I just got pinged by a bunch of reports about 2023 looking forward and felt it worthwhile to share those that hit top of my desk.

I guess the first one I’ll pick is from Deloitte, who cover all aspects of the main financial markets:

Retail banking: Envisioning new ways to serve and engage with customers

In the near term, retail banks will have to deal with higher rates, inflation, and lower growth. Net interest income should grow at many banks globally, although housing market stress could temper earnings in Asia Pacific. In the United States, challenges in the mortgage and auto loan markets and increased scrutiny of “junk fees” could also dent banks’ balance sheets.

Meanwhile, retail banking customers are also expecting more from their banks. In particular, they are clamoring for a superior cross-channel experience and hands-on guidance during challenging times. These heightened demands will require banks to go beyond a product lens and create customer experiences that are data-driven, consistent across channels, and complete with personalized advice.

In the long term, banks should develop inventive new applications for ESG, embedded finance, and digital assets. These efforts should prioritize empowering customers with initiatives targeting racial equity, decarbonization, and data security.

Consumer payments: Unlocking deeper financial relationships beyond transaction flows

In the short term, the macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending.

Moreover, digital payments should accelerate and transform the payments experience on multiple fronts. Yet, where money goes, so could fraud. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Meanwhile, the way money is created, stored, valued, and exchanged via digital currencies could have profound implications for consumer payments in the long term.

Issuers, card networks, acquirers, and fintechs across the value chain need to demonstrate an unwavering commitment to elevate their roles and become the top-of-mind choice among consumers and merchants.

Wealth management: Creating a new recipe for greater success

The wealth management industry is at an inflection point. Market dynamics are being shaped by multiple forces, in addition to macroeconomic conditions. Other trends, such as the democratization of advice and demographic shifts, including generational wealth transfer, are also upending established business models and existing ways of serving customers. Customers are increasingly expecting holistic advice, prompting a shift from a product focus to client-centricity. These changes, however, are coming at a time when the industry is in relatively good health.

Wealth managers need to be bold in reshaping their business models and building a franchise that’s defensible, scalable, and cost-efficient. For instance, delivering holistic advice, especially to mass affluent clients across the bank, is an efficient and effective way for wealth managers to win greater wallet and mind share. Further, product optimization strategies are becoming increasingly important to win the war for assets.

Commercial banking: Designing a new service model bolstered with insights and digital tools

Inflation, higher rates, persistent supply chain shocks, and a potential recession portend a more stressful environment for corporates. While commercial bank net interest income should improve as central banks raise rates, banks may also be forced to raise rates on deposit products to retain clients seeking higher interest–earning opportunities.

Despite a loyal client base, commercial banks will likely face fierce competition to win a greater share of corporate clients’ wallets. They are demanding bespoke digital, data-rich solutions, and tailored advice. These will likely require banks to excel at a new client service model.

Meanwhile, the fight against climate change presents a massive opportunity for banks to mobilize finance to aid corporate clients’ transition to net-zero carbon emissions.

Transaction banking: Shaping the future of global money flows

Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits. In the near term, however, macroeconomic uncertainties and geopolitical risks are expected to test their resilience. But there are some bright spots, including migration to the new ISO 20022 standards that should help banks with richer data to achieve their digital aspirations.

In the long term, banks would have to contend with new fragmentation risks to their revenue pools and operating model. Meanwhile, the relatively slow pace of digitization can diminish future potential.

Transaction banks should focus on building a modern, efficient, scalable technology platform to provide a holistic, real-time view of client transactions, and enable insights and innovation to serve clients better.

Investment banking: Weathering the storms with patience and ingenuity

Investment banking businesses will likely face a unique set of challenges in 2023. In the near term, banking institutions will likely be preoccupied with how best to react to macroeconomic conditions, including divergent interest rate trajectories across the globe. Volatility across asset markets may bode well for the Fixed Income Clearing Corporation (FICC) and equities divisions. Yet, the same market unpredictability could create headwinds for prospective deal-making and underwriting and also stress capital and liquidity buffers. These dynamics are in sharp contrast to the last two years, when investment banking divisions posted record profits.

Investment banks should preserve their role as capital market intermediaries in the wake of deglobalization, the rush toward a green economy, and the rise of private capital. As client demands evolve, they should also bolster customer experience by enabling front-to-back modernization. Accelerating digitization will remain key to unlocking future sources of value. Banks should also be agile and decisive in responding to the new talent dynamics and rising cost pressures. These challenges will likely test most investment banks’ patience and ingenuity.

Market infrastructure: Carving a new identity by creating differentiated sources of value

Market infrastructure providers are increasingly being asked to provide more than the best execution, low latency, and competitive costs. Buy-side and sell-side customers now demand a bundle of services across the trading life cycle to simplify their workflows and give them a competitive edge.

The most urgent priorities for large exchanges include bringing new technologies to scale, such as cloud-enabled microservices, market data tools and analytics, and digitized trading processes. In the near term, they should work to differentiate their offerings from specialist providers through mergers and acquisitions or by developing new capabilities internally. They also need to address heightened calls for fee transparency from global regulators and prepare for the transition to a faster securities settlement cycle.

Exchanges should also seize medium- to long-term opportunities in carbon trading, crypto markets, and the mass tokenization of financial assets.

Download the 2023 banking and capital markets outlook to learn more.

Then the newest one I received is from IBM’s Institute of Business Value (IBV), and my colleague Paolo Sironi who is heavily involved.

The report is titled: 2023 Global Outlook for Banking and Financial Markets and has three key themes:

An uncertain world demands financial services institutions that can flex as needed.

Digital business models and architectures enable this flex on hybrid cloud. Traditional business models and monolithic legacy architectures constrain the use of data and AI.

Healthier financial performance depends, in part, on business and technology leaders who function as coequals.

When business strategy is set, technology leaders need to be active participants in the process. Profitability faltered industry-wide in the last decade. Shifting ways of working can help.

The next systemic crisis could be an operational one.

As organizations become more digitally interconnected with each other and their customers, a secure digital foundation is more essential than ever

For banks, Accenture predict a challenging year with the metaverse and sustainability being high on the agenda:

And there is also Price Waterhouse Coopers (PwC), who dropped an intriguing discussion around banks and FinTech with major themes:

Fintechs are down, but they’re not necessarily out. The disruptors are reducing cash burn rates as capital raising is challenging for business models that often rely on low-cost debt. But as macro conditions improve, capital raising may be concentrated on the strongest fintechs which have a better chance of disintermediating banks.

Established technology and retail brands, hoping to capture more client time and money, are pushing financial services toward captive financing and strategic partnerships. With access to millions of customers, they can quickly scale a digital offering, threatening a bank’s market share similar to what we have seen across credit products and payments. In a worst-case scenario, digitally-savvy established brands may become the face of financial services, pushing traditional banks - and possibly some fintechs - into the background.

Still, the most likely near-term competitive threat comes from banks that are more digitally agile, delivering simpler, seamless and individualized experiences across their portfolio of products and services. Superior digital capabilities, especially those that offer advice to help customers navigate a difficult economy, can be a differentiator, inspiring customers to switch banks for a better experience.

Then there are the key FinTech forecasts from 11FS as well as my own.

Welcome to 2023 and happy new year! Thanks for coming back and it is truly appreciated. As usual, we start the year with a range of predictions. We’ll talk through those this week, from what will happen to banking, fintech and cryptocurrencies. On first day however, let’s take a look at the general global and economic trends.

What’s in store for banking in 2023?

Having covered the general economic outlook, let’s take a specific view of the banking sector. Not FinTech. Banking. According to Bloomberg, there will be six key trends emerging in the banking space: Big Banks Will Be Fine: big banks are well-positioned to weather what is expected to be a turbulent year. While capital levels are…

FinTech trends for 2023: separating the wheat from the chaff

I see a lot of people talking about 2023 as the year we see the FinTech markets separate the wheat from the chaff. No wonder when you look at the stats that show it’s the end of the boom party. As reported by Hugh Son at CNBC: Many fintech companies — particularly those dealing directly…

Tech and Cybersec in 2023: a world that is virtually different

Technology markets in 2022 were decimated. Tesla share price collapsed. Netflix stock has dropped more than 50% in the last year. Facebook is in freefall. Even TikTok might be in trouble. Oh, and cryptocurrencies lost 50%-80% in value. Will 2023 be better? I believe it will be and, continuing this week’s mop-up of the main…

Crypto 2023: Stronger (what doesn’t kill you)

After 2022’s bloodbath of the crypto world where so many firms were lost – FTX, Celsius, Terra, Three Arrows Capital, Voyager and Vauld to name just a few – this year will be sorting out the mess. Regulations will come to the crypto markets as will consolidation and organisation. It’s interesting that Coin Market Cap…

Then Ernst & Young (EY) sent me a nice report about regs in finance. The key themes of their report are:

- Complexity is increasing for financial services firms worldwide. Evolving regulations, in response to those challenges, present a further complicating factor.

- By anticipating regulatory changes, firms can unlock new areas of growth and reinforce competitive advantages.

- Leaders need to understand the regulatory landscape and potential changes in the near- to medium-term, to recognize the implications for their businesses.

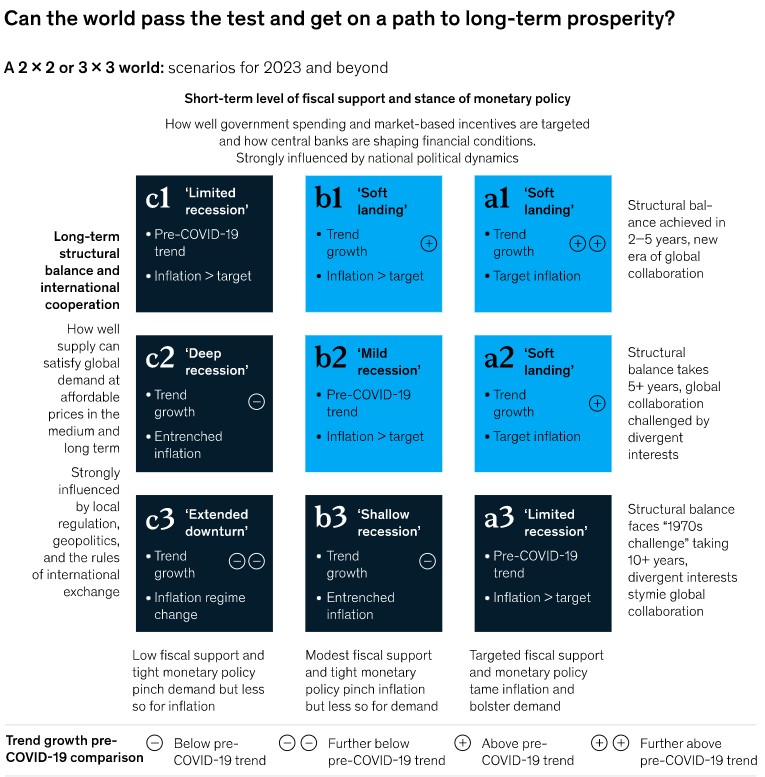

Finally, I got a report from McKinsey looking at different scenarios for financial services in 2023, and they concluded that:

Many business leaders see 2023 as a continuation of the most challenging environment management teams have ever faced—and for good reason. The scenarios we have shared can help give you the insight into the range of operating environments you could face, the opportunities and risks of the commitments you make, and where you need the discipline and strength to accelerate execution and build resilience. They can help you set your top priorities and prosper in a 3 × 3 world where uncertainties are multiplied.

Fairy snuff (Ed: did you not mean fair enough?).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...