A final wrap-up of the big trends of 2025 is obvs to talk about fintech.

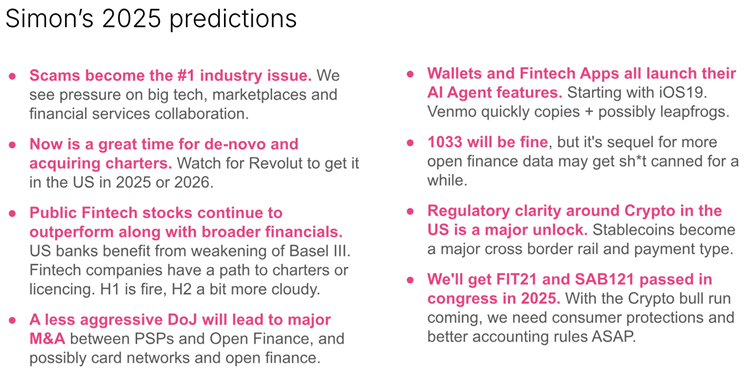

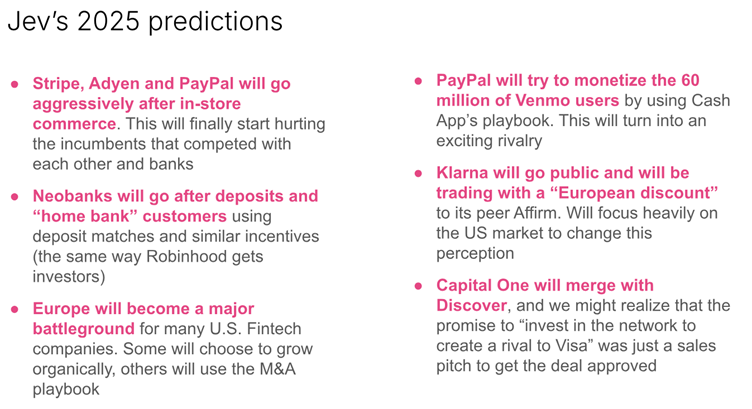

Looking at the big fintech trends, probably the best place to start is with Simon Taylor’s 111 page report (ONE HUNDRED AND ELEVEN PAGES!!!). Simon and his BFF Jev at Sardine note a number of developments, such as the fintech hyperscaler. What’s that? Oh, it’s where fintech challengers and providers become huge platforms like Nubank with over 100 million customers, Klarna achieving 85 million and Revolut 50 million. They also talk about AI being everywhere (but you have to ask: AI for what?). Anyways, here are their big predictions for 2025:

The themes seem to be that there’s an agentic AI fintech for everything; BaaS is going through a difficult phase due to the collapse of Synapse and massively increased regulatory scrutiny over BaaS operators; payments are an all-out fight for market share with the core focal point being your digital wallet (the wallet wars have started); the list goes on. Well worth a download if you have the time.

Similarly, Finovate’s Julie Muhn (@julieschicktanz) cites the big ticket items as crypto, stablecoins and open banking. The last one being the result of Section 1033 which implements open banking in America. There are also honourable mentions to Agentic AI, BNPL, Regtech, Real-time payments and Pay-by-bank.

Mambu’s annual partners predictions report is in synch with Finovate’s, although their top three are AI, embedded finance and open banking.

Silicon Valley Bank (SVB) has a slightly different view. They released their future of fintech report in October, and focused on other areas like KYC, AML, CAC (Customer Acquisition Cost) and more acronyms. The thing that stood out for me in their report however is 2025 being the era of dead fintech unicorns. I noted that fintech unicorns grew from 36 in 2017 to 363 in 2024 … but SVB forecast that many will fall and stumble in 2025. This is due to massive over valuations in 2021 and, as many hunt for reinvestments, they will find it tough.

By way of example, there are 114 US fintech unicorns but more than 76% were last valued over two years ago, when investors were hungry for deals. Now, investors have lost their appetite, exit options are limited and many of these firms will find life difficult.

This was reinforced by a couple of reports this week that show that the UK is still leading the fintech markets for investments and innovation but, even here, we are seeing the market still down.

Global fintech investment fell 20 per cent globally to $43.5bn (£35.2bn) in 2024. The UK attracted $3.6bn (£2.9bn) of total funding, more than the next five European countries combined, according to data from Innovate Finance. That may sound great, but funding fell faster in UK fintech than the global average. Times are still hard.

Finally, Bob’s Guide has a summary of 2025 developments, although some of the content is a wee bit out of date (citing a 2017 article on AI with JPMorgan for example), but the headlines are pretty accurate:

- Generative AI becomes a core financial tool

- Real-time cross-border payments take centre stage

- Embedded finance expands beyond banking

- ESG fintech solutions gain momentum

- DeFi edges towards mainstream

- Quantum computing reshapes financial security

- Seamless digital identity verification

- Automation in treasury management becomes the norm

- Metaverse Finds Its Place in Financial Services

- Interoperability defines the future of fintech ecosystems

You can read their views in two parts over on their website (Part One and Part Two), although my view is that their trends are a little bit out-of-date, e.g. I’ve been talking ESG, DeFI, AI and stuff for years … or is it just that I’m too far ahead? Meantime, there are many others making forecasts out there, and the themes all seem to boil down to three core messages: 2025 is going to be the year when AI, embedded, open finance becomes mainstream.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...