People took great delight in telling me how some of the big FinTech trade shows this year appeared to be lots of struggling FinTech firms holding out begging bowls to banks. Many start-ups are struggling, with their cash runway running out, and they desperately need funding and investment. The banks are smiling and feeling that they would be happy if these guys went bust, so that they can steal their talent and ideas.

The same seems to be true with cryptocurrencies crashing. The Luna-Terra, Celsius, Three Arrows Capital, FTX, BlockFi and more collapsing during 2022 has made many feel that they can cross their arms, put on a smug face and say told you so. So many in the financial community have claimed there’s nothing behind most cryptocurrencies and that they’re just Ponzi schemes. Now, they feel they’ve been proved right.

On both counts, if you feel this Schadenfreude, you’re wrong.

First, FinTech has not run out of cash. The firms that were too early stage, too visionary, had no plan, no backing and no customers, have hit the wall, but there are still thousands doing pretty well. For example, according to Business Leader, the ten largest FinTech firms are Stripe ($75bn), FTX ($32bn), Chime ($25bn), Opensea ($13bn), Brex ($12bn), Circle ($9bn),TripActions ($7.5bn), Chainalysis ($9bn), Fireblocks ($8bn) and Carta ($7.5bn).

Obivously one name on that list – FTX or, as the BBC called them, TFX

(I’ll come back to FTX) – stands out but, even so, the others are all doing interesting things across interesting spaces. In fact, 2022 has been the start of the great harvesting. FinTechs are being sorted, just like the wheat from the chaff, and those that come out of the recession ahead will be stronger and more robust than ever before.

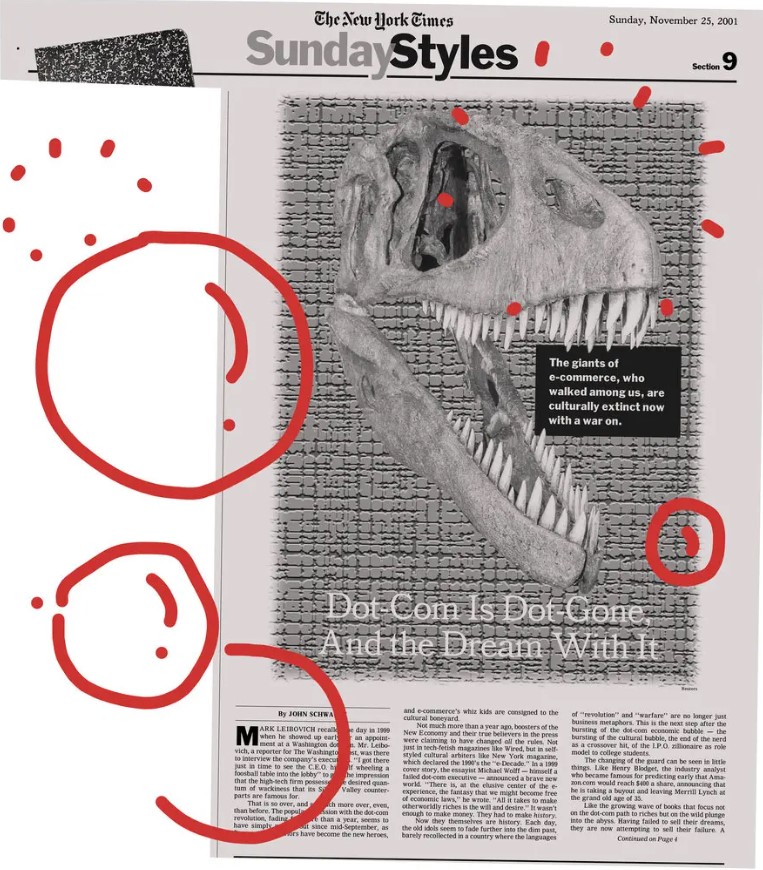

It reminds me of 2001, when the internet bust, and people thought most companies were going to go under.

There were headlines like Will Amazon survive? and yes, many firms did go bust … but not Amazon. Instead, the firms that were nascent in 1999, particularly those with good ideas, leadership and vision, became bigger, smarter and stronger. The same will happen with the issues FinTechs face today, and those who survive will be the Amazons of the future.

Meantime, back to FTX. With the collapse of FTX – which, in case you missed it, was caused by the Coindesk article that outed their leveraged position – hot on the heels of many other firms imploding, it is not surprising that many believe it is the end of crypto. As usual, we have many coming out saying the end is nigh, with the ECB being the latest: ECB says bitcoin is on ‘road to irrelevance’ amid crypto collapse.

That ECB view is dismissed by Coindesk, and for the right reasons because what the ECB and most don’t get is that the FTX collapse has nothing to do with the technology of bitcoin or Ethereum. It is just a trading platform of bitcoin and Ethereum that was badly managed, with poor governance.

For me, it is the same experience as MtGox in 2014. MtGox collapsed, but bitcoin didn’t. The same is true in 2022. FTX collapsed, but bitcoin didn’t. In fact, all of the implosions are noise on the network, but not the network itself. It’s like saying Netscape and AOL collapsed, so the internet is no longer needed.

It simply is not true.

Therefore, for all the financial players celebrating the crypto winter and the FinTech bloodbath, I suggest you think again. In fact, I suggest you follow the path of people like Larry Fink at Blackrock.

“I believe the next generation for markets, the next generation for securities, will be tokenization of securities,” BlackRock's Larry Fink said on stage at the New York Times DealBook Summit last week. “I actually believe this technology is going to be very important,” Fink said. “Think about instantaneous settlement [of] bonds and stocks, no middlemen, we’re going to bring down fees even more dramatically. Think about it. It changes the whole ecosystem.”

Yep but, for those of us who have been in this space a while, we’ve known this for almost a decade.

Repeat after me: Bitcoin Bad, Blockchain Good, May 2015

If you are interested in more, the New York Times made their Dealbook Summit discussions accessible for free.

Sam Bankman-Fried spoke about the collapse of FTX. In his first live interview since FTX filed for bankruptcy, the former C.E.O. of the cryptocurrency exchange repeatedly said he had not known the extent of its financial troubles and had not knowingly committed fraud or commingled funds. Bankman-Fried blamed the collapse on a “massive failure of oversight and said he was “deeply sorry for what happened.” Read the full transcript, and watch the video here.

Janet Yellen called the FTX collapse a “Lehman moment.” The treasury secretary said that even before the debacle, it was clear that the cryptocurrency industry did not have adequate regulation. Watch the video here.

Larry Fink said most crypto start-ups would fail. The BlackRock chief executive, who has long been a skeptic of crypto, placed part of the blame for the FTX failure on the venture capitalists who funded it with little due diligence, a model he said should change. Watch the video here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...