Everything I read talks about simplified customer experience in payments and yet, when I look at it, the process of payments is becoming far more complicated. You made a payment in the old world with a bank note or cheque, and it was a simple transaction over the counter. Cash involved two parties: the customer and the merchant; a cheque involved three parties: the customer, merchant and the bank.

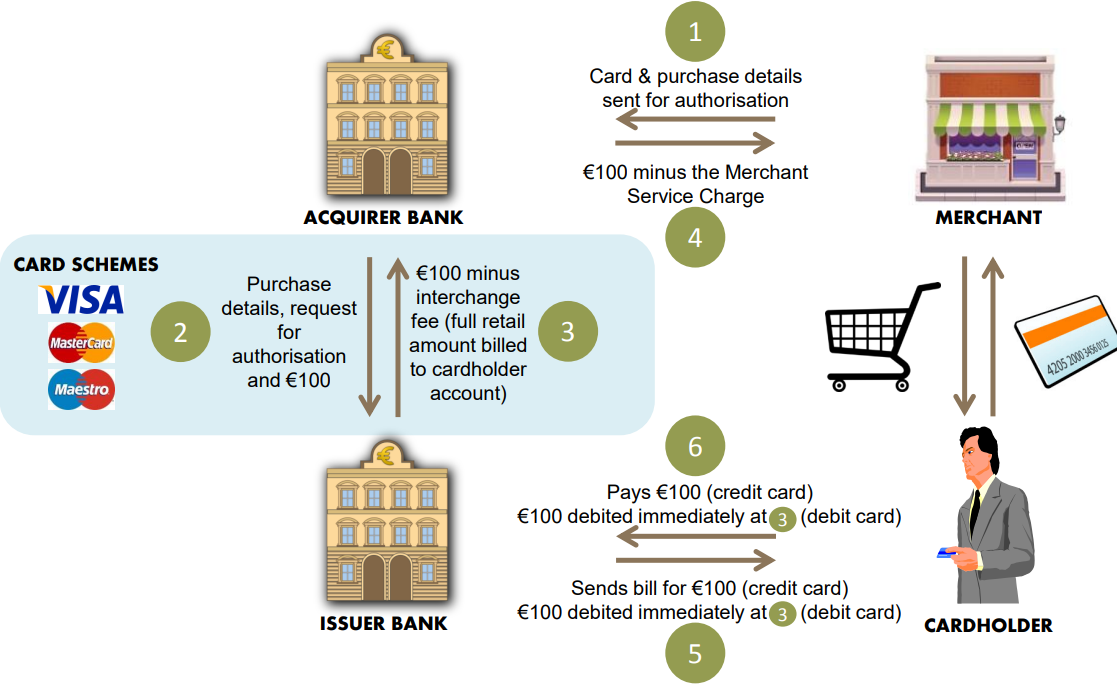

Then we moved to the four-pillar model when credit and debit cards entered the payments system. The four pillar model being the institution that acquired the merchant and the institution that dealt the customer. This led to the rise of the card systems of Visa, MasterCard and more, and it worked.

And now we have fintech that is meant to be simplifying payments and yet, from a customer view, is making it a lot worse. The reason I say this is because transactions are being reported as Stripe, Adyen, Braintree, PayPal and such like, and the customer has no idea who they paid for what.

An example this week is that I booked a hotel room via hotels.com. The next day, I get an alert stating that a direct debit payment had been taken from my bank account to PayPal. I do not have any direct debits to PayPal and am confused. Just as I start reporting fraud to the bank, I think: check who PayPal paid and yes, PayPal had paid out to hotels.com, but none of it made sense as my preferred payment method with PayPal is my charge card. That is a simple example of the confusion today's payment processes make for the customer experience. I have far worse ones.

More than this, it raises concerns around how many parties are involved in the process of a payment. Or is that pillars? It used to be just me and you; then it was me, you and the bank; then it was me, you, the issuer and acquiring bank; and now it is me, you, the issuing and acquiring bank, the payment processor, the third party support system of the payment processors, the network itself and more.

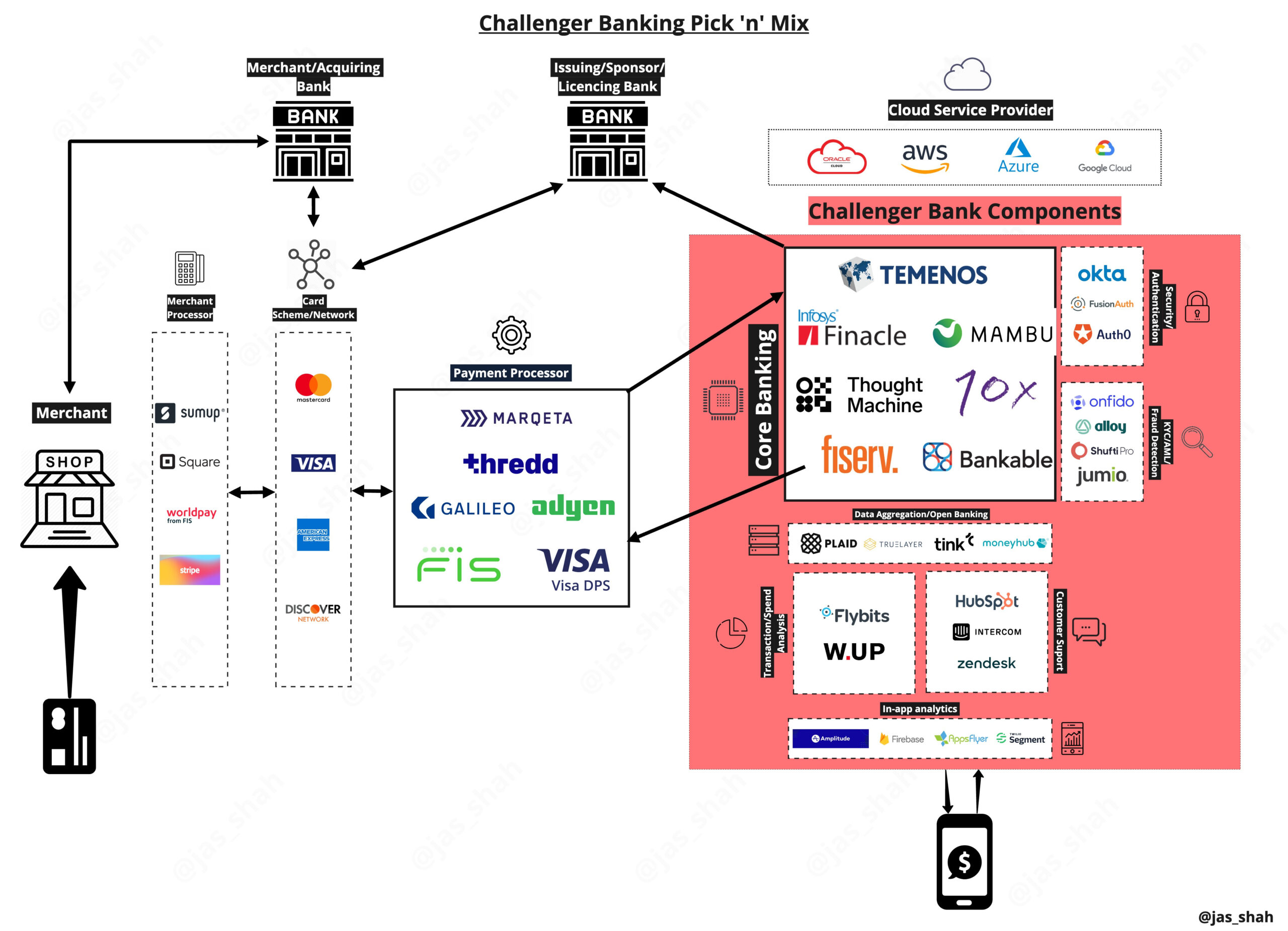

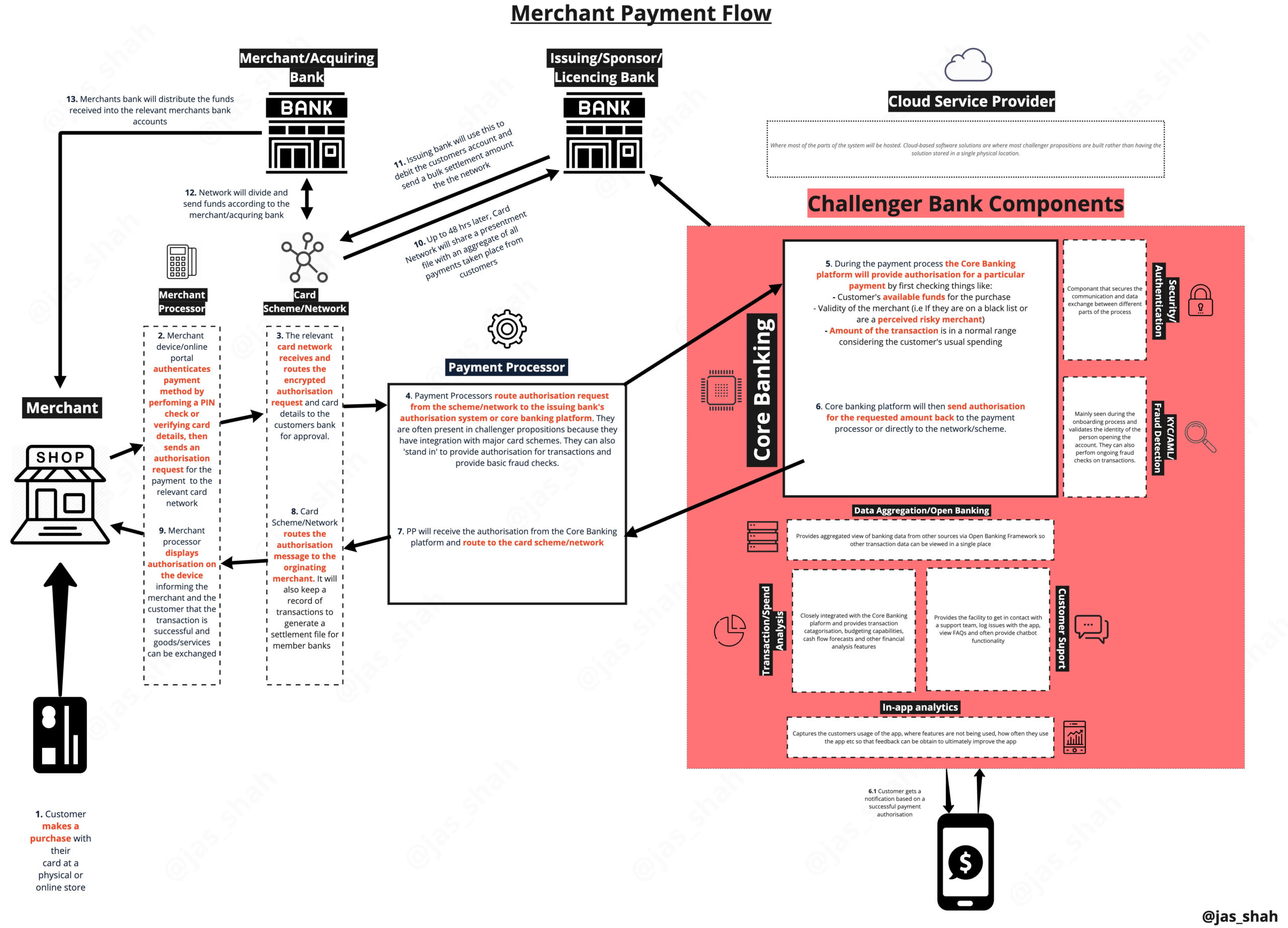

This chart from Jas Shah illustrates this point well:

Source: @Jas_Shah

The chart shows the simplification of payments processing and yet, for me, it shows the complication of payments processing. Sure, we are adding easier and easier ways to pay using cloud, apps and APIs, but we are also adding more fail points to the process. This means that if one point fails, the whole process fails.

The thing is that when that happens, who is at fault?

I remember when Visa went down in Europe a few years ago. It was one afternoon at the end of the week and turned out to be a hardware fault, but it illustrated the point of a process of finding who and where does the fault lie.

More recently, there have been many IT outages with banks – which I call the bank systems Jenga– and the challenge we all have is identifying where the fault lies in the process.

On the other hand we have concentration risk where the more we centralise structures, the more concern on total failure if one point is compromised. In other words, we have a dilemma of fragmeneted risk, where too many parties are involved, and centralised risk, where too few parties are involved.

What’s the solution?

Well, it’s not a twenty-pillar model and it’s not a one-pillar model. Maybe it’s best to go back to a four-pillar model, and just reduce the fees that are charged for each part of the process … oh, that’s what fintech is trying to achieve. Is it?

Source: @Jas_Shah

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...