Like most markets worldwide, the Middle East – or is that Western Asia? – has been sorely impacted by the pandemic crisis. Luckily not as much as Europe and the Americas, thanks to strict lockdowns and border closures, but this still creates a new paradigm shift in thinking. A shift towards being truly digital.

With many wealthy customers not wanting to risk visiting the bank or vice versa, how can you serve them effectively? This has been a key question for a long time and the answer has been to roll out more and more mobile and digital services. But there is a big difference between being truly digital or digital at the core, and adding digital or digital on top, and this is what became a really notable aspect of the pandemic environment. Some banks could serve; some banks could not.

Luckily most GCC* countries moved to be digital actively in the last few years. For some time, I’ve been heavily involved in the UAE and Saudi Arabia, but other countries from Egypt and Lebanon to Kuwait and Qatar are also dealing with the change from old banking to new. I’ve been to all of these countries over the past decade and recognise that each one is at a different stage of development. For example, I went to Dubai the first time in 2002 whilst my first visit to Kuwait was in 2019. This, for me, shows how interested and committed countries are to FinTech. It is not to say that I am a beacon of FinTech who you must invite to be relevant but, generally, I do find countries find me the more and more serious they are about FinTech.

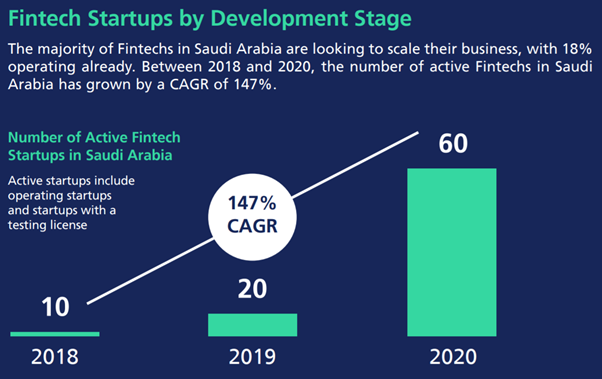

Some countries are showing their commitment big time in recent years, such as Saudi. In April 2018, the Saudi Arabian Monetary Authority in partnership with the Capital Market Authority launched Fintech Saudi, to support the development of the fintech industry in Saudi Arabia. In Fintech Saudi’s Annual Report second edition, released in July 2020, they show fintech start-ups in the country tripled in 2019 to 2020 from 20 to 60.

With that commitment, which comes directly from Salman bin Abdulaziz Al Saud, the King of Saudi Arabia and Mohammed bin Salman, the Crown Prince of Saudi Arabia, I will find it fascinating to hear the latest news of what is happening in the Kingdom during Fintech Saudi’s Fintech Tour 20, which takes place from November 29th to December 10th. There’s a rumour that Chris Skinner will be a keynote, so you might want to check it out (https://fintechsaudi.com/tour).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...