Building on my blog the other day about BLIK (the Polish digital wallet), I just got two really insightful pieces of analysis on European payments – talking of a payments vision – from PWC in a report on Europe’s open banking vision and Jeremy Light, a good friend formerly of Accenture, on EU wallets.

Here’s the low-down.

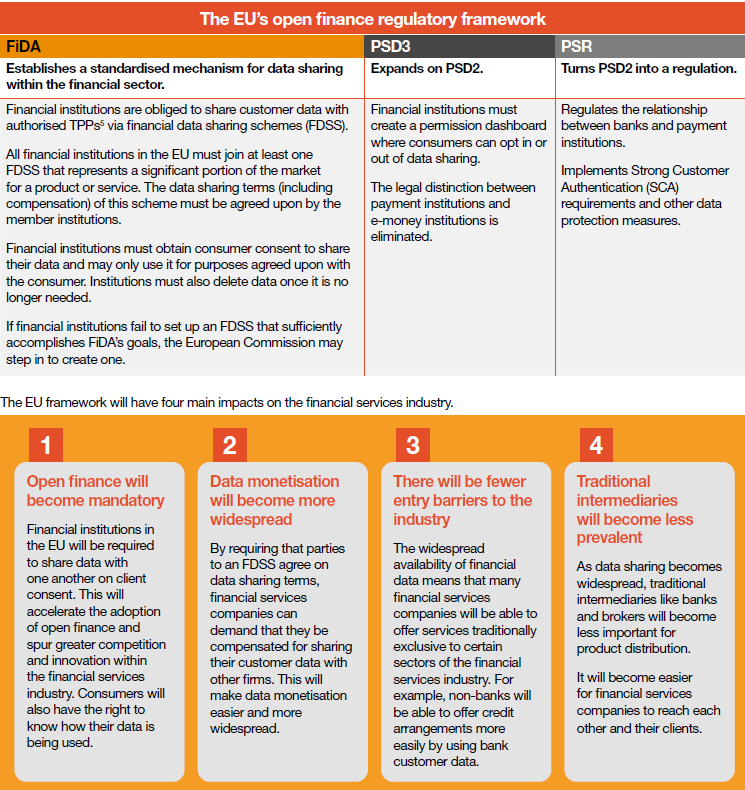

PWC look at the European regulatory developments and specifically FiDA, PSD3 and PSR.

FiDA is the Financial Data Access regulation. Specifically, it is the revised Directive (EU) 2015/233 on payment services in the internal market that paved the way to open, data-driven finance. FiDA expands the type of data eligible for sharing beyond mere payment account data to more information about accounts and access.

PSD3, the third Payment Services Directive, is in draft with the final text looking like it should be finalised in early 2025 for implementation in late 2026. The new rules will improve consumer protection and competition in electronic payments, and will empower consumers to share their data in a secure way so that they can get a wider range of better and cheaper financial products and services.

PSR is a Payment Services Regulation (PSR) that aims to improve customer rights, protect against fraud, and harmonise financial services across the EU. It is part of a wider regulation package along with the third Payment Services Directive (PSD3). The PSR is expected to be voted on by the EU Parliament in 2024 and, when approved, will be enforced across all 27 countries that form the region.

As well as the PWC report, you can find out more on these things here.

According to PWC, these EU regulatory initiatives will require many institutions to adopt open finance sooner than they might have otherwise. For this reason, regulation remains the key driving force of open finance in the EU, rather than market forces.

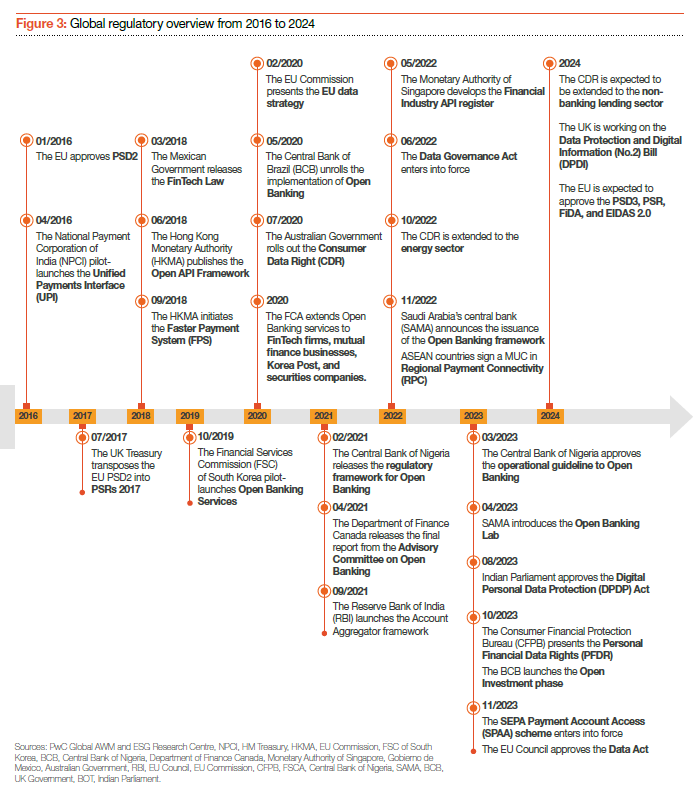

It was particularly interesting to look at a few charts in the report, and I liked this one on how global regulation in the payments sphere has developed over the past decade.

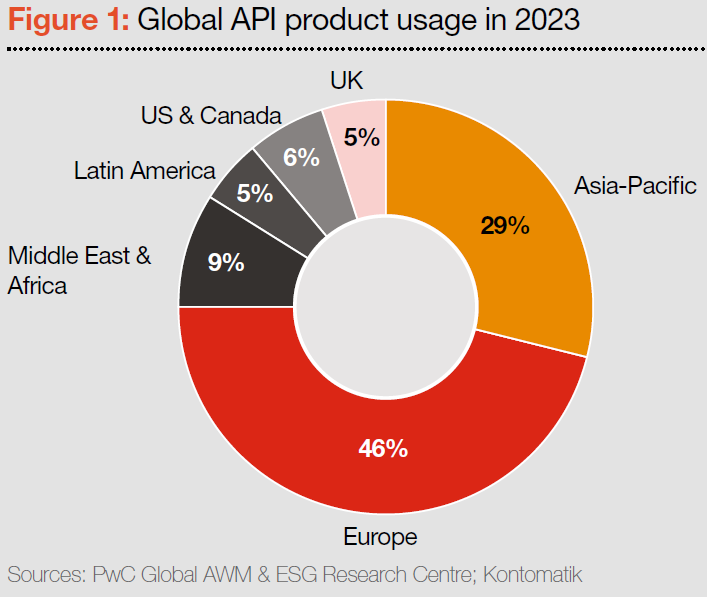

And also liked this one on API usage.

The report notes that API calls – the way systems communicate securely in real-time – are growing at a rate of 54.4% through 2027, mainly in Europe, rising from 102 billion API calls in 2023 to 580 billion in 2027. All driven through open finance and open data connectivity. That’s significant*.

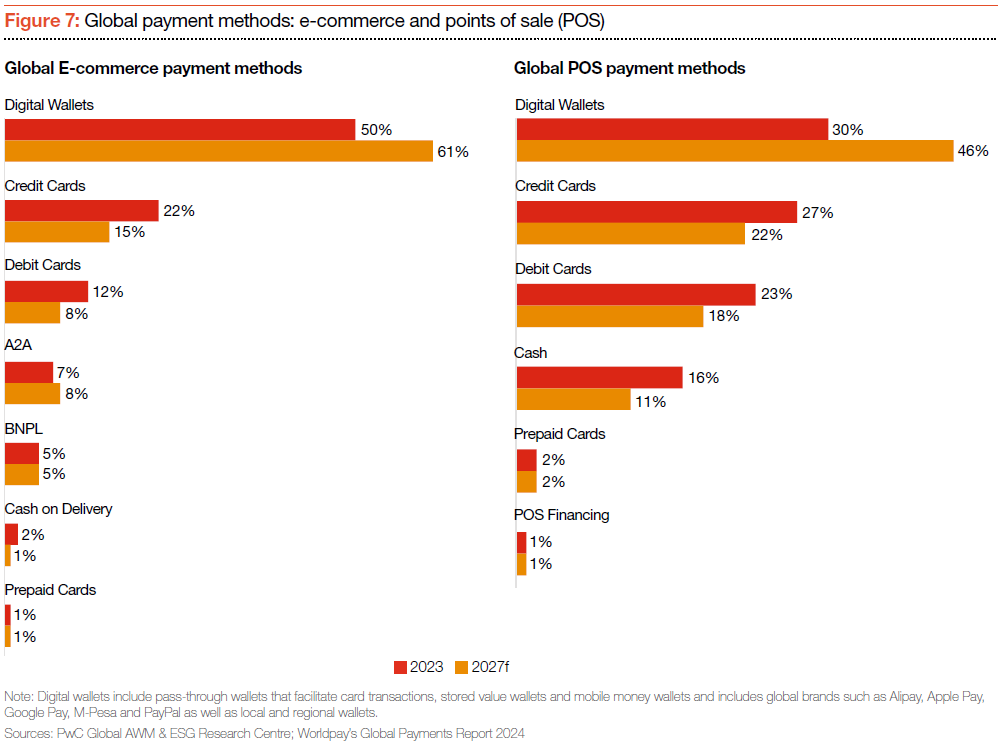

Then there’s a chart that shows the forecast that 2 out of 3 of us will be using digital wallets by 2027.

Which neatly brings me around to Jeremy’s analysis https://jeremylight.substack.com/p/we-need-a-wero

Using a nice play on a musical song, Jeremy says that We need a Wero. What’s a Wero? A Wero is the combination of We and the Euro to create a pan-European wallet, the dream of the EPI, the European Payments Initiative which, like SEPA, is not a mandate but an industry-driven consortia (think EBA).

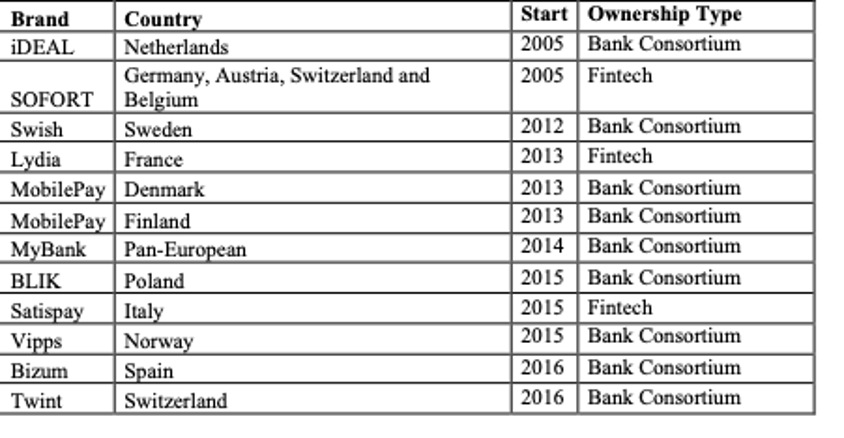

Thing is that there are already many wallets out there.

Jeremy neatly notes that there are many European countries with wallets, but few that are interoperable. I made this point to my Nordic friends a few years ago, when thinking that Chinese tourists can travel thousands of miles to Europe and use the same wallet everywhere and yet if Danes and Swedes go from Copenhagen to Malmo they cannot. That’s changed, but we now have a lot of wallets that are national and not European, whcihh is why EPI is trying to create the Wero wallet and, as Jeremy notes:

“It is evident that while these brands are successful, outside of cards there is no harmonisation of digital payments initiation and acceptance across Europe, which must be a concern for the European Commission.”

Interestingly, when EPI began, the aim was to create a European card scheme to discplace Visa and Mastercard, or that was my impression. Now, it’s to create a pan-European wallet which is probably based on Visa and Mastercard and, maybe tomorrow, it will be to have an EU-mandated Wero that replaces Visa and Mastercard through wallet domination.

Watch that space.

* The Open API area is questionable. For example, BLIK, Swish, Vipps, Mobile Pay, Bizum, iDEAL etc, enable A2A payments without using open banking APIs. They were developed before PSD2 came into effect.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...