I saw an interesting comment the other day that got lots of shares, likes and clicks: fintech founders MUST have some experience in banking or financial services background first before they are funded. Many fintech neophytes destroy so much value not out of deliberate actions but just pure ignorance.

Funnily enough the person making this comment did say it would be unpopular, but he bases his opinion on how bankers assess risk. That’s why I particularly appreciated a comment on the thread from Hafiz, a founder and VC, who states: one of the key skills of a good banker is sound risk assessment skills along with accounting understanding. A key skill for managing any company size.

This debate has been bubbling for years and strikes to the heart of my parent-child discussion.

of fintech. So, let’s be clear: a fintech founder does not need to have worked in finance. There are many good fintechs out there who have no financial people in their origins. Stripe – founded by two Irish guys who understood tech; Klarna – started by three friends who were flipping burgers; PayTM – founded by a guy who was homeless, but had a good telecoms knowledge; Clearbank and RTGS founded by Nick Ogden, who founded WorldPay; and there’s more.

Having said that, some of the other most successful fintechs have been founded by people with good banking backgrounds. Starling – founded by Anne Boden, as a seasoned financial professional; NuBank – co-founded by David Velez, formerly involved in investment banking and venture capital; Metro, Atom, 86400 and Archie – founded by Anthony Thomson who has spent his whole life immersed in the financial markets and marketing; and more.

There is no golden rule here, except one. If the FinTech has no one on the board or executive or advisory team who has grey hair, then it worries me. It goes back to that parent-child thing. I need to see someone who has wrinkles and experience in the founding team and, even better, someone who has worked in finance.

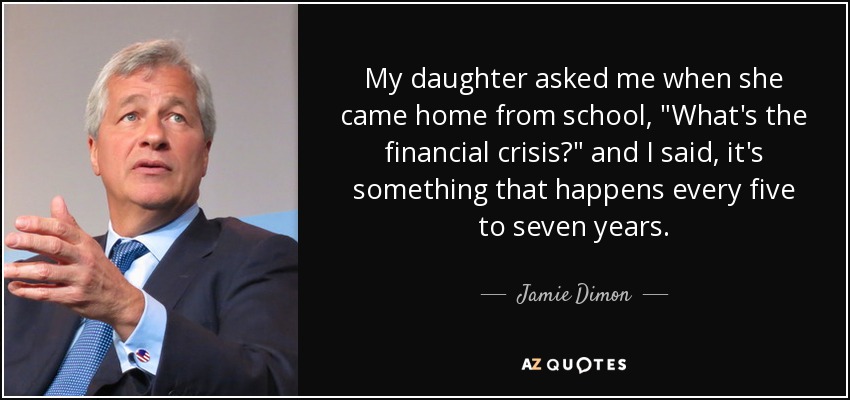

The best way to illustrate this is in those immortal words of the world’s leading banker, Jamie Dimon. After the big financial crisis of 2008, when JPMorgan bailed out Washington Mutual and Bear Stearns, Jamie mentioned that his daughter asked him “What's the financial crisis?”. His reply? “Something that happens every five to seven years”.

It is that knowledge, depth and understanding of the cycle of finance that is key to fintech firms success, as it is far too easy to start-up and then have to shut-down. Few fintech firms have been through the crisis of confidence we have seen over the past two years in the fintech bloodbath and crypto winter. Those that have had sage advice and oversight are doing well; those that had pure enthusiasm may crash and burn.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...