A few years ago, a bank CIO said to me that he was not that bothered about blockchain technologies, as these involved many externalities; he was far more interested in AI, as this could make breakthroughs with internalities. In case his words are lost in translation, what he meant is that blockchain would not deliver return on investment (RoI) because of so many external factors involved; but the RoI on AI was under his control and could deliver far sooner.

This is why AI has grown into a massive area of focus over the past few years, as evidenced by NVIDIA. Until recently, I thought NVIDIA was a chip for gaming. Now, I find it’s the technology behind AI and, as some would say, the only game in town. For this reason, their share price soared this week. Here is a quick overview courtesy of Forbes:

KEY FACTS

- Nvidia’s $13.5 billion in sales and $2.45 earnings per share last quarter smashed consensus analyst estimates of $11.2 billion and $2.08, according to FactSet.

- Revenue in its data centre unit, which encompasses its critical AI unit, was $10.32 billion, a whopping 171% year-over-year increase and far exceeding analyst expectations of $8.03 billion.

- Nvidia also said it expects $16 billion of sales in the current quarter, again coming in far above analysts’ projection of $12.6 billion.

- Shares of Nvidia spiked 7% to over $500 in after-hours trading, set to top its intraday all-time high of $482 set Tuesday.

KEY BACKGROUND

By far the largest producer of the chip technology powering generative AI, Nvidia has enjoyed a massive uptick in its valuation over the past year amid AI excitement among investors. Thanks to a more than 300% surge in Nvidia’s share price, its market capitalization has exploded from less than $300 billion to nearly $1.2 trillion over the last 10 months, making it by far the top-returning stock listed on the S&P 500. Nvidia is one of just six companies on the planet worth more than $1 trillion, joining Apple, Microsoft, Saudi Aramco, Alphabet and Amazon.

This news followed another headline I spotted this week regarding PwC:

Partners at PwC have taken a hit to their annual payouts in favour of ploughing £100 million of investment into artificial intelligence. Kevin Ellis, senior UK partner of the professional services firm, said that AI had been “the story of the year”. Under his watch, he said, it had “made many bets on the AI space” in the past 12 months, including collaborations with Microsoft and Icertis, and an exclusive partnership with Harvey AI, which uses the technology to analyse documents.

To say that AI is big is understating the case. AI is huge. The move towards ChatGPT began a race that is now a war. A war between the big tech giants and a war to understand how to apply such technologies to industries and use cases within industries.

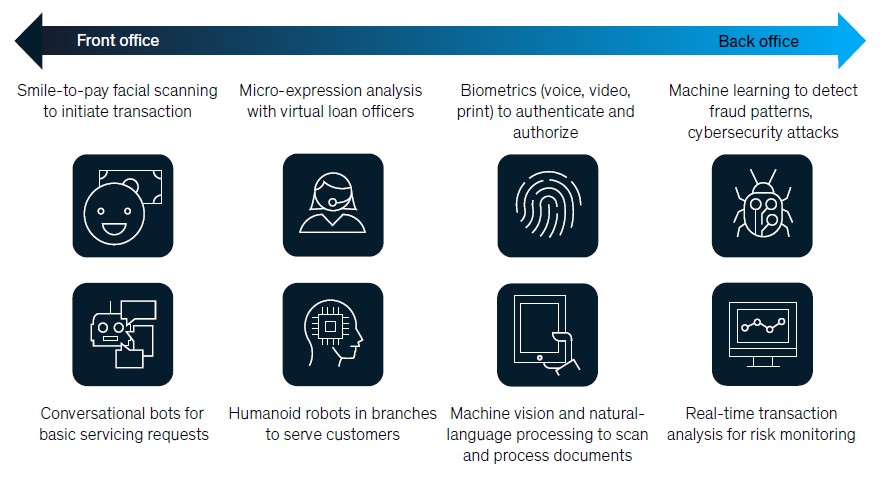

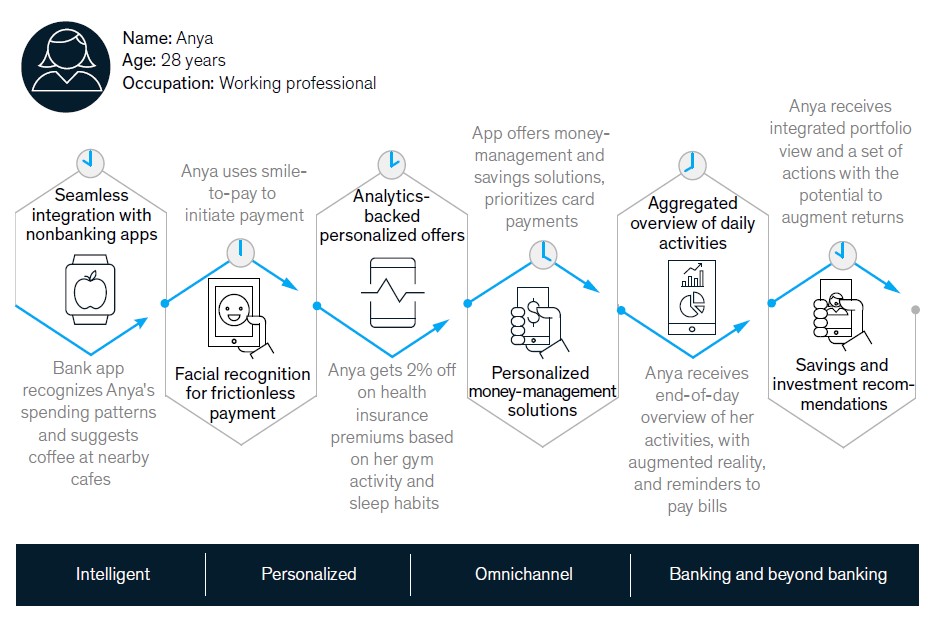

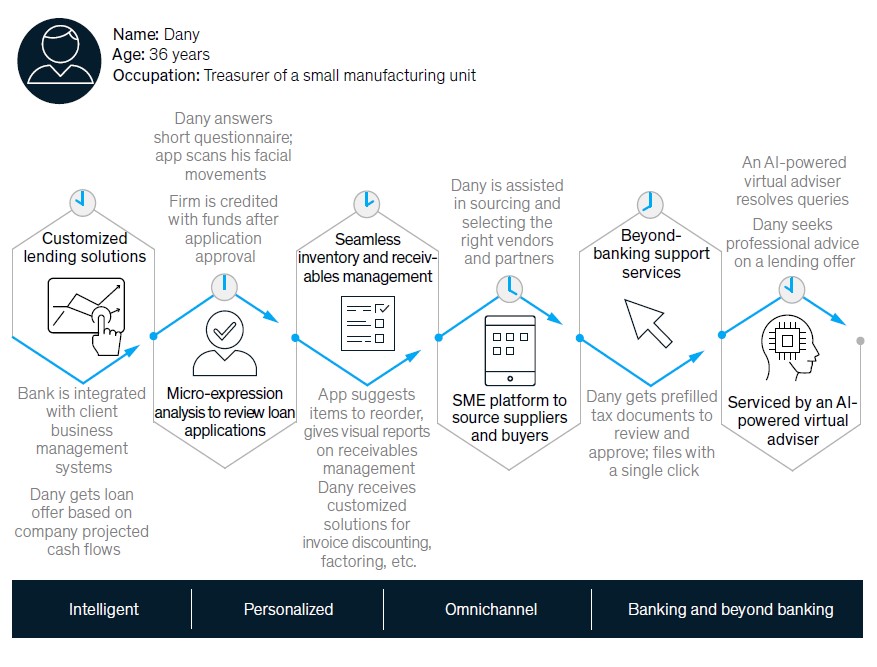

In the most simplistic form, it is using AI for text servicing customers but, in its most sophisticated form, AI can become a full service agent. As McKinsey noted in a recent research report. AI can address everything from front to back office to improve services and automate tasks.

But then, I wonder something. What happens when the AI goes wrong?

By way of example, my favourite AI story is now six years old, and highlighted the fact that JPMorgan could analyse contract wording in a few seconds using AI that, previously, involved 360,000 hours of human legal time. Cool. But what if the AI gets it wrong? What if that word slips through that shouldn’t have? What if AI isn’t bulletproof?

We are moving to a future where we trust the technologies we use so much that we don’t bother fact checking what they say.

This will be an interesting landscape to watch over the next decade, as in the number of court cases where AI is accused of manipulating the truth (lying). Watch this space carefully.

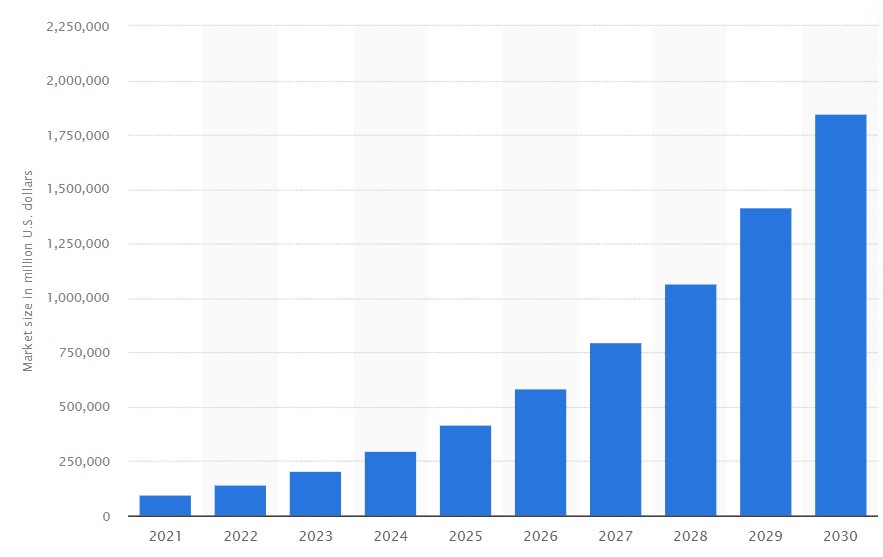

Meantime, going back to NVIDIA and PwC, everybody will be investing in AI big time (over $2 trillion a year by 2030) and, if you’re not, why are you here? What are you doing? What’s your future?

Artificial intelligence (AI) market size worldwide forecast until 2030 (in million U.S. dollars)

Source: Statista

Postnote:

The IMF just produced a report outlining the risks of AI to financial markets. Interesting. Here are the key takeaways as highlighted by Richard Turrin:

🔷 Data Privacy

AI/ML systems raise several well-known privacy concerns: data leakages from the training data sets, the capacity to unmask anonymized data through inferences, and AI/ML “remembering” information about individuals in the training data set after the data are used and discarded.

🔷 Embedded Bias

An important challenge for AI systems is embedded bias—systematically and unfairly discriminating against certain individuals or groups of individuals in favor of others.

🔷 Robustness

Robust AI performance is rapidly becoming an important issue for safeguarding financial stability. AI/ML models face a challenging task when previously reliable signals become unreliable, leading to a loss in prediction accuracy.

🔷 Synthetic Data

GenAI could impart some of its risks (for example, bias accuracy) to the generated synthetic data.

🔷 Explainability

Financial institutions must be able to explain their decisions and actions internally and to external stakeholders, including prudential supervisors. The breadth and diversity of the data used by GenAI— which are at the core of its utility—make it exceedingly difficult to map GenAI’s output to the data, including in the extreme case of hallucination.

🔷 Cybersecurity

GenAI poses significant new challenges to the cybersecurity landscape. GenAI models could be vulnerable to data poisoning, input attacks, and jailbreaking attacks.

🔷 Financial Stability

AI/ML may also automate and accelerate the procyclicality of financial conditions. AI/ML could also quickly amplify and spread the shock throughout the financial system.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...