I was quietly annoyed by one of the headlines I saw the other day: Using crypto for crime is not a bug — it’s an industry feature

It’s an attack on the whole idea of cryptocurrencies in an opinion piece by Financial Times columnist Jemima Kelly. She talks about being heckled for saying that crypto is all about crime:

Crypto enthusiasts argue that it’s wrong to claim that it enables crime because the technology itself is “neutral” so cannot be blamed for any illicit activity. But this simply isn’t true: crypto was designed as a censorship-resistant payment mechanism that operates outside the traditional financial system and beyond the remit of regulators.

She quotes Binance’s Chief Compliance Officer stating: “We see the bad, but we close 2 eyes.”

She quotes Stephen Diehl, co-author of Popping the Crypto Bubble, saying: “These exchanges know exactly what they’re doing. They’re basically creating a dark transnational payment network and, not surprisingly, that will be used by criminals. They’re purpose-built for that.”

The article goes on to cite various figures and accusations that may be right or wrong. So, why was I quietly annoyed?

Two reasons.

First, Jemima quotes Chainalysis’s annual report on cryptocrime, and missed a key line in the report:

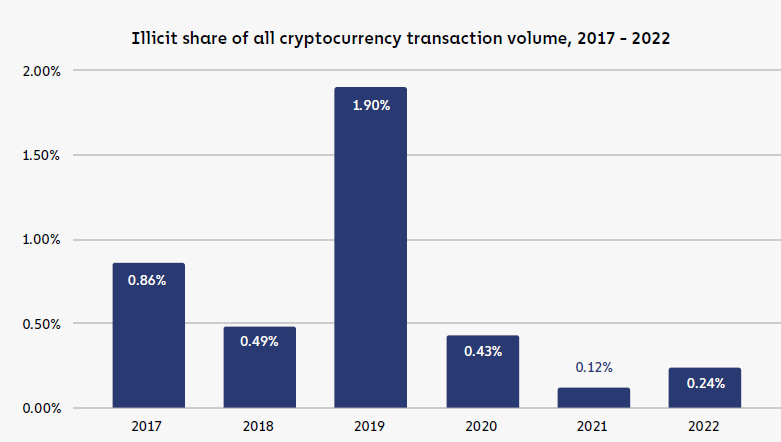

The share of all cryptocurrency activity associated with illicit activity has risen for the first time since 2019, from 0.12% in 2021 to 0.24% in 2022.

0.24% of all cryptocurrency is for criminal activities. The banking system launders trillions of dollars a year, estimated to be over one percent of all banking activity. Which is more efficient?

Second, although Jemima quotes the Chainalysis report, she fails to mention their opening sentence:

Every year, we publish our estimates of illicit cryptocurrency activity to demonstrate the power of blockchains’ transparency – these kinds of estimates aren’t possible in traditional finance – and to teach investigators and compliance professionals about the latest trends in cryptocurrency-related crime that they need to know about.

In other words, criminal activity is far easier to track and trace digitally than through the banking system, where physical documents are used to open accounts and allow nested companies to hide their connections.

That’s what really annoyed me.

But then there are many other similar headlines that annoy me, in this context. For example:

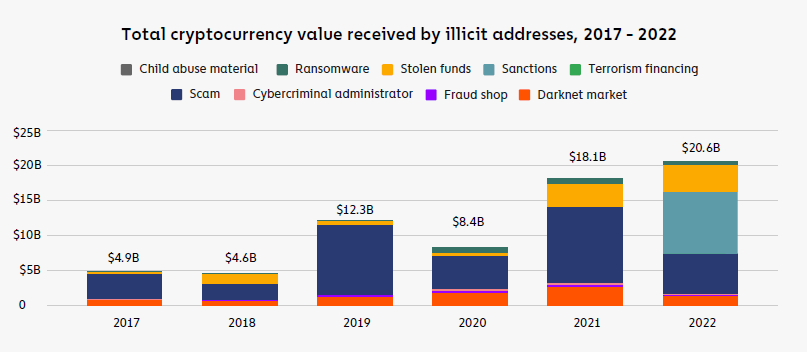

Crypto crime hits record $20 bln in 2022, report says, Reuters, January 2023

Cryptocurrency money laundering on DeFi skyrockets, Pinsent Masons, February 2022

There are many more, all of them painting a picture of everything to do with crypto being bad because banks are good. It’s all claptrap. The fact is that most digital currencies can trace crime far more easily than most banks.

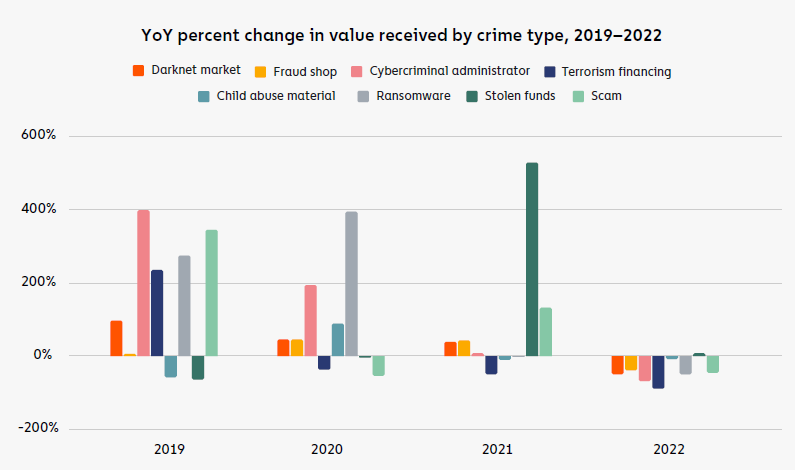

For example, how can the Chainalysis report produce these charts:

… if there was no way to track and trace what was happening?

In general, it just appears to me to be a media collusion with government and finance to say crypto bad, blockchain good. Have I heard that before?

Repeat after me: Bitcoin Bad, Blockchain Good, The Finanser, May 2015

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...