KPMG’s recent Global Analysis of FinTech Funding Report shows a mixed landscape for fintech funding in H1 of 2023.

The Americas, Asia Pacific (ASPAC), and Europe, Middle East, and Africa (EMEA) saw different rsults when it came to investments in venture capital and private equity funding.

The key takeaways from the report for H1'23 included the following:

Global fintech funding declined from $63.2bn in H2'22 to $52.4bn in H1'23, with a particularly soft Q2'23.

The Americas, led by the US attracted significant fintech funding, accounting for over 2/3 of global fintech funding in H1'23.

Funding in the EMEA and ASPAC regions declined significantly in H1'23, with EMEA experiencing a sharp drop in funding.

The payments sector received the largest share of fintech funding in H1'23, with over $16bn in investments, driven by its perceived resilience.

AI and generative AI gained attention in H1'23, particularly in cybersecurity, wealth management, and insurance applications, with big tech giants leading the way.

High interest rates, macroeconomic challenges, geopolitical tensions, and depressed valuations contributed to subdued fintech funding in H1'23.

The report went further to provide some of the following predictions for H2'23 including ...

Investors will prioritise profitability when making fintech investments, favouring companies with strong revenue growth, solid unit economics, and a clear path to profitability.

The payments sector will continue to thrive globally, with increased consolidation as firms seek to achieve greater scale and adapt to changing market conditions.

Corporate fundings will focus on startups that help companies operate more efficiently in areas like cybersecurity, finance, supply chain, logistics, and payments.

M&A is expected to rise as market conditions improve, with both distressed and value accretive M&A opportunities.

Interest in AI will grow with fintechs leveraging AI for operational efficiency and service enhancements, and large tech giants playing a pivotal role in AI fintech solutions.

Interest in blockchain-based solutions, particularly those aligned with ESG and sustainability, is expected to increase as crypto funding remains subdued due to regulatory pressures.

The conclusion from the report indicates that while H1'23 presented challenges, the long-term outlook remains positive, with opportunities for innovation and growth in various sectors.

For more information, checkout this page and, meanwhile, much of this blog update is stolen from Davidson Oturu. Equally, always take statistics with a pinch of salt:

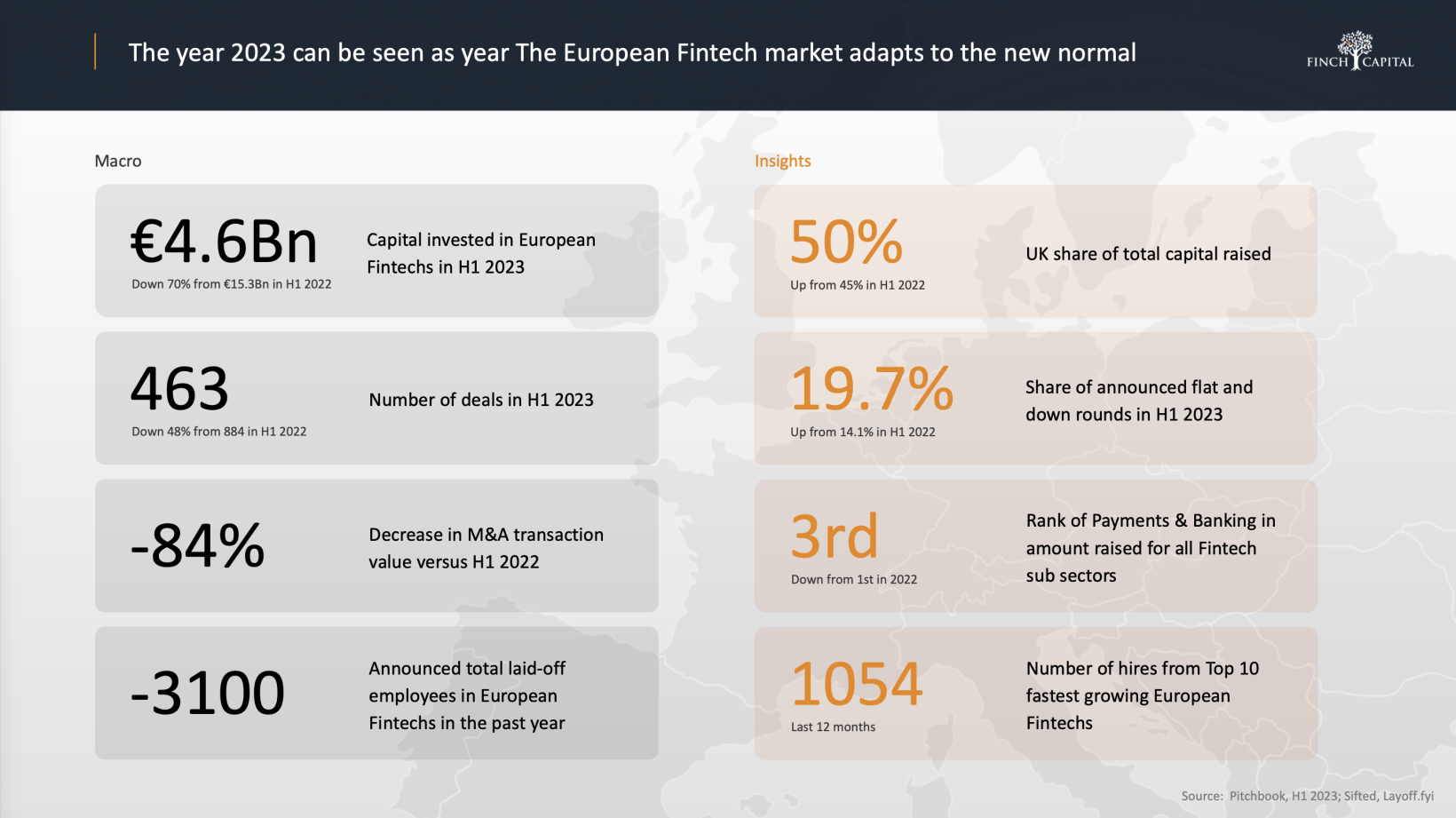

Source: Finch Capital

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...