I often talk about my week in Hangzhou last year, writing the case study on Ant Financial for the new book Digital Human, and particularly the words of Jack Ma on how he sees managing the Alibaba platform:

Management. The word is there for regular companies. At Alibaba we treat it more like governing an economy, as we have to manage so many companies dependent upon us as partners. By 2036 we will have built an economy that can support 100 million businesses for billions of users. We won’t own that economy. We will just govern it.

The more I reflect on this statement, the more I think that the move to globalisation through technology overcomes borders and creates new global economies, governed by those who run these platforms. There is another statement often quoted from TechCrunch 2015:

Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate.

This is also talking about platformification, and the move from physical structures to digital structures. Digital structures don’t recognise countries and borders as they are global. They often don’t produce anything themselves either, they just connect people who have something with people who need something.

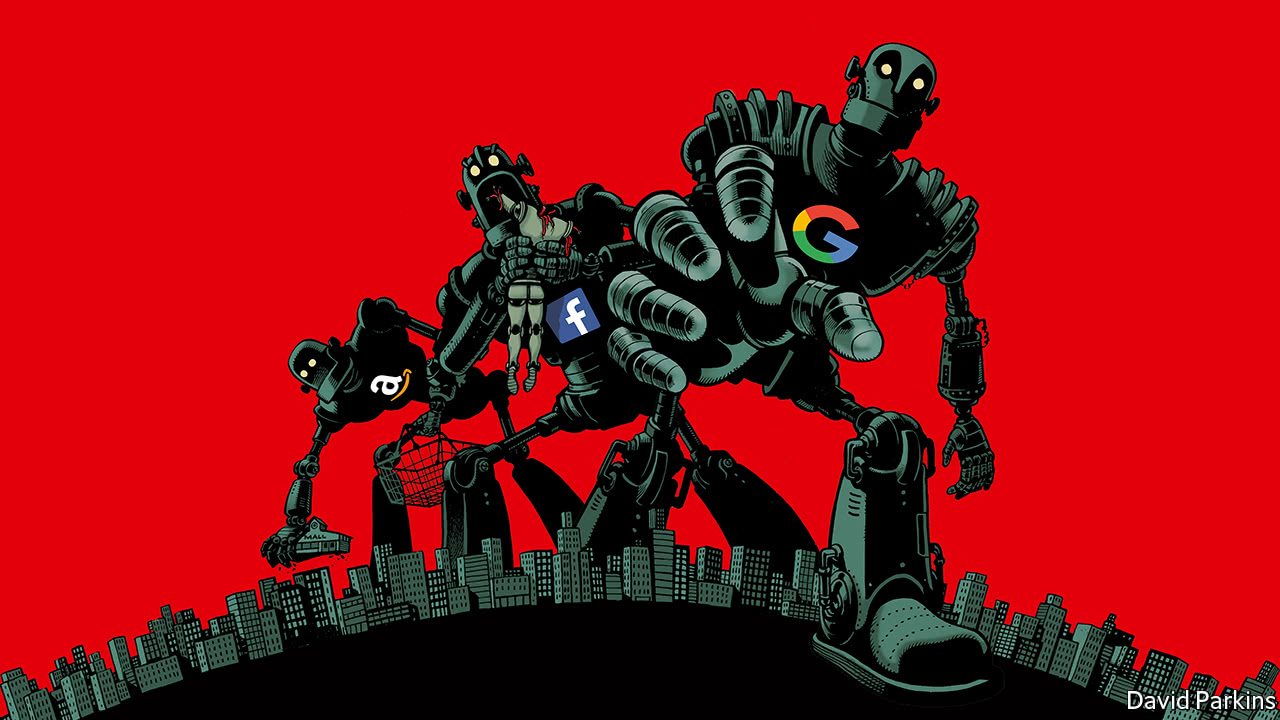

Amazon, Facebook, Google, Baidu, Tencent, Alibaba, Uber, Twitter and co have nothing but a critical mass of buyers and sellers, content producers and content consumers, drivers and passengers that are connected through their platforms. Their platforms then need to manage the behaviours of their constituencies: in other words, to be good governors.

This is where Uber let itself down, both culturally under co-founder and former CEO Travis Kalanick, and professionally by not vetting drivers or following health and safety rules effectively. That is being fixed, but it illustrates the issue well. Similarly, Airbnb gets regular press where some renter trashes an apartment and Facebook gets called out for fake news and online suicides. In other words, the role of the Mark Zuckerberg’s, Jack Ma’s, Pony Ma’s and Jeff Bezos’s of this world is to be the Prime Ministers, Presidents and Governors of these new global platforms.

What does that do for national governments? What role does the President of the USA have in relation to the President of Amazon? How does the Chinese President play with the President of China? Or rather what role does the President of the USA have in relation to the President of Tencent and vice versa?

This gets interesting. After all, the USA recently blocked Ant Financial’s acquisition of MoneyGram as they are concerned about a Chinese firm running a payments service used extensively by US defence workers. What I see happening over time is that the companies emerging particularly from China and America will no longer be Chinese or American. They are global platforms governed by a development community of hopefully ethical, trustworthy and moral people, who have their community’s best interests at heart.

The thing is that most country’s governments do not believe this is the case. This is the theme explored in depth in January 20’s Economist, claiming that these companies are “BAADD—big, anti-competitive, addictive and destructive to democracy”.

Maybe they’re right, and certainly the regulators are taking these firms to task. Google have been hauled through the European courts twice recently – creating the right to be forgotten and forcing Google to stop rigging their shopping search results – and Facebook is on the back foot for fake news. All of this is a friction that will be hard to resolve, as it is the challenge of how to regulate global platforms within national regulatory structures that have borders not recognised by those platforms.

Today, the approach is to fine and focus upon those firms that are engaged in activities that need governmental attention. All well and good as you know where the headquarters of Jeff Bezos and Jack Ma can be found. Not so easy for cryptocurrencies that have no head office or central control. Just a thought.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...