There’s nothing more annoying than when you get that note saying that you have just been charged $149 to renew your annual subscription to Youreanidiot.com. I subscribe to lots of different things and often forget that I subscribed. Then you suddenly find that $100s are leaving your account each year on things you no longer use and didn’t know you had. It’s really bad.

Mind you, it’s not like it’s an unknown problem. There are lots of start-ups and companies like Atomic Financial, Chargebee, Minna Technologies, Rocket Money, Scribepay, Spendesk, Subaio and more focused upon solving it. Visa and Mastercard are also on the case, both announcing solutions this year.

Visa announced Subscription Manager in April:

Visa Brings Convenience and Control to Booming Subscription Economy (yahoo.com)

“Managing subscriptions can often feel like a maze, with consumers sometimes feeling trapped in a cycle of confusing charges,” Visa Global Head of Issuing Solutions Kathleen Pierce-Gilmore said. “Our goal is to make this process simpler and ensure cardholders know exactly where their money is going, and when.”

Hot on the heels of Mastercard’s announcement of Smart Subscriptions in March:

Mastercard simplifies subscription management with Smart Subscriptions | Mastercard Newsroom

According to a Mastercard survey, 73% of consumers indicated they’d be interested in a tool that would help them identify, track, cancel, or renew subscriptions, and 60% of consumers trust their bank with such a tool. Smart Subscriptions connects multiple accounts into one central hub using Mastercard’s open banking technology, provided by its U.S. open banking arm Finicity.

With the subscription economy already worth $650 billion and forecast to grow to $1.5 trillion by 2025, it is no wonder that so many firms are trying to simplify the process. Talking with ITN Navpreet Singh Randhawa – Chief Financial and Commercial Officer with Minna Technologies – says that: “nobody likes things to be confusing so, what we’re doing is [saying], ‘forget everything, just work through your banking app. Most of your spend is there, all your money is there, so manage it from there’. Pay for things you need; for as long as you need it, and when you don’t, just get out of it. When you do again, just get on with it.”

After surveying over 2,000 consumers, Navpreet found that one in two consumers will actually switch banking application if their bank did not provide subscription management. Except I’m not sure I believe that. People will say it, but will they actually do it?

Most folks are lazy and if $6.99 a month is taken here and there, and they don’t notice, would they really switch to another bank? I reckon most of them go my bad, cancel and move on.

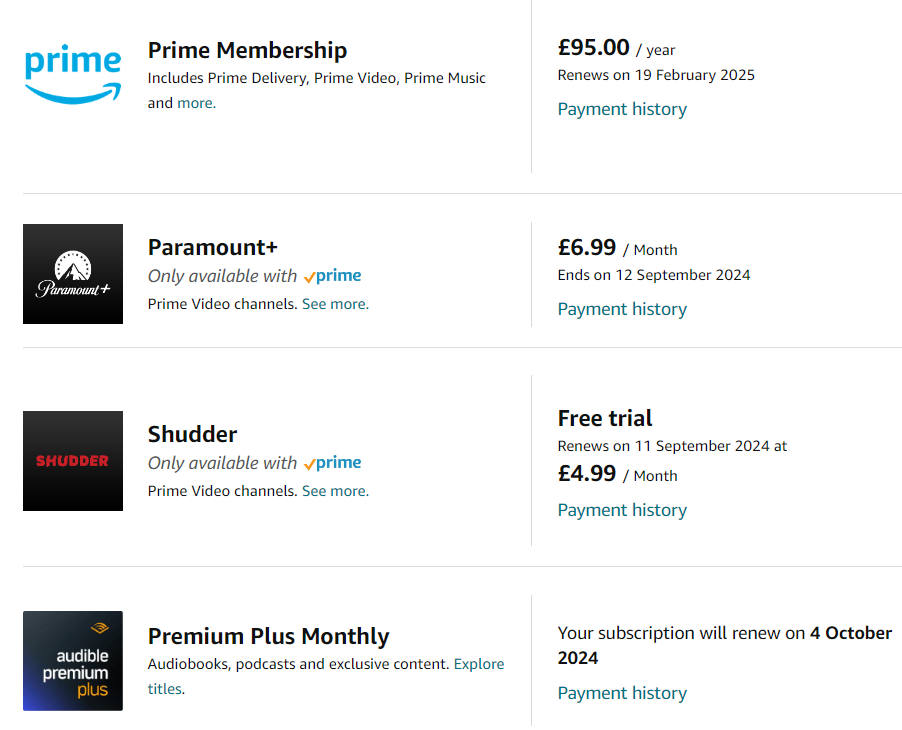

By way of example, I just discovered that I’ve been paying £6.99 a month for Paramount+ on Amazon Prime and didn’t even know. Reason: I watched the new series of Frasier there last year, and haven’t watched a single thing since.

It’s easy money for businesses to lock consumers into auto-renew. Banks and payment providers need to not only make that process simple, but to clearly alert consumers when there is something about to auto-renew, warn them a few days before and give them a clear opt-out button to cancel such renewals. That should be regulated, not something offered by providers who do not even communicate that these options are available effectively.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...