I was looking through Google Analytics to see which of my blog entries had been most read in 2016. Here’s the list and, as you will see, it’s mostly people reading about blockchain news, although how to change the bank, fintech and innovation all get high rankings too.

The top ten trends in banking innovation (February)

This was a summary of the top trends from the Accenture/EFMA research paper published annually. It was nicely summarised in an Infographic by Payment Components.

Four banking business models for the digital age (October)

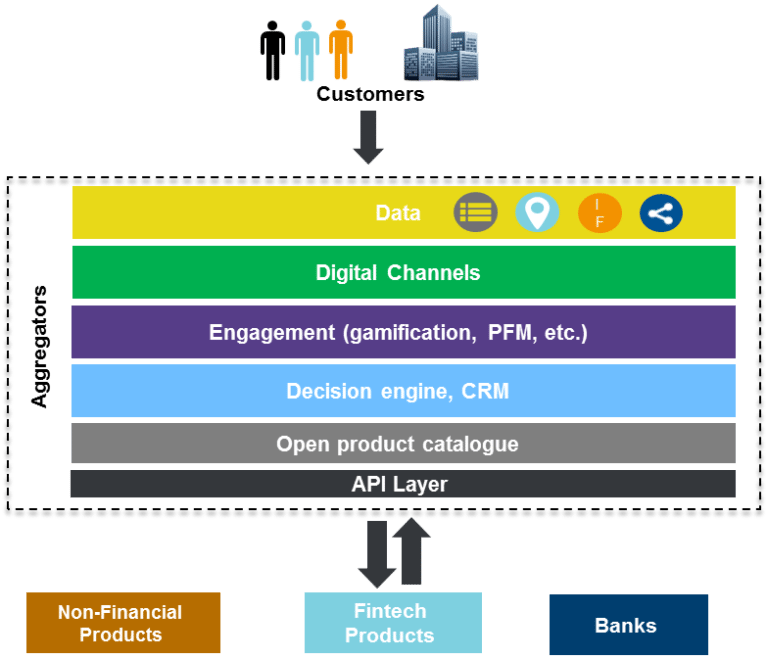

I spotted a lengthy, but very insightful post, by Ben Robinson, Chief Strategy and Marketing Officer for Temenos. This was posted on the blog and created a lot of discussion and reaction. The key to the discussion is the open marketplace model of finance, that is becoming the standard for the future.

Then there are four articles together that created the most interest because they gave away a lot of free, but decent research:

- The best free research papers on #Fintech and #Blockchain (February);

- The best blockchain white papers, March 2016 [Part 2] (March);

- The best blockchain research papers, Q2 2016 (July); and

- The best FinTech research of 2016 (December).

In fact, a lot of the most read blog entries are research or analytical articles, rather than my opinion pieces (ed: not that I’m bothered about that at all, no way), with the sixth most read blog entry being The Six Biggest Trends in Fintech (July) by Susan Visser

Eventually, we get to something what I actually wrote (ed: note that this is a homage to Morecambe & Wise). So, in seventh place was my detailed entry on open marketplace platforms in banking: If you want to convince the bank to change, read this blog (October). As mentioned in my review of 2016, open marketplaces and platforms became hugely popular this year: A seven year old idea comes of age (July).

I’ve been presenting a summary of Digital Bank and ValueWeb for a few months and thought it worth sharing back in May: The future of banking, money and finance [Presentation] (May).

And there are also many case studies I post here throughout the years with the most popular in 2016 being details of India’s billion digital identities (September).

Finally, blockchain features a lot in my blog, and it’s incredibly popular as a topic with readers, as evidenced by the fact that 10 of the top 20 entries are about this subject. The first general piece on the area was a summary of the discussions of blockchain and ledgers, and how confusing the terminology and technology can be: #Blockchain? It’s complicated (March). In fact, that discussion featured a lot on the blog, which I tried to clear up in several key entries:

- What is and what isn’t a ‘blockchain’? (February);

- Blockchain is like the internet before the browser (July); and

- Blockchain is dead, long live the Blockchain (December).

Having clarified the confusion, the final group of most popular blog entries during 2016 related to my discussion of the use cases for blockchain and ledgers. This started with a blog update back in March: The five major use cases for financial blockchains. That blog entry led to writing a group of ten articles during the summer to cover these items in depth so, to complete the most blog entries of 2016, here is the final detailed discussion of blockchain use cases and companies:

Applying Blockchain to Clearing and Settlement

I’ve talked a lot about blockchain, but not much lately about the use cases, of which four stand out in terms of real activity: Clearing and Settlement, Trade Finance, Payments and Digital Identity. I thought I’d do a deeper dive into these during the quietness of …

Six Standout Start-ups Focused Upon Blockchain Clearing and Settlement

After yesterday’s blog generally about blockchain use case implications in Clearing and Settlement markets, here are the six companies I see as being at the forefront of changing the game: Digital Asset, SETL, tO, Clearmatics, Symbiont and itBit. Digital Asset Digital Asset – also known …

Applying Blockchain to Trade Finance

After Clearing and Settlement as a blockchain use case, the next big area of interest is Trade Finance. This is primarily because it’s an area full of inefficiencies and open to fraud. Bills of Lading and Letters of Credit are old world methods of managing …

Five Standout Start-Ups Focused Upon Blockchain Trade Finance

In Trade Finance there’s a lot of activity. As mentioned yesterday, you have HSBC and Bank of America working with HyperLedger; R3 trialling with 15 banks based upon Corda; Ripple working with Standard Chartered and DBS; and JPMorgan have been developing a trade finance trial …

Applying Blockchain to Payments

I’ve blogged for over a week about blockchain based developments in Clearing & Settlement and Trade Finance, and will continue for another week talking about the developments in Payments and Digital Identity. However, at this point, I should clarify that I use the term blockchain …

Nine Standout Start-ups Focused Upon Blockchain Payments

There are a number of base blockchain platforms that are important in the payments sphere, with the three leading players being Bitcoin, Ethereum and Ripple. These are the base development platforms, rather than a payments service per se, and choosing which to use is intriguing …

Applying Blockchain to Identity

In my final deep dive into blockchain use cases, I come to digital identity. Now this is a thorny area for three reasons. First, we need to understand what we mean by identity before we can talk about how blockchains could help. Second, we need …

12 Standout Start-ups Focused Upon Blockchain Identity

Digital identity is a complex area, as discussed yesterday. First, it is focused upon shared ledgers and blockchain, not just blockchain; second, it needs to have some permission basis; third, we need to have a structure agreed for who is providing permissions; and fourth, it …

How much is being invested in blockchain start-ups?

I can’t finish writing my blockchain and DLT dialogue without wrapping up the missing bits. This blog series is not meant to be an exhaustive list of every company and every use case, just the ones that stand out for me in a banking context. …

Wow! It’s been a busy year and all about platforms, marketplaces, ledgers and blockchains. What does 2017 have in store? Come back next week to find out.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...