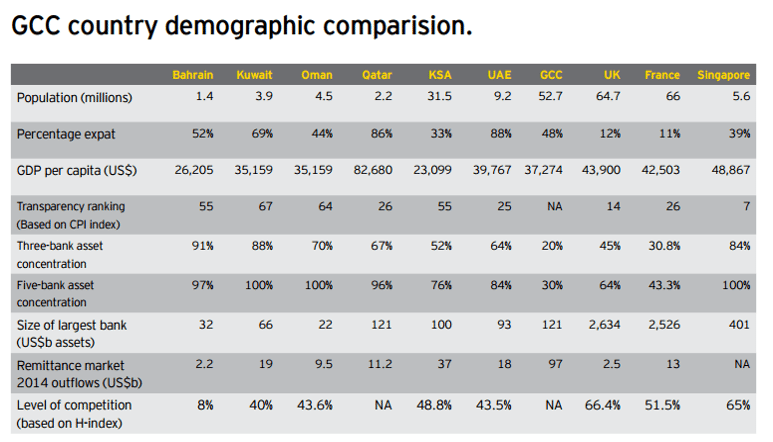

I took part in a webinar the other day, focused upon the developments in digital banking in the Middle East. Having visited Abu Dhabi, Bahrain, Dubai and Qatar recently, I can claim to know a little. Equally, having been to the region regularly since 2002, I’ve seen how it is developing and changing. This is illustrated well by these two charts, which illustrate the demographics of the GCC (Gulf Cooperation Council, like the EU for the Middle East) countries in 2016:

Source: EY World Islamic Banking Competitiveness Report 2016

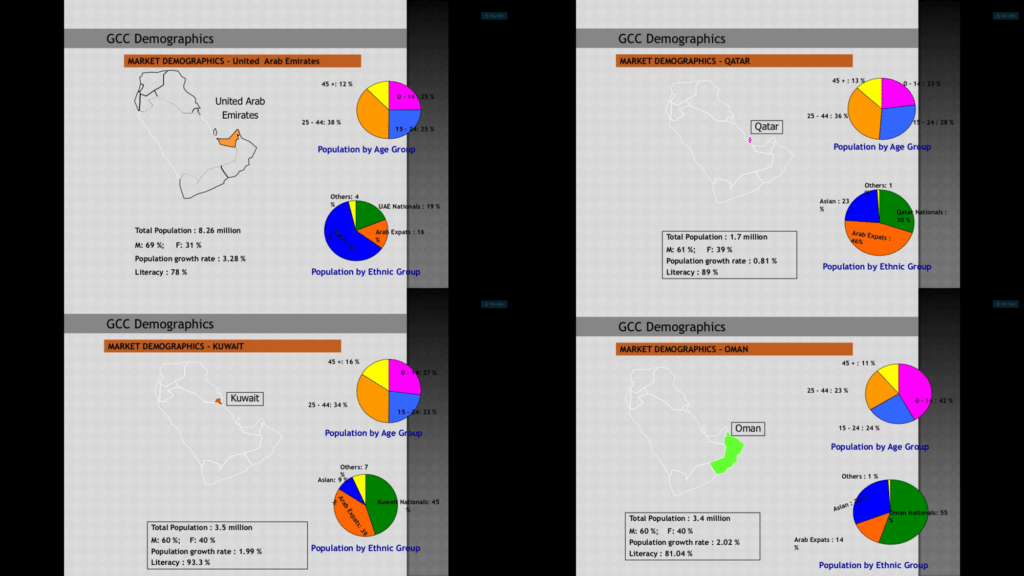

and 2012:

Source: Apparel Presentation

The market is a very mixed one of a minority of nationals in many countries of the GCC, a large number of Asian migrants, especially Indian due to the wide range of construction works; along with expats from both other Arab countries as well as many from Europe and America. It’s a vibrant world that changes almost every day. For example, the Dubai Canal has appeared recently. It’s a three kilometre long canal through the centre of the city built in just 18 months. Imagine any other major city ripping itself through the centre in a major construction project in suhc a short period of time. It just illustrates the market well, and has an attitude of Just Do It. More on that in other blogs, as the focus of this one is the market diversity.

During the webinar, it hit home that looking at these demographics, you have a small number of Ultra High Net Worth Individuals (UHNWI)* who expect service beyond anything. Imagine you’re a billionaire with a bank account. You never go to the bank – the bank comes to you. You never ask for anything – you just expect it to be done. You never need to check your balance – someone does that for you.

A good way to illustrate that is through former UK Chancellor George Osborne’s brother, who runs an UHNWI concierge service:

Our potential clients are quite time-poor, so we’re like a support system, providing everything from a last-minute private jet to a Friday-night table at Zuma. Like that. I have access to all the Grands Prix, tickets to the Oscars, paddock passes, backstage passes. Some companies will organise tickets to go and see Bon Jovi or whatever, but we organise passes to go backstage to meet him. It’s anything you want.

These are the customers that bank need to reach digitally and physically, at their beck and call 24*7.

There’s then a whole raft of bankable customers, many coming from overseas, who have been used to the service of a Citigroup, HSBC or CBA. These customers are probably pleasantly surprised by the service they recenve from an Emirates NBD or NBAD (Natinal Bank of Abu Dhabi). I liken it to the difference between flying British Airways or American Airlines and Etihad, Emirates and Qatar Air. It’s like being in a battatered old black or yellow cab (dependent on the city) and switching to luxuriouis limousine that’s shiny and new. The Middle Eastern airlines are fleets of A380s that are amazing. The BA and AA aircraft tend to be a little old and tired, as are their staff.

There’s then another mass of population, many from Asia, who are called migrants rather than expats. Expats are viewed as profeesionals; migrants are generally unskilled and have moved to the GCC for work. As illustrated by the Dubai Canal, there’s plenty of it. Across most of the GCC, but particularly in UAE, Bahrain and Qatar, you’ll see crane after crane aftrer crane in the sky. These aren’t the crane birds, but the metal cranes of construction. Hundreds of them are erected every day to build new offices, apartments and hotels. It’s non-stop and is the reason why the population is doubling eveyr few years in these countires.

The net:net is that you have a rapidly growing economy, with a mix of young migrant workers who need remittance serices; anoher group of professionals who expect mass affluent services; and a small group of High Net Worth and Ultra High Net Worth Individauls who take exceptional service for granted.

An interesting place to be a bank.

Meanwhile, if you’re interested in the sldies from the webinar, you can check them out here:

* To be a High Net Worth Individaul, you need $1 million of investable assets; to be Ultra High Net Worth, you need $30 million minimum. Read more here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...