This post was first published on SAP for Banking

Many markets are being 'disrupted' by peer-to-peer (P2P) connectivity and new open marketplaces. Think Uber for taxis and Airbnb for hotels. These are the new marketplaces for personal transport and accommodation. Some say that P2P lending is the new marketplace for financial credit. From mortgages to trade finance to personal lending, P2P crowdfunding is changing the game but, in this update, I content that it is not disruptive at all. Instead, it is just a shift from traditional institutions funding consumers and businesses to a new form of risk mitigation through an additional third party layer.

I’m often asked whether it’s too difficult for an incumbent bank to adapt and change to the 21st century digitalisation challenge. It’s certainly difficult if you have to rip out core systems, reorganise the whole bank and rethink everything whilst keeping the existing organisation running. That’s why a number of banks are launching new banks. But there are other strategies. I’ve blogged quite often about banks that are incubating, escalating and investing in fintech, yet that is also a flawed strategy as it gives the bank a stake in a new potential unicorn but it doesn’t change the bank.

Then there’s another strategy that’s starting to emerge which is to view those who are disrupting as risk partners. This is certainly the development that began in the USA, after the regulators stopped the rise of P2P lending. In fact, it’s interesting to see how the P2P lending markets have diverged between USA and UK, two of the biggest marketplaces for such markets alongside China.

The USA regulated American peer-to-peer lenders back in 2008 such that they must conform with US Securities regulations. What does that mean? It means that peer-to-peer lenders are not actually lending peer-to-peer. What they are doing is buying a promissory note from the marketplace platform – Prosper, Lending Club – and that note obliges the marketplace to repay you as long as individual borrower’s payback. If they don’t payback, the investors lose.

This was viewed as a structured securities agreement by the SEC and, on 24 November 2008, forced the P2P lenders to package their loans as securities. You can read more about it all on the P2P Lending Expert’s website.

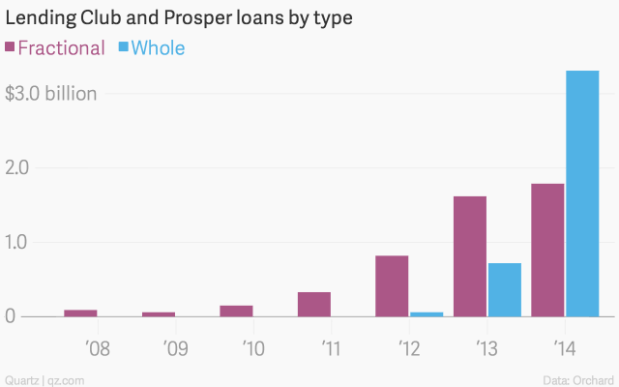

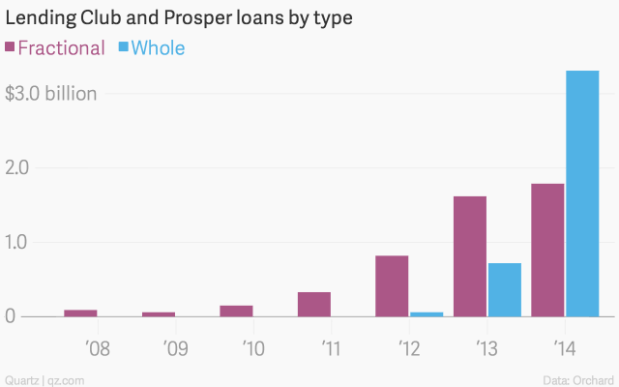

The reason why it’s important to look at this move in the USA is that it’s led to over 65 percent of American P2P lending being FSI2P – Financial Services Institutions to peer, not peer-to-peer.

Chart from Quartz

The good news is that by being funded through institutions loans are matched far faster. In the old days of peer funding, a loan could sit on the platforms for weeks. Now most are completed in seconds, because the investors are programmed into the marketplace platforms to fund on demand. This has also created an issue for Lending Club and Prosper as the institutional investor funding is now dominating their markets to the almost exclusion of retail investors.

This article published by the Financial Times states the issue well:

“Lending Club has placed limits on the amount of loans investors can purchase and has also installed new technology that is intended to allow individual investors time to scan the site and give them a chance to compete for loans. The most sophisticated investors use computer programs to plug directly into the company’s platform and rapidly evaluate the best loans available. Late last year, Prosper installed speed limits to deter trading firms from buying up its loans unfairly by using multiple servers and rapid-fire computer software. Investors seeking to buy loans from Prosper are now limited to a maximum number of server hits per second and institutional investors are confined to buying ‘whole loans’ instead of the smaller pieces of loans intended for retail investors …

“Big investors may be seeking large amounts of loans in order to bundle them into securitised bonds which can then be evaluated by credit rating agencies and sold to even more investors. Last year, Eaglewood Capital, a New York-based investment firm, created the first P2P securitization, which was unrated. Securitizing P2P loans ‘will increase the complexity and interconnectedness with the broader financial market’, Iosco warned in its report.”

In an even more landmark move, the first P2P securitization to receive a credit rating occurred at the start of 2015, when BlackRock Financial Management created a P2P bundle called Consumer Credit Origination Loan Trust 2015-1. The deal was put together by packaging loans originated through Prosper worth $327 million. Moody’s gave the loans a rating of Baa3 for the first $281 million and Ba3 to residual $46 million.

In fact, the securitisation of the P2P lending industry in the USA creates this complex mix of marketplace platforms being majority funded by institutional investors who package their loans to pension funds and asset managers. That’s very different to the cuddly feeling of me lending to you that was the original intent when Zopa launched back in 2005.

But that has historically been the difference between US FSI2P and UK P2P.

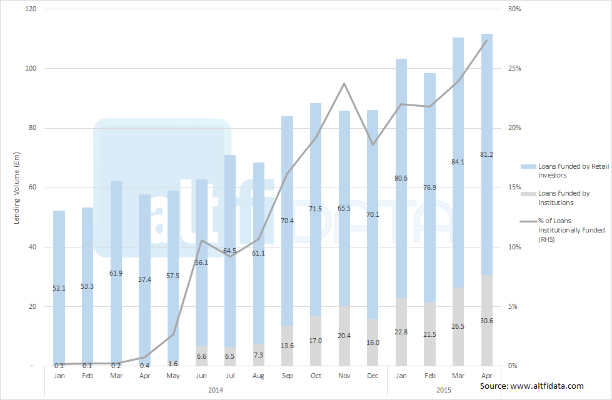

For most of the UK life of peer-to-peer lending, the lenders have been individuals. That has stifled the market a little bit but, as this marketplace blossoms, so the platforms adapt. Recently, the UK has seen a similar pattern to the USA for example. As AltFI points out: Is P2P Lending a thing of the past?

Chart from AltFI

This is a very recent trend and may be because the sector has gained respectability after:

- creating a trade association – the Peer-2-Peer Finance Association, P2PFA;

- gaining a regulatory structure – since April 1 2014, the Financial Conduct Authroi9ty has supervised the P2P markets; and

- being included in the formal markets of savings and loans – the Treasury now recognises P2P as an investment vehicle for tax exempt saving products called ISAs, whilst Metro Bank has partnered with Zopa for their savings products

All in all, what we’re really seeing is what was called Alternative Finance becoming the Risk Management Market for credit for financial institutions. The platforms take the risk and the banks fund them. It doesn’t disintermediate the bank. It just means the bank gets more efficient profit for less cost. Or that’s how I see this developing …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...