I’ve just been reading Jim Marous’s Digital Banking Report which ties in nicely with my new book Doing Digital, as the themes are similar.

In Jim’s 70+ page report, Jim concludes that:

“While there is an almost universal awareness of what needs to be done to digitally transform financial institutions, the progress is still slow to non-existent at most organizations. This is a recipe for failure in today’s banking ecosystem.”

He explains this in more depth in the report, and published a good summary on The Financial Brand:

While progress is being made by banks and credit unions in their digital transformation efforts, there is still a great deal of work required as organizations need to move beyond technology implementation to changing organizational culture around digital banking. This will move initiatives beyond IT to include the cross-functional collaboration required to compete against fintech and big tech offerings.

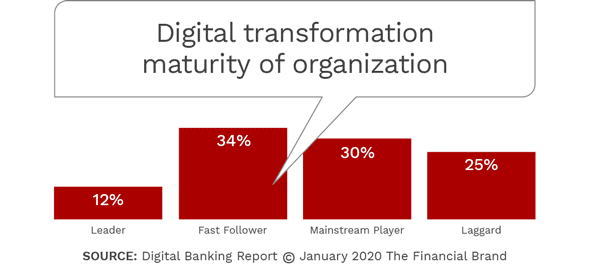

Understanding how leading organizations are managing their digital transformation process is more important than ever to the future competitiveness of banks and credit unions of all sizes. Unfortunately, as we found in the area of innovation, a surprisingly small number of financial institutions (12%) consider themselves to be digital transformation ‘leaders’, with 34% considering themselves to be ‘fast followers’ and 55% stating they were either ‘mainstream players’ or ‘laggards’.

Key takeaways of the report include:

- Digital banking maturity is very low in retail banking, with only 12% of firms indicating that they are ‘leaders’.

- There is a very strong correlation between innovation leadership and digital transformation leadership in retail banking.

- The current focus on retail banking transformation is in the infancy stage (1-3 years), with most efforts revolving around delivery channels.

- Less than 50% of organizations believe they are prepared for competitive threats, customer expectations or technology advancements.

- The most successful digital transformation efforts are led by a CEO (37%) or the CDO (17%) and have a formal team with a broad cross-departmental scope.

- Most organizations have not integrated advanced technologies (design thinking, AI, robotics or IoT) into their digital transformation process.

- The biggest challenges to digital transformation in banking is limited budget, legacy culture, talent availability and IT infrastructure.

Interesting. For a guide as to how to do digital transformation buy Doing Digital; for a guide as to why do digital, buy Jim’s Digital Banking Report.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...