Building on Friday’s blog, everyone is asking whether the house of crypto is falling apart like a house of cards. People are saying that Sam Bankman-Fried, the founder and faller at FTX, was running a Ponzi scheme.

What is the definition of a Ponzi scheme?

According to the Oxford Dictionary, it is “a form of fraud in which belief in the success of a non-existent enterprise is fostered by the payment of quick returns to the first investors from money invested by later investors”; and is named after Charles Ponzi, who carried out such a fraud in the 1900s.

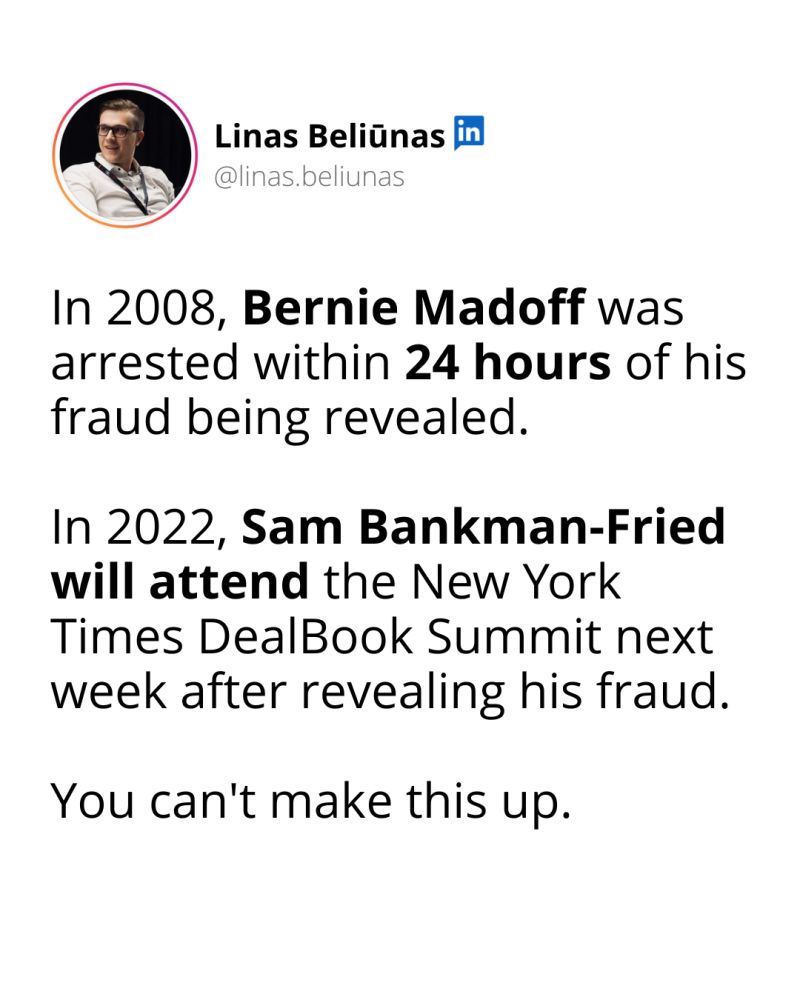

So how can cryptocurrencies be frauds (ed: and how come I haven’t mentioned Bernie Madeoff, pun intended)?

Well, let’s get back to basics, and the core of all financial markets is belief. The more who believe in the value of something, the more valuable that something becomes. A good example are diamonds. Diamonds have zero value. It is purely marketing that makes us believe they are desirable.

“Diamonds are intrinsically worthless”, former De Beers Chairman, Nicky Oppenheimer

But then, as Rare Carat explains:

For gem-quality diamonds that you put in rings, the value comes from the value we assign to them as a society. On a deserted island, a gem diamond is not going to do you much good, but neither is a bar of gold, a pile of cash, or a Picasso painting. However, we know these objects have value because we collectively believe they have value. So unless you live on a deserted island isolated from society, diamonds do have value, even if it is assigned by us.

So things are only valuable if you believe they are valuable, which brings us back to crypto.

When Terra-Luna collapsed back in May, a house of cards began to fall. The first knock-on effect was Celsius, a bankrupt cryptocurrency lending company. Then we have the fintech explosion caused by FTX, a bankrupt cryptocurrency exchange. And now it looks like FTX is rapidly being followed by Genesis, another cryptocurrency lending company.

People are wondering if this is the end of cryptocurrency and bitcoin but, as The Economist points out:

To take out crypto entirely would require killing the underlying blockchain layers. They could either give way first, kicking the stool out from underneath everything else. Or the industry could unravel from the top down, layer by layer like a knitted scarf.

What’s happening at the moment is the unravelling of the froth on top of blockchain structures, which have foundations in bitcoin and Ethereum. However, those foundations have some very useful basics and use cases, such as the use of smart contracts and decentralised finance. Therefore, for me, the idea that the whole house of cards could unravel is not feasible. Nevertheless, the belief in cryptocurrencies has taken a big knock due to the unravelling of the froth on top: Terra-Luna, Celsius, FTX and Genesis.

Meanwhile, going back to the Ponzi reference, a Ponzi scheme is only a Ponzi scheme if you are using customer funds to re-invest in pumping the value of your fund. That’s the mistake that Sam Bankman-Fried (FTX) and Do Kwon (Terra Luna) made. The fact that the billions lost by these individuals has not resulted in law suits and jail is surprising, to say the least. But then maybe it will.

“Whenever you have a business that fails, as the facts emerge, there are typically lessons learned that can inform other companies in that industry, as well as the broader public, about where risks lie and how similar risks could be avoided in the future,” Deborah Meshulam, a partner at D.L.A. Piper and a former official with the Securities and Exchange Commission, said. “We’re in very early days.”

Meantime, going back to the start, was FTX and its brethren a Ponzi scheme or just a creation of businesses that people believed in? To be honest, both are one and the same and, if you argue things this way, you could claim that the US dollar, Euro and Yuan are Ponzi schemes. You only believe in them whilst others believe in them. If you don’t accept that statement, just take a look at the Zimbabwe dollar.

Oh, and a Ponzi scheme only falls apart when you find it is a house of cards.

Image from The Washington Post

Postnote:

I've given a few examples above but the full list is a lot, lot longer, as The Financial Times notes.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...