I find it weird as my news waves have recently been drowning in pay-by-bank PR and marketing. Finally, I decided to see what this pay-by-bank news was all about and it turns out that it’s the USA finally allowing A2A payments. Wow, big news … not.

The thing about the USA is that their payments system trails the rest of the world by about a decade – just look at faster payments and FedNow. I’m not having a dig at America, but after Europe adopted Chip & PIN and faster payments twenty years ago, it just surprised me how long it took the USA to do the same. So, let’s move on to pay-by-bank.

It’s a simple idea: I’ll pay directly from my account, rather than using a debit or credit card.

Why is it radical or new? Stripe claims it is a much better way to pay due to lower transaction costs, faster transactions, increased customer control and lower rates of chargebacks. Adyen claims that the most popular use cases for pay-by-bank are recurring payments, such as utility bill payments and subscriptions. JPMorgan announced their deal to do pay-by-bank solution with MasterCard last year. The idea is that it provides billers with the ability to allow their customers to pay bills directly from their bank account ... sounds like direct debits and standing orders to me but then Sehrish Alikhan, a reporter with Finextra, makes it clearer:

“Pay-by-bank may be on track to replace card payments, as it is an alternate payment method that requires no log-in or authentication factors for the user. The pay-by-bank payment method is not be confused with account-to-account payments apps such as Venmo and PayPal, which offer peer-to-peer payments. Pay-by-bank is often used for bills, subscriptions, and loan repayments.”

I guess this really sets the US in context, in that they are finally catching up with the rest of the world’s payments structures but are still way behind. I blogged the other day about P2P vs A2A, and to find pay-by-bank is delivering a service Europeans have been using for decades seems shocking. But then you have to remember that America is a check-based economy.

Why do Americans rely on checks instead of bank transfers?

That’s a very good question … and here is the answer.

“Many businesses continue to use checks due to their established accounting practices. Checks provide a paper trail that can be easily audited, which is essential for many businesses. Additionally, small businesses, which form a substantial part of the American economy, often prefer checks due to their ease of use and the lack of transaction fees associated with many digital payment methods.”

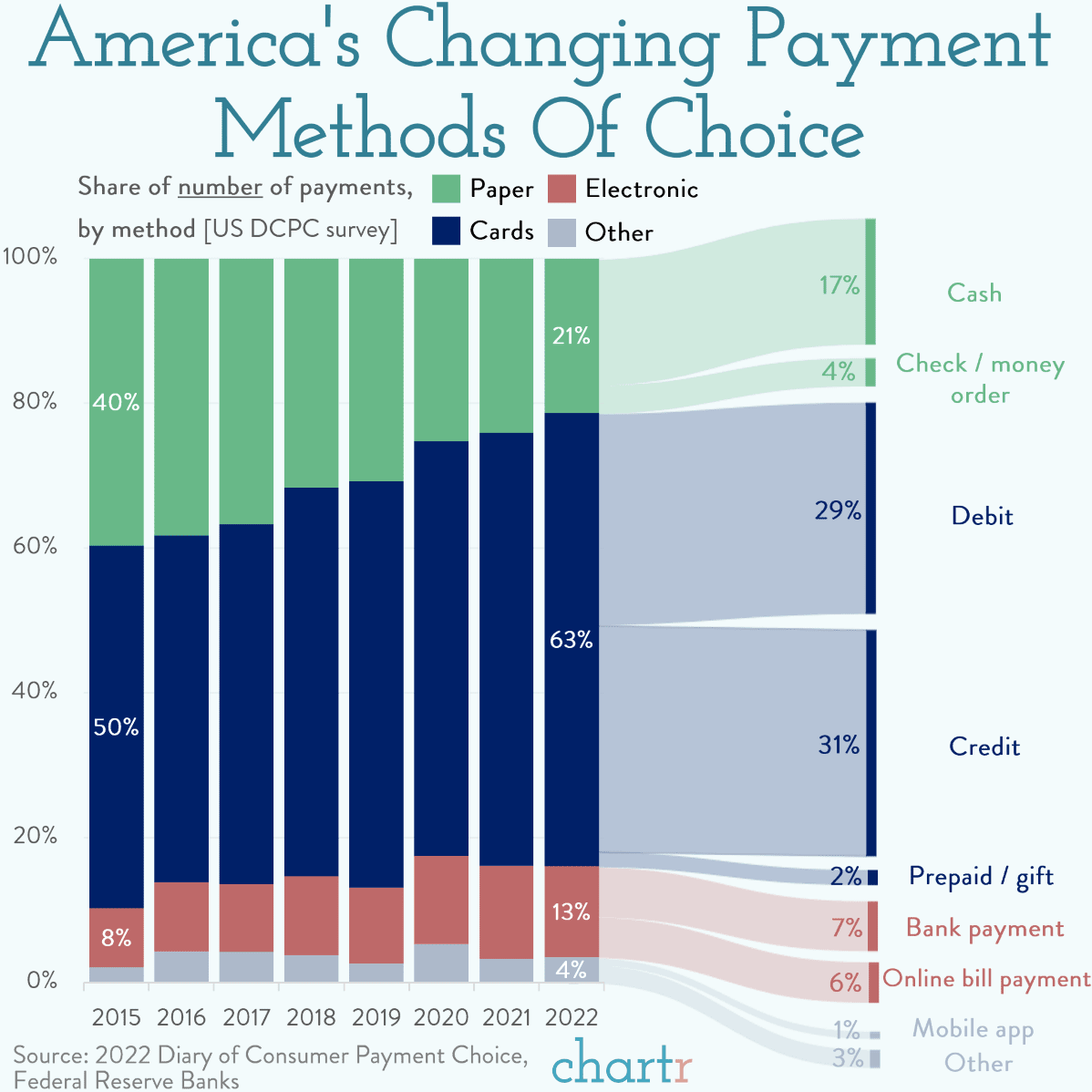

Meantime, just to be realistic, most payment in America are made by debit or credit card.

The use of check/cheque payments is decreasing, but card payments are most popular today and the mix of digital wallets and pay-by-bank is changing the game. This means that the digitalisation of America is happening fast now, after years of languishing behind the rest of the world.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...