Back in 2012 I argued that there would soon be mobile wallet wars. In 2014, I speculated that there would be mobile wallet wars but that it was early days. In 2020, I still noted that mobile wallets were pretty awful. Today, it is clear that the mobile wallet is the core of the customer relationship and competitive landscape for payments and more.

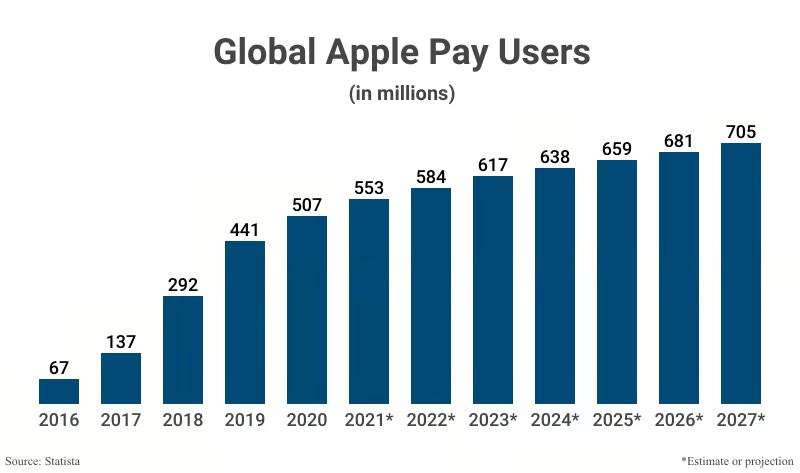

Interestingly, in this long debate, Apple was derided and denounced when it first launched a mobile wallet – Apple Pay – but, today, leads the pack. According to Capital One Apple Pay is one of the most popular digital wallets in the world:

- An estimated 640 million people worldwide are Apple Pay users in 2024.

- Trends indicate that over 700 million people will use Apple Pay by 2027.

- If trends continue, over 25% of consumers will use Apple Pay by 2030.

- Apple Pay consumers live in 84 countries worldwide.

- Apple Pay processed a global total of $6 trillion in payments in 2022 and produced a revenue of $1.9 billion.

In the USA, the numbers are huge:

- Apple Pay is the #1 most popular digital wallet with a 92% market share.

- 48.7% of Americans owned iPhones in 2022.

- An estimated 60.2 million Apple Pay users in the United States used their wallet in 2024

- Projections indicate that over 75 million American consumers will use Apple Pay by 2030.

- 7.8% of Americans with access to Apple Pay use it for eligible in-store purchases.

- As of 2023, Apple Pay processed 14.2% of all online consumer payments and 3.5% of all in-store purchases.

- Consumers use Apple Pay in 56% of in-store mobile wallet transactions, up 16.6% over the previous year.

- Over 90% of U.S. retailers accept Apple Pay.

- During Black Friday / Cyber Monday 2022, 12.7% of both online and in-store shoppers paid with Apple Pay, up from 7.8% and 8.1% (respectively) the previous year.

Oh, and in case you’re wondering, most Apple Pay users are Millennials. 4% of consumers born between 1981 and 1996 (Millennials) use Apple Pay and, of those in that age range, 51.1% of Millennials use Apple Pay weekly. Compare that with GenZ (consumers born between 1997 and 2012), only 2.5% use Apple Pay but, of those that do, 73.1% use it at least once per week.

A big kicker for Apple Pay was the pandemic, as consumers moved from cash to cards to wallets. The contactless wallet is the mainstream way to pay today.

You can find more stats over here but, as I predicted a decade ago, the winner of the wallet owns the customer relationship, so guess who that is today?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...