Yesterday the UK’s Financial Inclusion Commission published their report on Financial Inclusion for the UK.

The Financial Inclusion Commission is an independent body of experts and parliamentarians who came together to put financial inclusion back on the political agenda ahead of the 2015 General Election. The Commission set out to:

- take stock of the extent of financial exclusion and of current interventions to promote inclusion;

- review the changing context four years after the Financial Inclusion Taskforce was wound up, including welfare reform, technology and squeezed household budgets;

- raise awareness of the issue of financial exclusion; and

- urge policymakers, regulators, the financial services industry and other key stakeholders to support the aim of making the United Kingdom a more financially inclusive society

Here’s the summary of the report:

OUR VISION FOR 2020

The Financial Inclusion Commission wants to see a financially inclusive United Kingdom in which every adult and child can enjoy decent financial health. We want financial services that are accessible, easy to use and meet people’s needs over their lifetime. We want people to have the skills and motivation to use financial services, and to benefit meaningfully from them.

This means a United Kingdom in which:

- every adult is connected to the banking system, through having access to – and the ability to make full use of – a transactional account of his or her own;

- every adult has access when necessary and appropriate to affordable credit from responsible lenders;

- every adult is encouraged and enabled to save, even in small or irregular amounts, to show the importance of a common savings culture, to build up resilience against financial shocks and as an additional resource for retirement;

- every adult has access to the right insurance cover for his or her needs, at a fair price;

- every adult has access to objective and understandable advice on credit, debt, savings and pensions, delivered via the channel most suited to that individual;

- every adult and child receives the financial education he or she needs, starting in primary school and carrying on throughout life and into retirement; and

- government, regulators, the financial services industry and civil society all work together to deliver this vision, before the General Election in 2020, under the leadership of a Minister for Financial Health.

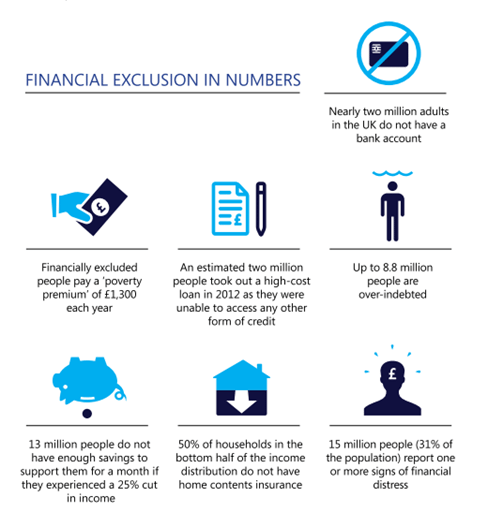

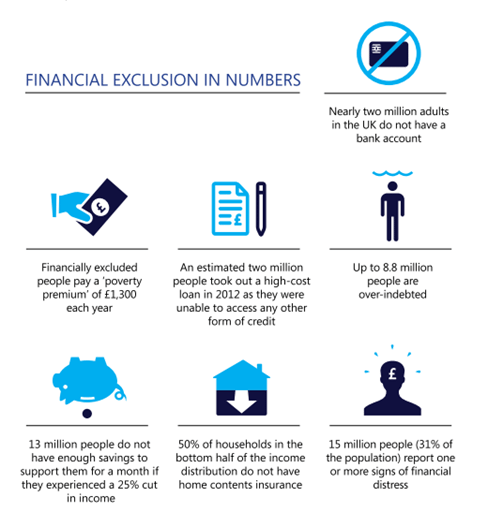

THE REALITY IN 2015

Political parties are understandably focused on the state of the public finances. But the Financial Inclusion Commission’s work has highlighted the vulnerability of private finances and the lack of resilience in the system. This ought to be a major political concern given the big disruptive factors that are emerging, such as welfare and pension reform and interest rate rises. Financial inclusion should be a higher public policy priority. We need more leadership and coordination at national level.

KEY CHALLENGES

Leadership

The United Kingdom does not have a national financial inclusion strategy. There is not enough momentum and coordination across all sectors, notably government.

Banking and Payments

Banking services (particularly Direct Debits) are still not meeting the needs of low income consumers. Technology is changing the face of financial services.

Credit and Debt

There is a credit gap for people on low incomes who are not served by the mainstream market. This will be widened by the Financial Conduct Authority’s cap on payday loans. Debt solutions have not evolved to reflect the changes in people’s needs and debt advice is fragmented.

Savings and Pensions

Many people lack financial resilience. Savings products are not suitable or rewarding enough for those wanting to save small sums. Proposed pension reforms, even though desirable in principle, could have serious unintended consequences in the longer term

Insurance

Insurance is seen as irrelevant or unaffordable by many. Some groups may be paying disproportionately high premiums.

Financial Capability

The people of the United Kingdom need better financial skills. Universal Credit will change the way many people on low incomes manage their money.

OUR RECOMMENDATIONS

LEADERSHIP

Designate a senior minister as the government lead on financial inclusion, and financial capability, with the title of 'Minister for Financial Health'

Establish a Ministerial champion for financial inclusion in each interested Department and in all devolved administrations

Establish an independent, expert group to report to the Minister for Financial Health on emerging issues and on progress toward financial inclusion, similar to the Financial Inclusion Taskforce

Place a statutory duty on the Financial Conduct Authority to promote financial inclusion as one of its core objectives

Establish an independent, industry-funded think tank to work with consumer groups, tackle regulatory challenges and facilitate innovation in the interests of financially excluded consumers

BANKING AND PAYMENTS

The Competition and Markets Authority to promote transparent pricing as part of its investigation into retail banking

The new Payment Systems Regulator to ensure Direct Debits and Faster Payments are accessible to small organisations and new entrants

Regulators to ensure payment mechanisms are responsive to the needs of all consumers

The Department for Work and Pensions to promote inclusive alternatives to the Post Office Card Account to support the introduction of Universal Credit, which meet the new basic bank account industry standard agreed by HM Treasury, including electronic payment facilities

The Financial Conduct Authority to promote greater consistency and accessibility in identity requirements for opening a bank account, and the Cabinet Office to continue to work with industry to deliver a world-leading digital identity that supports financial inclusion

CREDIT AND DEBT

Government to enable the use of public sector and non-traditional data in credit scoring, with safeguards, to make access to financial services easier for excluded groups.

Government to lead a collective effort with retail banks and others to promote wider data disclosure and to ill the low income credit gap which has been widened by departing payday lenders

Promote measures to make community finance institutions more sustainable, such as government lifting the APR cap on credit unions, lenders and investors developing a better understanding of business models and risk, and community lenders attracting a wider customer base

Adapt Scotland’s Debt Arrangement Scheme for the whole United Kingdom, with frozen interest rates, reduced fees, more breathing space, reduced time on the credit file and the offer of financial skills training

Promote a more coherent approach to customer-focused debt advice through better coordination and clear regulatory guidance

SAVINGS AND PENSIONS

Rebalance government subsidies for savers to ensure everyone is encouraged to save, introduce auto-enrolment for workplace savings schemes and conduct a feasibility study into which savings models work best for people on low incomes

Government to conduct a robust evaluation of ‘Pension Wise’ to ensure that everyone has access to an affordable, objective service that is it for purpose

The Department for Work and Pensions to work with the industry to deliver a Swedish-style pensions dashboard to help people understand the prospective real value of their consolidated public, private and occupational pension income

INSURANCE

The Financial Conduct Authority, using its proposed new financial inclusion objective, to ensure that risk profiles, premiums and refusals of cover in the personal insurance market are based on accurate information

The Treasury to lead a debate on suitable and affordable protection for consumers unable to obtain personal insurance through the market

FINANCIAL CAPABILITY

Provide financial skills training from primary school through to retirement, including at key life stages and events, and covering cultural as well as technical aspects of money management

Develop a robust, outcomes-based evaluation of how to improve financial capability, with resources to enable it, developed with industry, government, consumer groups and civil society, and coordinated by a reformed Money Advice Service

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...