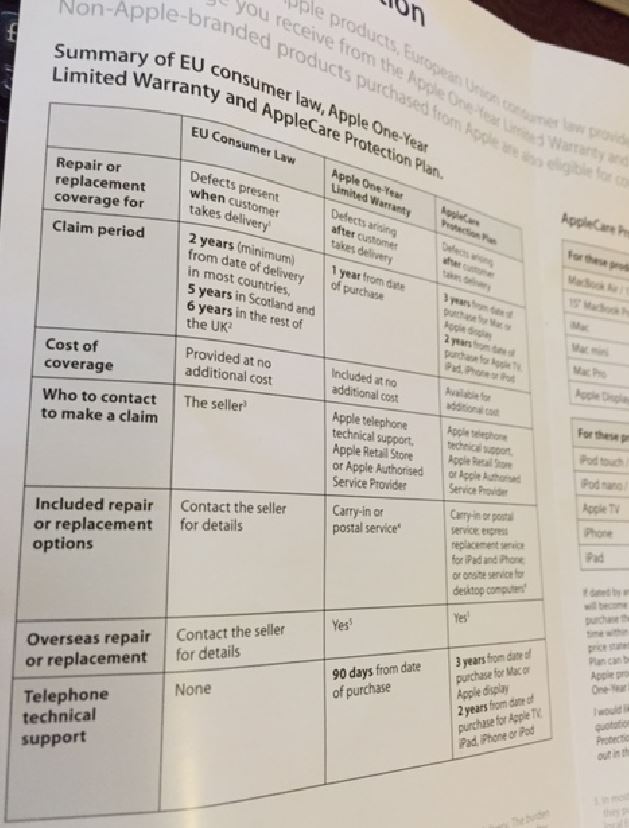

As it turned out, when I did get a Genius Bar appointment, they didn’t need a proof of purchase. However, the bad news was that the phone was dead due to a likely hardware fault and, as the phone was over a year old, they advised me to go back to Vodafone who would replace or repair the phone as, under EU Consumer Law, they are liable for a phone with a hardware fault for two years from sale as the retailer (in fact, under UK Law, it’s six years).

In fact, it must be something that happens fairly often to these devices as the helpful Genius Bar staffer gave me a leaflet that made it quite clear that Vodafone was liable for repair or replacement under EU law, along with a diagnosis that this is a hardware fault that would be covered under such a ruling.

So I go to the Vodafone shop near the Apple Store and the manager says: “yes, no problem, we will replace your telephone … but all of our systems are down right now so can you come back later?”

Jeez … no mobile through all of Christmas and New Year, and the saga continues.

I return the next day and go to a different Vodafone store.

“Ah … I’m not sure we would replace it, but I’ll have a look”.

After a while, the assistant returns and says they have no iPhone 5S 64Gb mobiles in stock but the store 1 kilometre away in Bond Street does, and ask for Istvan or Saquib who will deal with the issue.

I make my way to the Bond Street Store and explain the situation to Istvan. He says they don’t repair or replace, but he’ll check.

Istvan swaps over the Saquib who says they used to repair Apple phones but don’t anymore and they won’t replace either. I show him the document that Apple gave me that explains, under EU consumer law, Vodafone is liable for the issue. He says they’re not and that’s the end of it. Oh no it isn’t.

I start a sit-in the store by calling 191 and waiting the half an hour to get hold of Vodafone customer support, whilst Saquib and Istvan skulked around giving me dirty looks. I guess they don't like argumentative customers who have an issue with a broken phone that, under EU law, they are accountable to repair or replace.

I then engage in three more conversations with Vodafone customer support, Vodafone technical support (a third party company) and Vodafone escalated customer services, each time telling them the unfolding story of disaster. This has now taken me 75 minutes of waiting and talking with Vodafone HQ in the Vodafone Bond Street store, as the staff in store cannot answer the question satisfactorily. I finally get hold of Kirsty at HQ, who tells me they will honour a replacement telephone as the other store had told me they would provide one and to put Saquib on the line.

Saquib sees me walking over waving my mobile for him to talk to Head Office, and immediately waves his hands in a “no, I’m not dealing with them” manner and runs away to hide in his closed office downstairs.

WTF?

I explain to Kirsty that their employee, Saquib, will not talk to her or his management. She then tells me that her manager has pointed out that Apple products only have a 12 month warranty under the Vodafone terms and conditions, unlike most other handsets that have a 24 month warranty, and that it is therefore not covered for repair or replacement. In other words, you have a dead phone, it's your dead phone and we're no longer having anything to do with it. It is a £650 piece of junk.

This is not the first time I’ve had hardware faults with Apple – I recently had to pay out heavily to get the screen board replaced on my 24 month old Mac – but I was shocked by this whole affair:

- Apple’s technologies are full of known bugs and faults (this phone issue is regularly googled, as was my Mac issue);

- Apple knowingly only cover their phones for 12 months but pass the buck to the retailers by making it clear that their phones are not covered after 12 months by Apple but, under EU law, should be covered by the retailer, in this case, Vodafone;

- Retailers like Vodafone and Carphone Warehouse explicitly exclude Apple from 24 months warranty for this reason; and

- I’m now stuck with £650 brick that is useless, and will only be exchanged for £199 payment to Apple (more rip-off from my wallet).

And, in all of this, the most unimpressive thing is that you spend ten years as a customer of Vodafone thinking their service is expensive but just about acceptable until the one day you have a problem. You then have to engage with their human customer services, rather than the self-servicing you’ve been used to for the last ten years, and find it so appalling that you immediately want to jump off a cliff rather than deal with them ever again.

I did spend another hour trying to get a PAC code to change to O2, only to find Vodafone saying they would stiff me for a further £350 to break the contract, which has 11 months to run. I declined and will be their reluctant customer for the next 11 months but, in a cunning plan, I call them every day and ask them to call me back and then hang up when they do. Just my way of getting a little shaudenfraude revenge.

Oh, and I recount this story mainly because it is markedly different to my experience in banking. When I deal with my bank, 95 times out of 100, their staff will go an extra mile to try and help, rather than pass the buck or ignore the customer in store, as Saquib at Vodafone did with me.

In fact, when the problems hit is when any service organisation should go the extra mile, as that’s when the rubber hits the road. Whilst the customer is quietly self-servicing and needs no support, then they’re happy. When the customer is asking for help is when the company should be immediately accessible, responsive and flexible.

This last paragraph is why I’m really posting this on the blog, as banks generally try to be the latter: a useful service agency when customers encounter issues they cannot resolve themselves. I am amazed at just how bad Vodafone was when it came to needing help as, if anything, they ignore the customer as evidenced by the minutes of waiting due to an understaffed service channel and a branch network full of people who don’t like dealing with customer problems, only sales.

Therefore, after ten years I will be terminating the contract with this appalling company in November, when the contract comes to an end, but feel that it is pointless in many ways as all providers are the same … or are they?

Any views or advice welcome.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...