I spend a lot of time talking with my friends in Turkey, particularly since the big change in climate after the protests last year. Nevertheless, from a financial markets point of view, it's a fascinating place. One of the first to be contactless and, more recently, one of the first to offer social retail banking. If nothing else, I love Turkey for their cheesy adverts:

In this latest update BKM, the ACH for most of the retail banks, provides the story of Troy, the first and only national payments scheme of Turkey.

Payments in Turkey, an ever-growing market… by Soner Canko, CEO of BKM

Turkey, at the crossroads of Europe and Asia, has a banking sector that defies expectations. It has grown at an annual compound rate of 20 per cent over the past 15 years in terms of asset size. In this growing and dynamic market, payments have been one of the major drivers of growth and innovation.

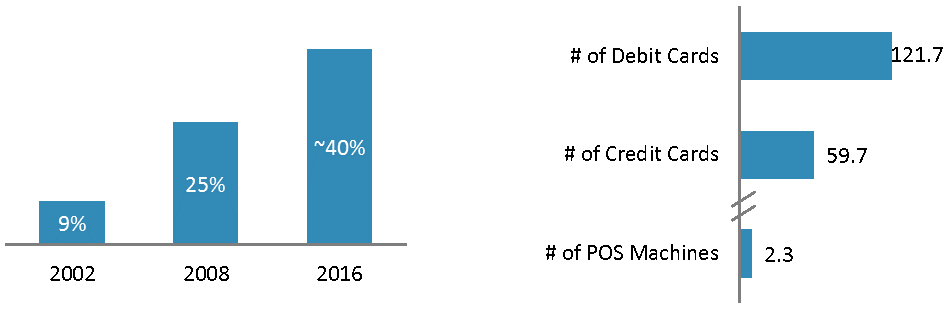

Fifteen years ago, only 9 per cent of total household consumption was through cards. Today this ratio has almost reached 40 per cent, with a dramatic rise in recent years. The vision is to have a 100 per cent cashless society.

Today, Turkey is the largest market in terms of total number of cards and point-of-sales (POS) machines[1]. There are over 120 million debit cards, 59 million credit cards, and 2.3 million POS machines in the market.

Exhibit 1: Turkish payments market in numbers

… inspiring the world with its innovative solutions

Turkey with its rich history, going back to thousands of years ago, is a land that has shaped the history of economics as well. Money, commerce, and the concept of the stock exchange, all were born in Anatolia.

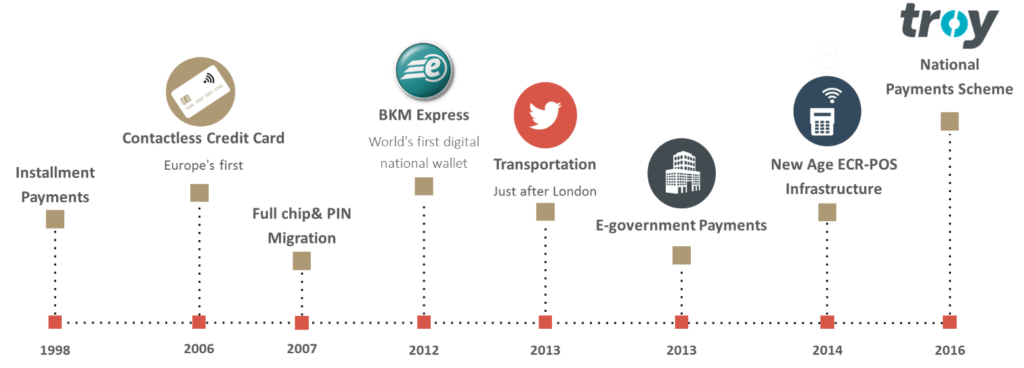

Turkish society’s shopping and payment culture has grown out of this rich heritage. Its young population embracing technology and new products has traditionally made Turkey a center of innovation for payments also in modern times. Turkey was the first European country that issued a contactless credit card in 2006 and the third European country that fully completed the Chip & PIN migration after France and the UK in 2007. Turkish banks launched the world’s first national digital wallet, BKM Express, as early as 2012. Most recently, Turkey launched its first ever national payments scheme, “Troy – Turkey’s Payments Method” in 2016 marking the start of a new era in the Turkish payments market.

Exhibit 2: Turkey’s payments market has pioneered with its innovative solutions

“TROY, Turkey’s Payments Method” as a strategic initiative in this innovative market

Troy -the payment method and brand developed by Turkish banks’ shared platform BKM (Interbank Card Center of Turkey)- is a strategic initiative supported by all the banks and managed by BKM. In a market where 97 per cent of card transactions are domestic, the need for a national scheme had become more and more concrete. Building on advanced payments technologies, secure infrastructure, and knowhow, Turkish banks combined forces to create a national payment scheme that can better address local requirements, shorten go-to-market time for innovative products, enlarge freedom of capabilities, and increase cost effectiveness.

As an initial step, Troy achieved 100 per cent acceptance on all the terminals in Turkey (over 2.3 million) including ATMs, point-of-sales machines, and e-commerce sites. This is what differentiates Troy from other national schemes around the world and gives Troy the edge to grow in a challenging market like Turkey.

Following the completion of necessary infrastructure, Troy was launched for consumer in May 2017 with a nation-wide campaign and is now ready for mass distribution.

Troy provides a wide range of products and services developed specifically for the benefit of the Turkish market. Its product portfolio includes magnetic stripe, contact, and contactless technology in debit, credit, and prepaid cards that can be used both for online and physical payments. Troy will add mobile to its portfolio in 2017.

Troy Innovation Center, which was established to develop and test new cards and terminals spearheads Troy’s development of new solutions. Leveraging the Innovation Center, Troy is poised to launch more innovative products in the coming years with a reduced product development period.

Troy, initially established as a domestic scheme, aims to add international acceptance to its value proposition. In alliance with an international cards scheme as the preferred partner, Troy will ensure international acceptance in 185 countries. Troy’s members will also have the liberty to work with any international scheme of their own choice.

TROY to be instrumental in realizing Turkey’s vision of “having a cashless society by 2023”

With the full support of whole payments ecosystem from issuers/acquirers to regulators, Troy aspires to grow fast in Turkey. As of today, 26 financial institutions -constituting to almost 100 per cent market share in number of cards- are members of Troy. 16 of them, 15 banks and 1 non-bank, are currently ready to provide debit cards, prepaid cards, and credit cards with the Troy logo. The target is to have all the banks to be providing their customers with cards with the Troy logo and place a Troy card in each and every wallet, as BKM CEO Dr. Soner Canko mentioned during a press conference.

Given the growth potential of the Turkish payments market and dedication of the stakeholders, the near future will witness Troy thriving and contributing to Turkish economy in many facets. For the banking sector, it will help the sector grow in a sustainable way by improving product development capabilities and cost effectiveness. Troy has already created a large ecosystem from issuers to technology suppliers and this ecosystem will definitely expand, as Troy grows further. On the consumer side, it will not only increase financial inclusion among unbanked population but also improve the financial literacy of the Turkish population. Troy will be instrumental in increasing card usage and realizing Turkey’s vision of “having a cashless society by 2023”.

[1] Based on the 2015 statistics by European Central Bank’s “Payments Statistics:General Notes” Report

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...