The fintech bloodbath continues as three really interesting articles came across my desk last week (we discussed them on Fintech Uncut in case you missed it).

The first, from Reuters, talked about the valuation of Stripe, my favourite FinTech. Why are they my favourite? Because they expanded massively from a new entrant in 2011 to a multinational unicorn in just a few years based upon seven-lines of code. The code is an API (Application Program Interface or easier to think of as plug-and-play software) and it was picked up rapidly by many.

About 60% of tech startups that went public in 2021, such as food delivery firm DoorDash, used the company’s services and, as a result, processed payments worth about $640 billion in 2021, up 60% from the year before.

The last time I looked, the company was worth $95 billion …

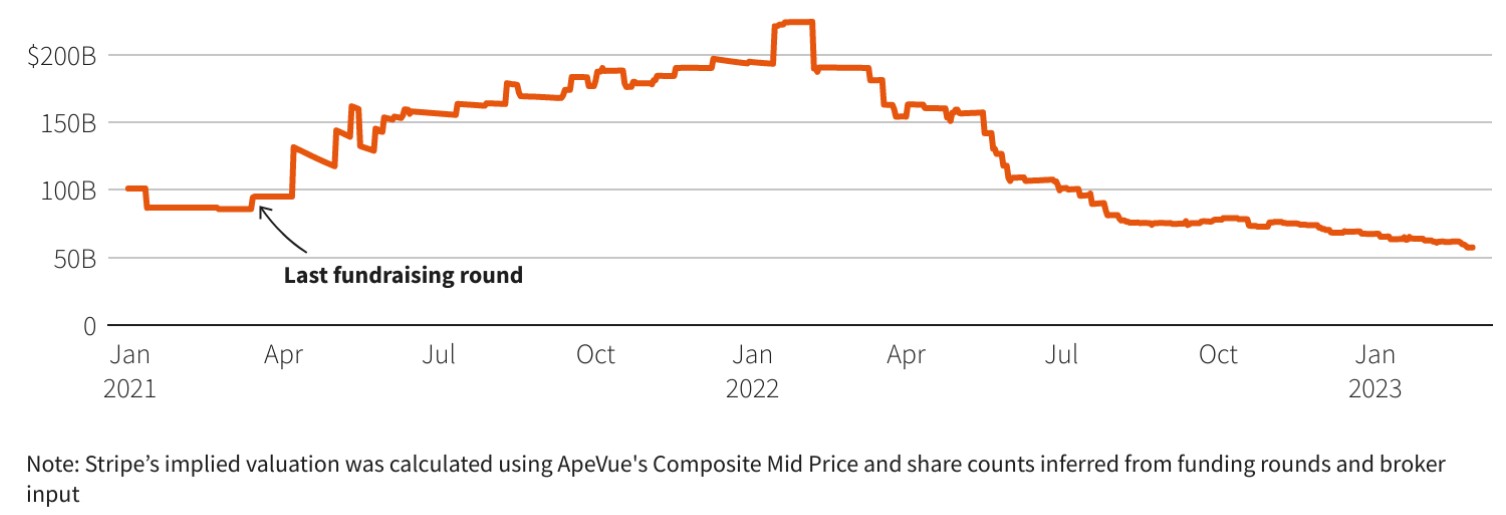

In March 2021 a funding round led by Fidelity and Sequoia valued Stripe at $95 billion, nearly three times the $35 billion price tag it set less than three months earlier. In February the following year investors bought shares in secondary private markets at a valuation equivalent to $220 billion, according to data from ApeVue.

But now it’s talking about a valuation of just $50 billion, 75% down on that peak high a year ago.

The company is aiming for a valuation of $50 billion, according to The Information, slightly below the current price for its stock in secondary markets. That’s equivalent to 3.5 times last year’s gross revenue. By contrast the $44 billion Adyen, which is solidly profitable and is forecast to grow by 30% this year and next, trades on a multiple of 4.6 times.

Sign of the times?

I would add my other favourite FinTech Klarna to the mix (see my interview with Niklas Adalberth, Co-Founder of Klarna, from 2015).

I use both Stripe and Klarna as examples of excellence regulatory in my talks and presentations, but Klarna has also stumbled this year, making $1 billion losses. But then, when you lift the hood, those losses make sense as they are massively expanding in America.

Klarna announced a 71% year-over-year increase in gross merchandise value (GMV) in the US in 2022, making the US Klarna’s biggest market by revenue. The company now has more than 8 million monthly active app users in the US, a 33% jump from its February 2022 total. But, as Finextra pointed out:

“Klarna last made a full year profit in 2018. Since then, a costly expansionist growth policy has led to spiralling losses in the face of macro-economic headwinds. The company has been forced to undergo a year of painful restructuring which has seen its valuation slashed and the sacking of 10% of staff.”

Interestingly good friend Ron Shevlin of Cornerstone Advisors says: don’t call Klarna a buy now, pay later company.

I thought Klarna invented buy now, pay later (BNPL) but, as Ron rightly points out, it is far more than that. It offers shopping, cards, intelligence and commerce enablement:

Why will Klarna be able to succeed against the likes of Capital One and American Express? Because it is:

- capturing consumers’ shopping activity and preferences;

- identifying consumers’ loan repayment history;

- creating consumer payment relationships that avoid revolving debt, high interest rates, and punitive fees; and

- developing symbiotic merchant relationships.

Sounds a little like Amazon, no?

Interestingly for me is that Klarna is partnering with payment services like Western Union to offer BNPL, but Western Union have taken it one step further where you can Send Now and Pay Later (SNPL). Partnering with BeforePay, users can send a remittance and pay later with Western Union:

Western Union and Beforepay today announced a first-of-its-kind collaboration, allowing consumers to boost their cross-border money transfers by accessing reliable, ethical and affordable short-term lending. Consumers can ‘Send Now, Pay Later’ by borrowing up to AUD 2000 through Beforepay’s wage-advance product on Western Union’s digital channels.

The world moves on …

Postnote:

We discussed these stories and more on FinTech Uncut! in case you missed it ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...