I was at a conference the other day when the presenter showed this quote from the Wall Street Journal:

The question is so simple it seems silly: What is a bank? Of course you know the answer. A bank pools savings and then allocates that capital. Simple, right? But that’s just the start. In 2016 a big bank also doubles as an enterprise software company and a mobile-apps developer. It is a customer-service organization to big companies and individuals alike. It is a tool of government-mandated social policy. A shareholder-return engine. An international intermediary. A seller and trader of securities. A policeman of criminals. A policeman of itself.

I was impressed. Why? Because this is the dilemma we all live with today. So many companies are now technology firms who happen to do X. Uber is a technology company that happens to do rides. Amazon is a technology firm that happens to do shopping. Google is a technology firm that happens to provide answers. This is today’s world, and today’s world makes almost every business that is not technologically relevant, irrelevant.

I say this because I travel … a lot. Getting off the plane yesterday, all I saw was every passenger staring at their phone. They were looking for messages. Urgent things to be done.

- Have you remembered to tell Charlie good night?

- Don’t forget to buy a Singapore souvenir.

- Are you coming back Wednesday or Thursday?

- The order is confirmed.

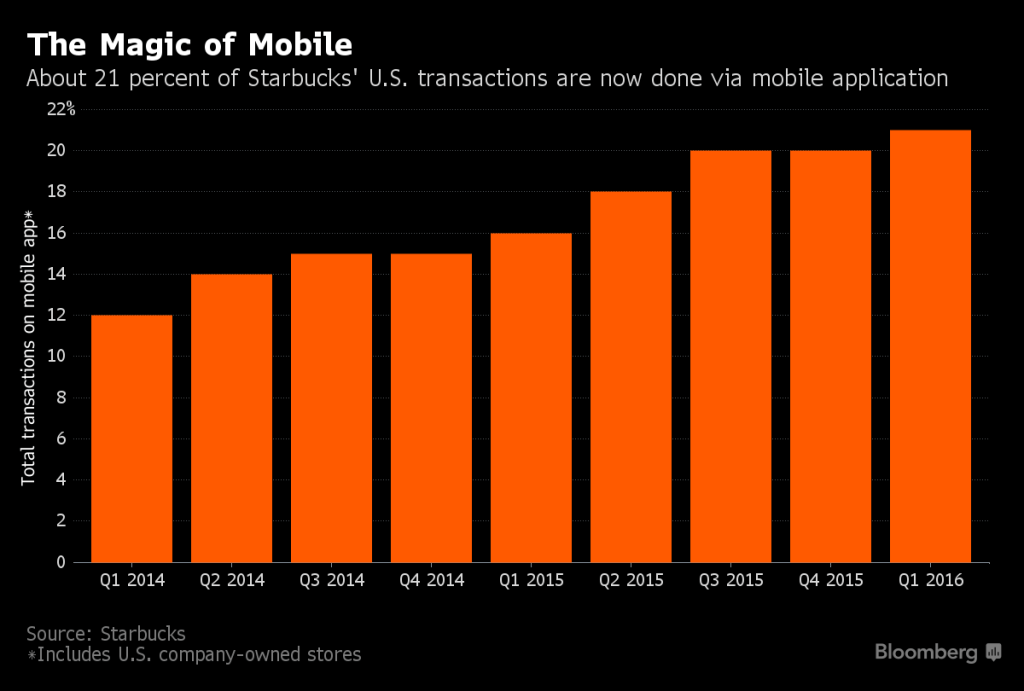

Whatever the text said, I don’t care. What I do care about is that today’s world is ultra-connected and I’m not sure that my industry, banking, is keeping up. In fact, the Wall Street Journal series illustrates this contradiction whereby a bank is no longer a bank. A bank is just a technology company trying to keep up. In a similar fashion, most other firms are just technology companies trying to keep up. To illustrate the point, Domino’s Pizza. A pizza firm or a technology company? A technology firm. Half of all Domino’s pizzas are sold on their mobile internet service, so they’re a technology company that happens to make pizzas. Same with Starbucks. A coffee company making $1 in $5 from their app.

So what is a bank? A bank is all sorts of things, as outlined by the WSJ. It’s all things to all people but, most importantly, it’s a technology software and services business. Get it?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...