I mentioned FinTech London has seen a major bloodbath as companies lost value and growth. Since the start of the pandemic layoffs.fyi estimates that 4,300 people have left the sector in London. How many more will be leaving now that Britain is seen as a basket case after Liz Truss actions.

First there was the mini-budget and the markets went wild. Wildly against Britain. Then there was her speech at the Conservative Party conference, and even her own party turned against here. Suddenly, a strong G7 country had become an unstable basket case emerging country, according to some.

On reflection, there were ideas in the mini-budget announced on 22nd September, but the ideas were not substantiated. The idea was cut tax and increase spending. Hmmm … that’s like saying we’ve just been made redundant, but we’re going to buy a new house and car as we’re bound to find another job.

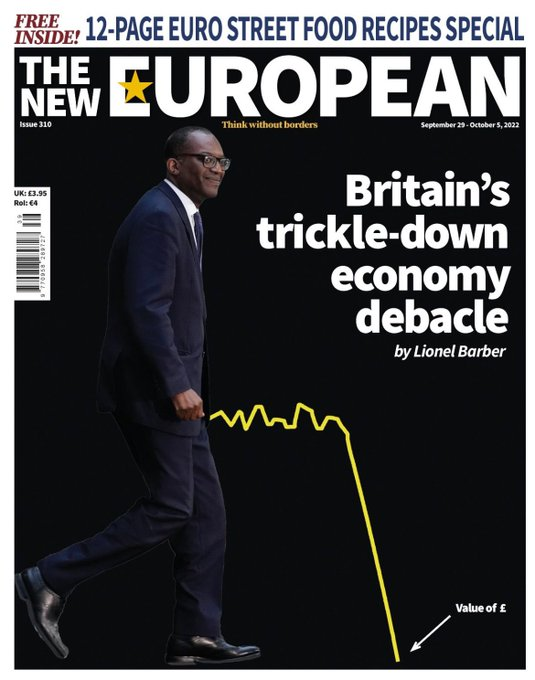

The resultant turmoil saw the value of the pound plummet, interest rates tripling on mortgages, UK borrowing on the bond markets becoming untenable and a loss of belief in the UK government and its policies.

Not bad for a Prime Minister who had been in the job for two weeks, during which there was time to reflect on ideas during the Queen’s mourning.

The mini-budget has been a disaster, with U-turns on everything from higher rate taxes to corporation tax. As I said after her Conservative Party conference speech:

The UK Prime Minister’s speech about growth, growth, growth is a weird juxtaposition from my University mentor who states that we should focus upon degrowth, degrowth, degrowth.

On reflection, the big mistake was that a government cannot invest for growth whilst losing billions of income through tax cuts. It leaves a gap. A £65 billion gap.

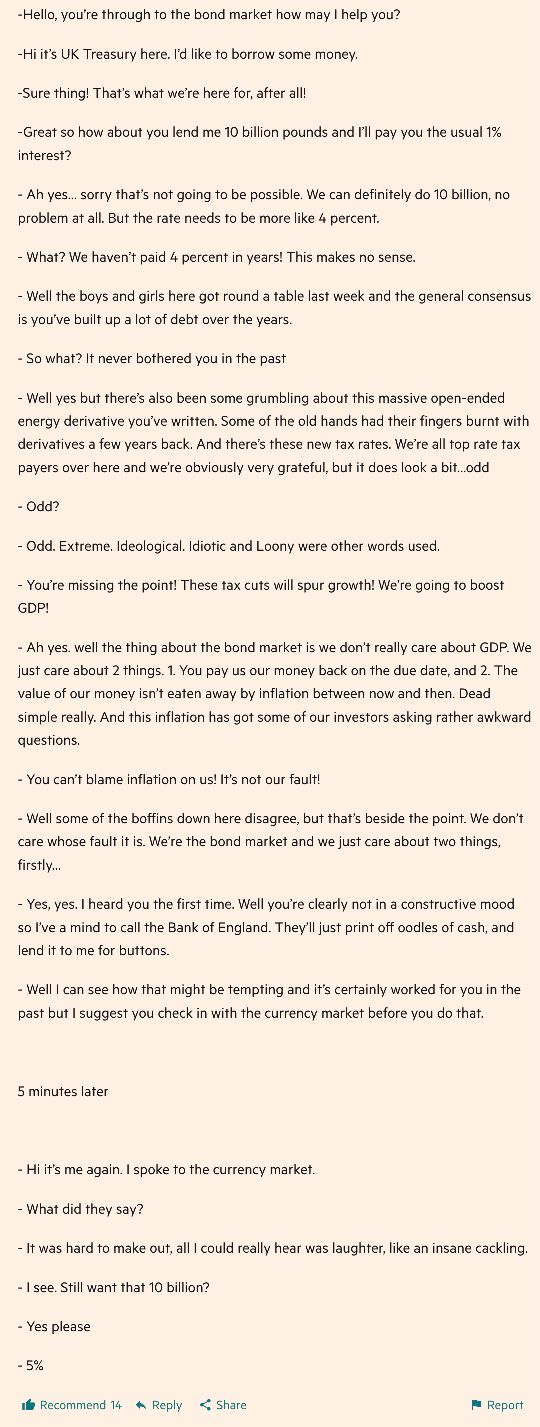

The markets lost confidence and memes and jokes were rife.

Bear in mind this all against the backdrop of Brexit, where the dust has still not settled, and you have a country that looks like it is ripping itself apart. As I’m no politician or economist, it’s not my place to comment further, except to think about what this means for UK banks and London as a FinTech centre.

The City of London has been viewed for all of my life, and many before, as a stable market that can trade and transact on behalf of the world. Some of that is a hangover of Empire days but, more importantly, it’s because the City of London understands finance, financial market, financial instruments and, more recently, financial technologies.

This is my worry: has the actions of the new Prime Minister ruined that credibility and respect? In a market that is already seeing a bloodbath, as discussed yesterday, has this trashed that market? Is she really Liz Trash?

I’m not sure, but after the crazy year we’ve had with a change of leader and chancellor and treasury more often than Arya Stark from Game of Thrones changes faces, something is amiss.

Does this pull the rug on London as a financial and FinTech centre?

I don’t think so, as memories are short and infrastructure is long. But it does make life more challenging in a time of challenge. Funding and investment was already falling through the floor, and the events of the past five weeks will add to the issues in this area ten times more difficult.

Overall, can the Conservatives get the house back in order, or will the turmoil continue? If I were a betting man, my view is the latter. I think we will see a general election occurring in the nearer term, and then things will settle. There may well be a new Labour government, after the Conservatives self-implode, and a period of dust settling.

During that period, the UK economy, the City and London FinTech will find times are hard, but then times are hard everywhere. Give it until 2025, and all will be back to normal and things roar back. Just be prepared for a period of austerity (again).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...